Answered step by step

Verified Expert Solution

Question

1 Approved Answer

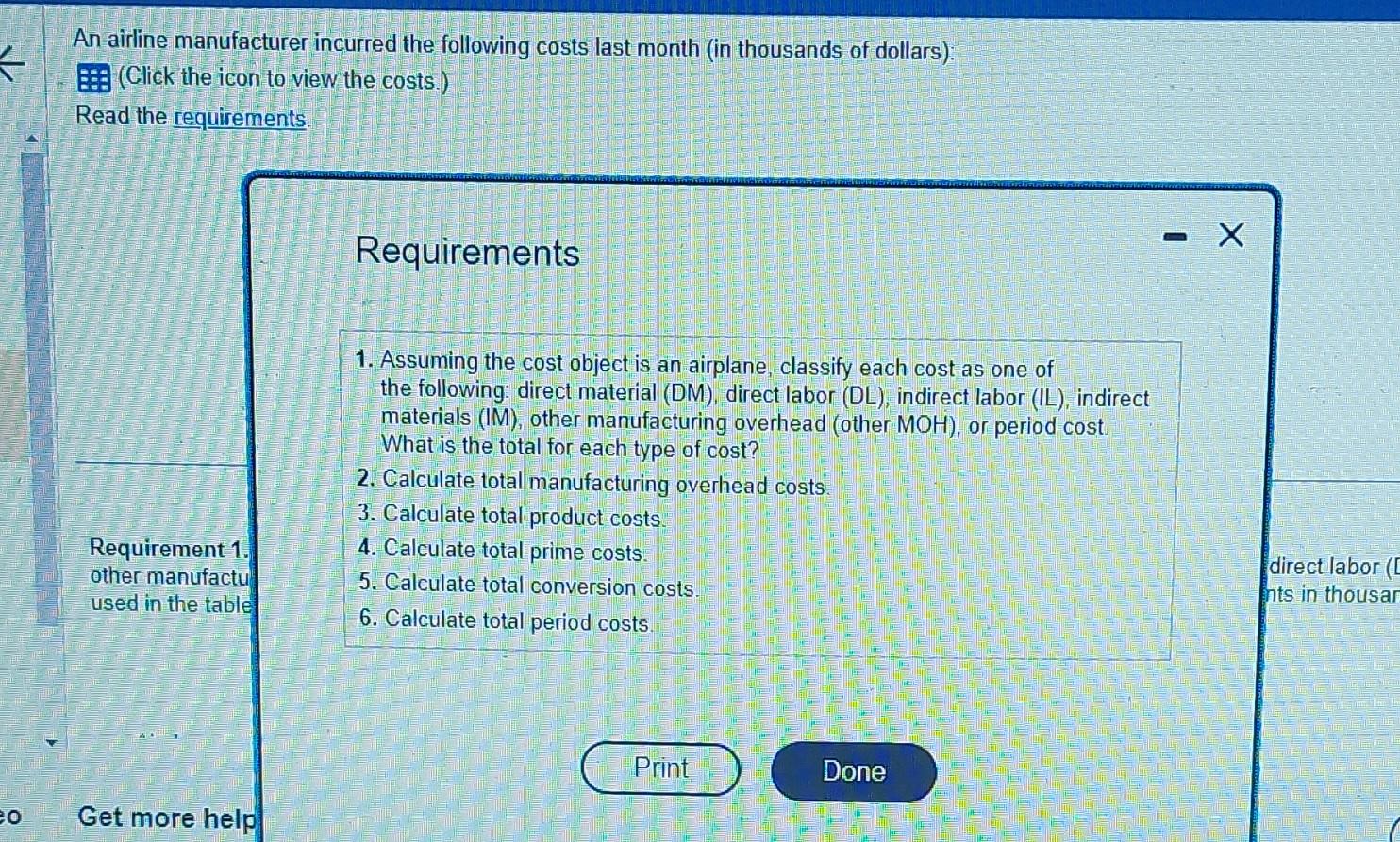

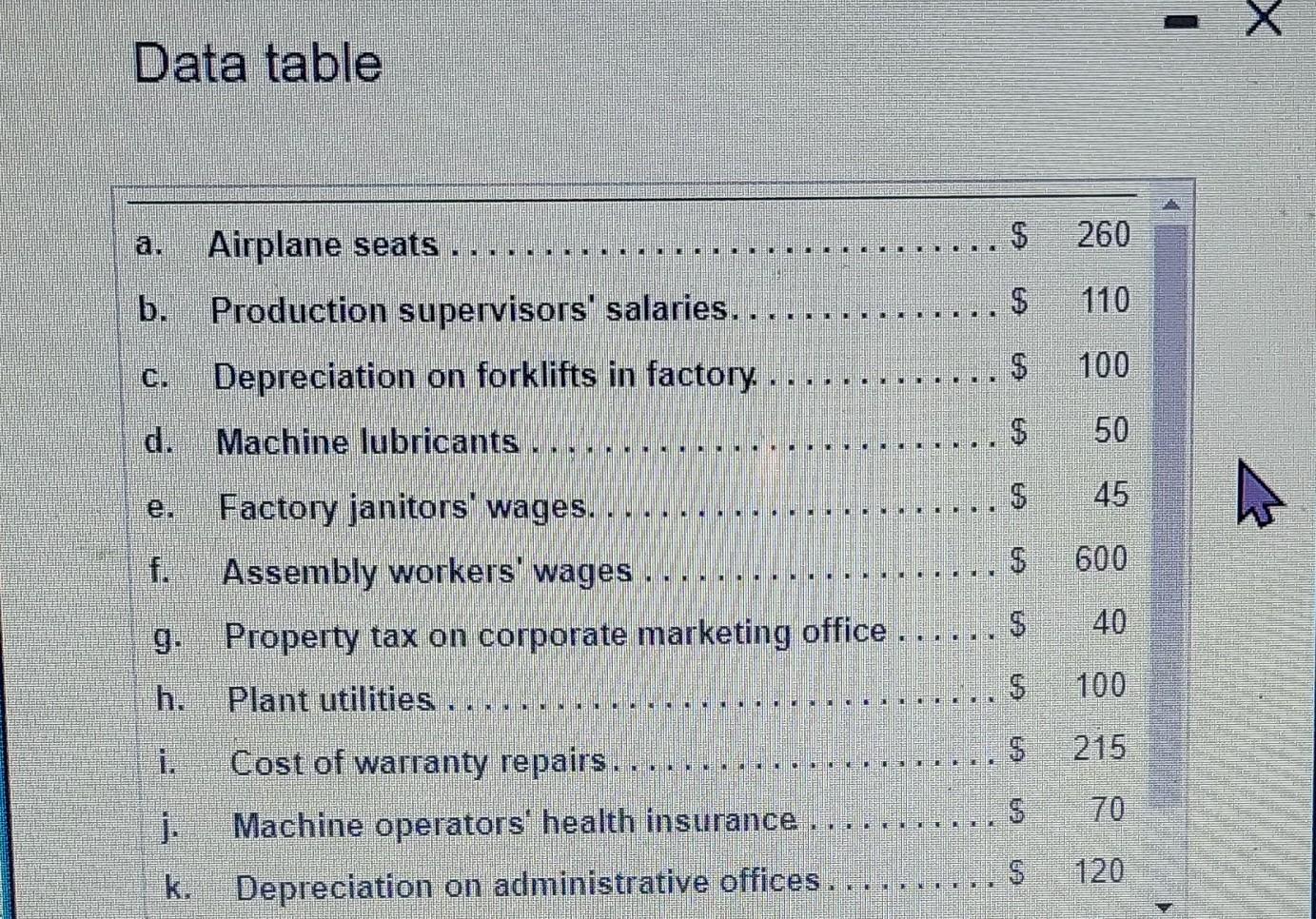

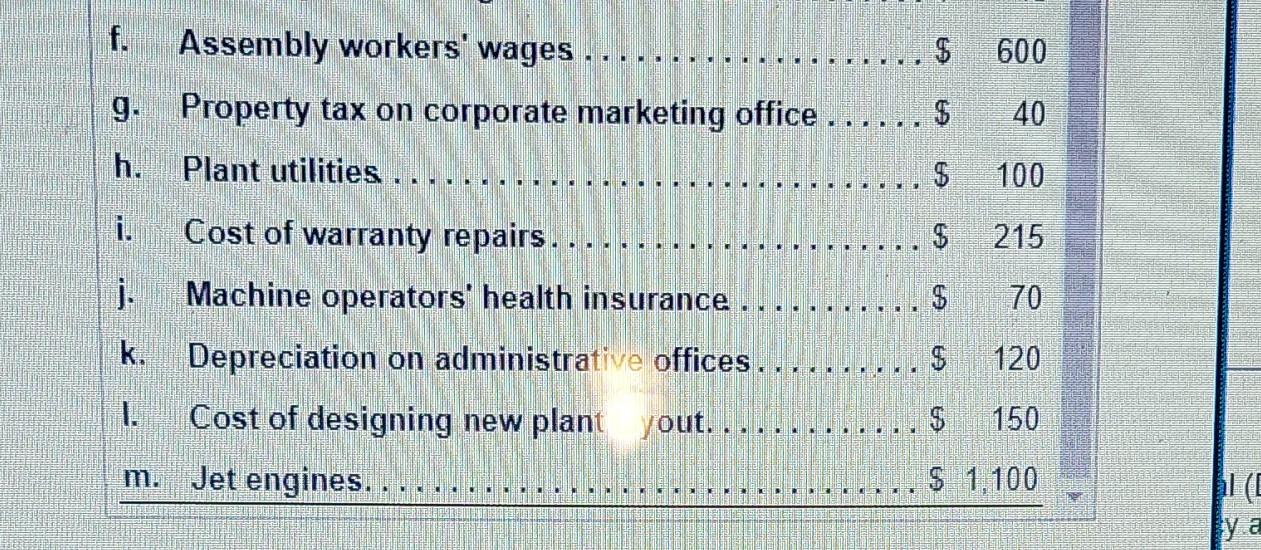

An airline manufacturer incurred the following costs last month (in thousands of dollars): (Click the icon to view the costs.) Read the requirements. Requirements 1.

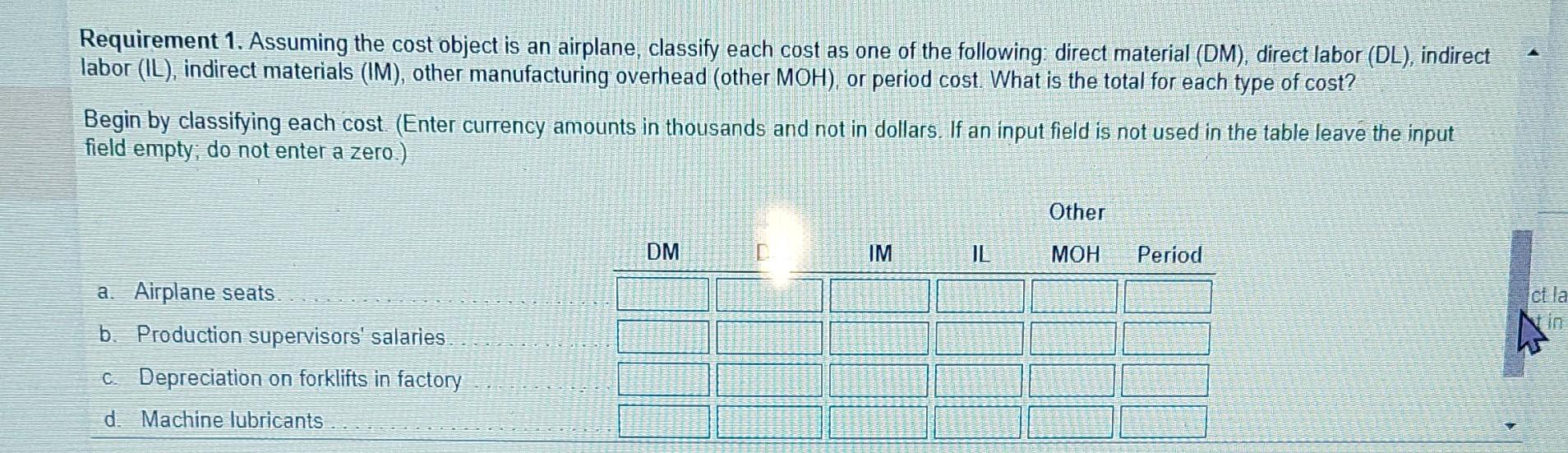

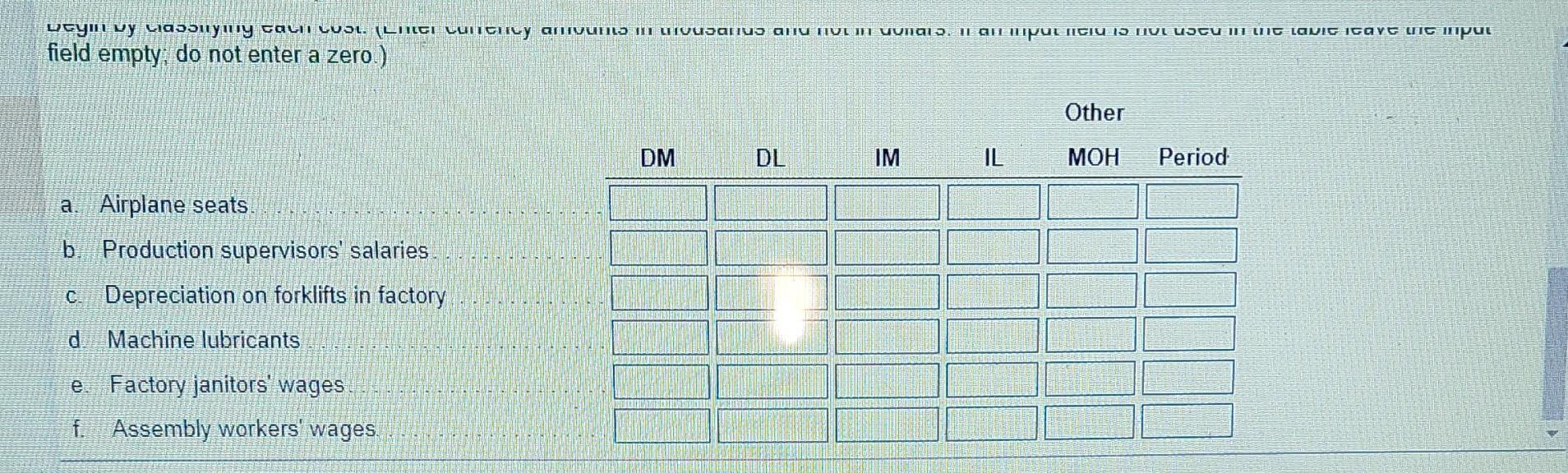

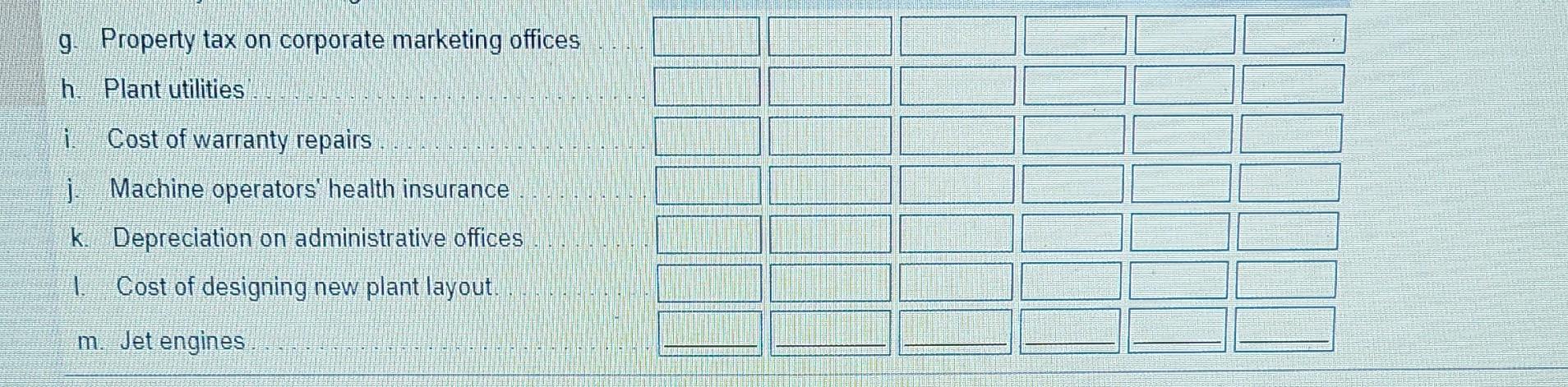

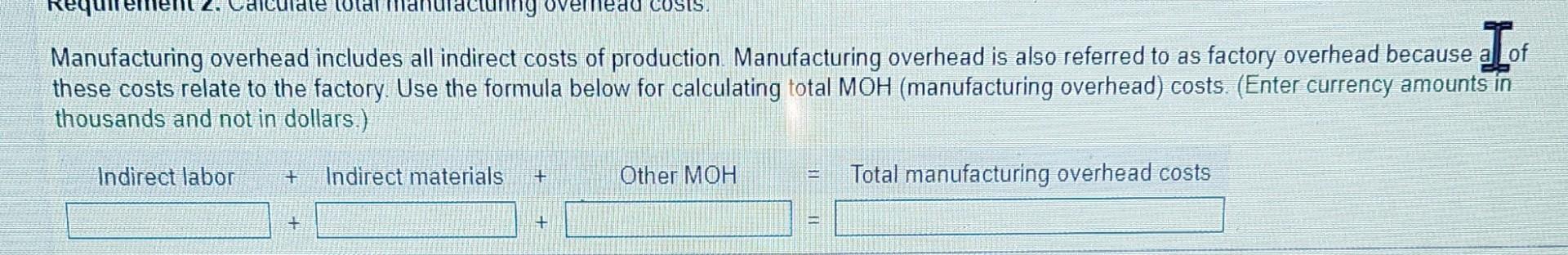

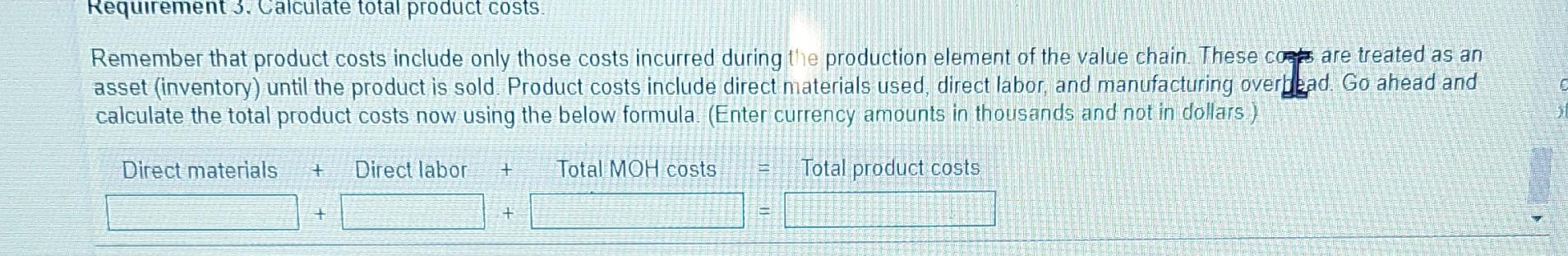

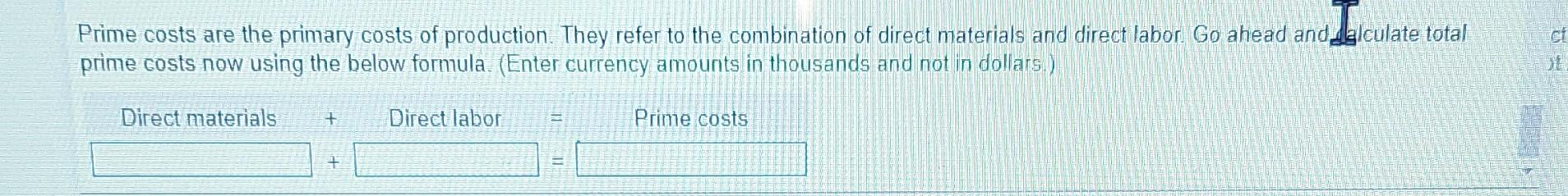

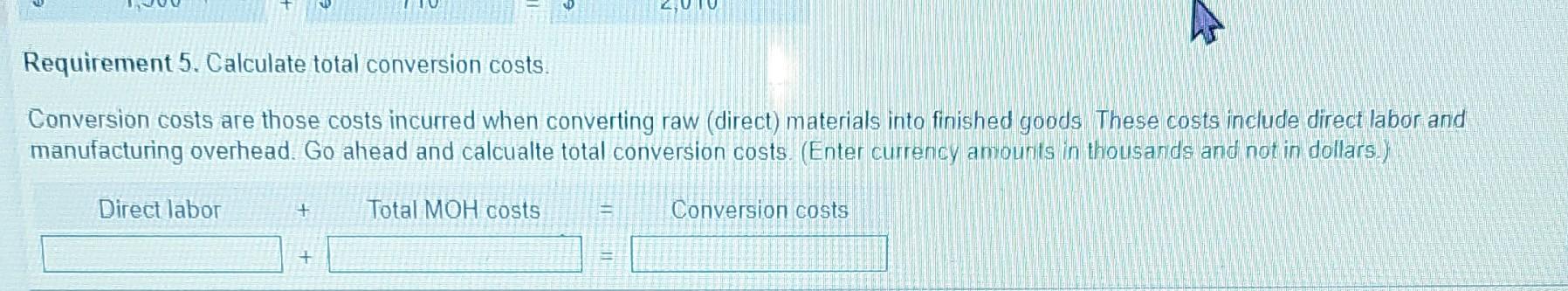

An airline manufacturer incurred the following costs last month (in thousands of dollars): (Click the icon to view the costs.) Read the requirements. Requirements 1. Assuming the cost object is an airplane, classify each cost as one of the following: direct material (DM), direct labor (DL), indirect labor (IL), indirect materials (IM), other manufacturing overhead (other MOH ), or period cost. What is the total for each type of cost? 2. Calculate total manufacturing overhead costs Requirement 1. 3. Calculate total product costs. other manufactu 4. Calculate total prime costs. used in the table 5. Calculate total conversion costs. 6. Calculate total period costs. Data table a. Airplane seats b. Production supervisors' salaries. ......... \$ 110 c. Depreciation on forklifts in factory . . . . . . . . \$ $100 d. Machine lubricants e. Factory janitors' wages. ................ $45 f. Assembly workers' wages . g. Property tax on corporate marketing office ..... $40 h. Plant utilities ... i. Cost of warranty repairs j. Machine operators health insurance ......... \$ 70 k. Depreciation on administrative offices ......... S 120 f. Assembly workers' wages .$ g. Property tax on corporate marketing office ..$40 h. Plant utilities i. Cost of warranty repairs. . 215 j. Machine operators health insurance $70 k. Depreciation on administrative offices ....... \$ 120 I. Cost of designing new plant yout......... 150 m. Jet engines. .................. 1,100 Requirement 1. Assuming the cost object is an airplane, classify each cost as one of the following: direct material (DM), direct labor (DL), indirect labor (IL), indirect materials (IM), other manufacturing overhead (other MOH), or period cost. What is the total for each type of cost? Begin by classifying each cost (Enter currency amounts in thousands and not in dollars. If an input field is not used in the table leave the input field empty; do not enter a zero.) field empty; do not enter a zero.) g. Property tax on corporate marketing offices h. Plant utilities i. Cost of warranty repairs j. Machine operators' health insurance k. Depreciation on administrative offices 1. Cost of designing new plant layout. m. Jet engines Manufacturing overhead includes all indirect costs of production. Manufacturing overhead is also referred to as factory overhead because alof these costs relate to the factory. Use the formula below for calculating total MOH (manufacturing overhead) costs. (Enter currency amounts in thousands and not in dollars.) Remember that product costs include only those costs incurred during the production element of the value chain. These coef are treated as an asset (inventory) until the product is sold. Product costs include direct materials used, direct labor, and manufacturing overblad. Go ahead and calculate the total product costs now using the below formula. (Enter currency amounts in thousands and not in dollars) Prime costs are the primary costs of production. They refer to the combination of direct materials and direct labor. Go ahead and dalculate total prime costs now using the below formula. (Enter currency amounts in thousands and not in dollars.) Requirement 5. Calculate total conversion costs. Conversion costs are those costs incurred when converting raw (direct) materials into finished goods. These costs include direct labor and manufacturing overhead. Go ahead and calcualte total conversion costs. (Enter currency amounits in thousands and not in dollars.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started