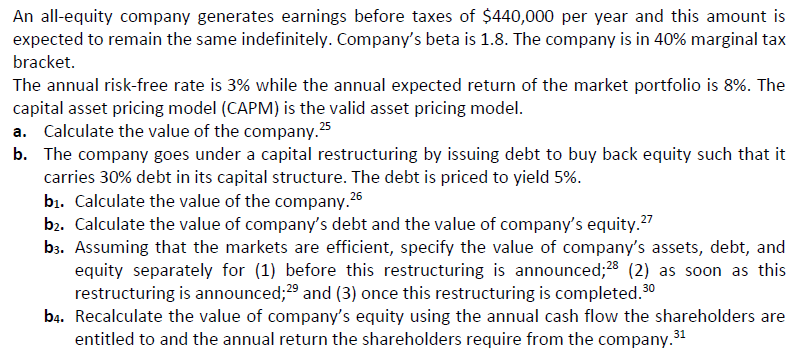

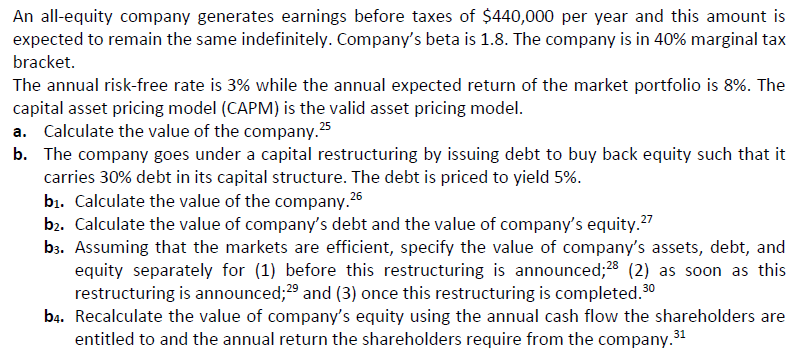

An all-equity company generates earnings before taxes of $440,000 per year and this amount is expected to remain the same indefinitely. Company's beta is 1.8. The company is in 40% marginal tax bracket. The annual risk-free rate is 3% while the annual expected return of the market portfolio is 8%. The capital asset pricing model (CAPM) is the valid asset pricing model. a. Calculate the value of the company.25 b. The company goes under a capital restructuring by issuing debt to buy back equity such that it carries 30% debt in its capital structure. The debt is priced to yield 5%. bi. Calculate the value of the company.26 b2. Calculate the value of company's debt and the value of company's equity.27 b3. Assuming that the markets are efficient, specify the value of company's assets, debt, and equity separately for (1) before this restructuring is announced;28 (2) as soon as this restructuring is announced;29 and (3) once this restructuring is completed.30 b4. Recalculate the value of company's equity using the annual cash flow the shareholders are entitled to and the annual return the shareholders require from the company. 31 An all-equity company generates earnings before taxes of $440,000 per year and this amount is expected to remain the same indefinitely. Company's beta is 1.8. The company is in 40% marginal tax bracket. The annual risk-free rate is 3% while the annual expected return of the market portfolio is 8%. The capital asset pricing model (CAPM) is the valid asset pricing model. a. Calculate the value of the company.25 b. The company goes under a capital restructuring by issuing debt to buy back equity such that it carries 30% debt in its capital structure. The debt is priced to yield 5%. bi. Calculate the value of the company.26 b2. Calculate the value of company's debt and the value of company's equity.27 b3. Assuming that the markets are efficient, specify the value of company's assets, debt, and equity separately for (1) before this restructuring is announced;28 (2) as soon as this restructuring is announced;29 and (3) once this restructuring is completed.30 b4. Recalculate the value of company's equity using the annual cash flow the shareholders are entitled to and the annual return the shareholders require from the company. 31