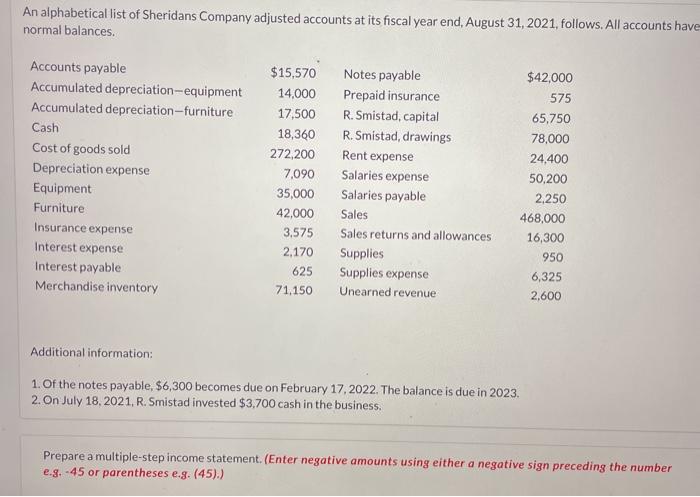

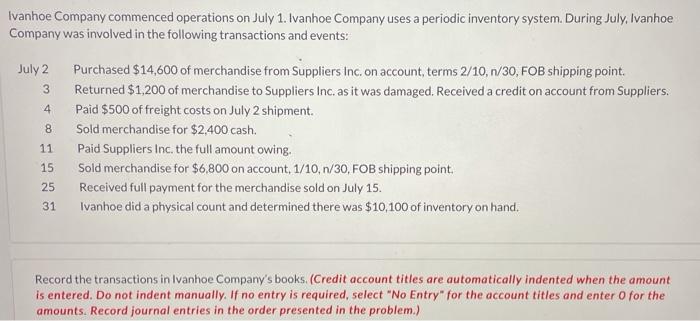

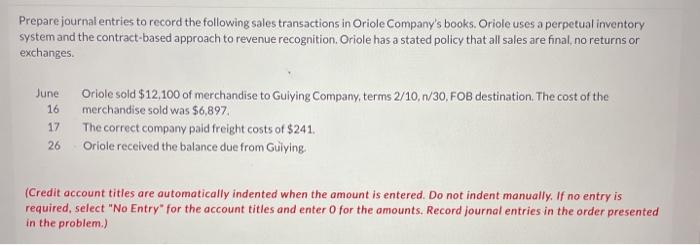

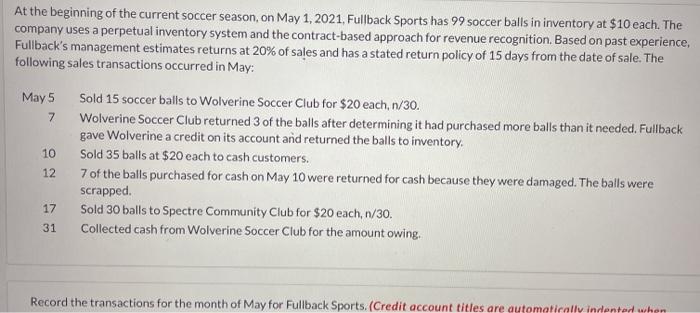

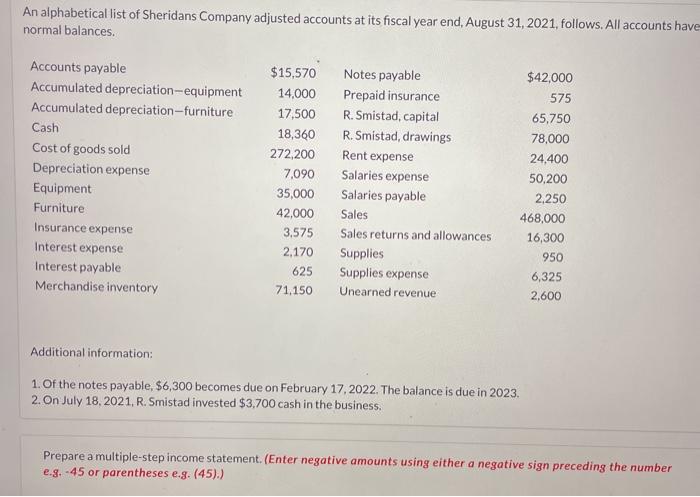

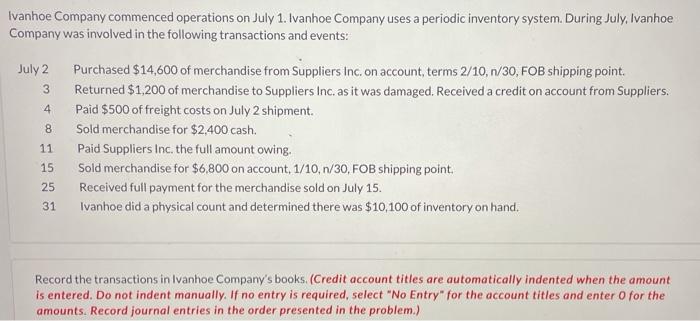

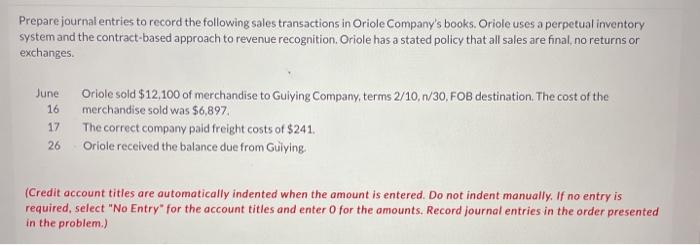

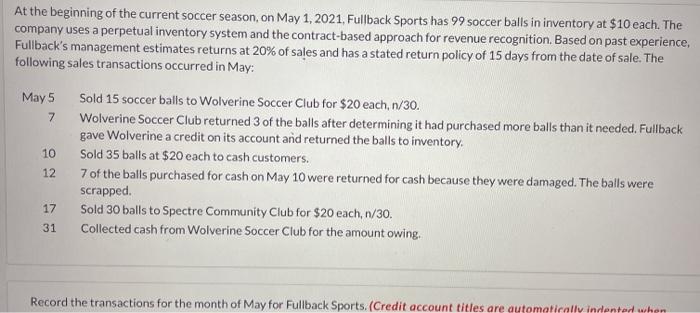

An alphabetical list of Sheridans Company adjusted accounts at its fiscal year end, August 31, 2021, follows. All accounts have normal balances. Accounts payable Accumulated depreciation-equipment Accumulated depreciation-furniture Cash Cost of goods sold Depreciation expense Equipment Furniture Insurance expense Interest expense Interest payable Merchandise inventory $15,570 14,000 17,500 18,360 272,200 7,090 35,000 42,000 3,575 2,170 625 71.150 Notes payable Prepaid insurance R. Smistad, capital R. Smistad, drawings Rent expense Salaries expense Salaries payable Sales Sales returns and allowances Supplies Supplies expense Unearned revenue $42,000 575 65.750 78,000 24,400 50,200 2,250 468,000 16,300 950 6,325 2,600 Additional information: 1. Of the notes payable, $6,300 becomes due on February 17, 2022. The balance is due in 2023. 2. On July 18, 2021, R. Smistad invested $3,700 cash in the business. Prepare a multiple-step income statement. (Enter negative amounts using either a negative sign preceding the number e.g.-45 or parentheses e.g. (45).) Ivanhoe Company commenced operations on July 1. Ivanhoe Company uses a periodic inventory system. During July, Ivanhoe Company was involved in the following transactions and events: July 2 Purchased $14,600 of merchandise from Suppliers Inc. on account, terms 2/10,n/30, FOB shipping point 3 Returned $1,200 of merchandise to Suppliers Inc, as it was damaged, Received a credit on account from Suppliers. Paid $500 of freight costs on July 2 shipment. Sold merchandise for $2,400 cash. Paid Suppliers Inc. the full amount owing, Sold merchandise for $6.800 on account, 1/10, n/30, FOB shipping point Received full payment for the merchandise sold on July 15. Ivanhoe did a physical count and determined there was $10,100 of inventory on hand. 4 8 11 15 25 31 Record the transactions in Ivanhoe Company's books. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Record journal entries in the order presented in the problem.) Prepare journal entries to record the following sales transactions in Oriole Company's books, Oriole uses a perpetual inventory system and the contract-based approach to revenue recognition. Oriole has a stated policy that all sales are final, no returns or exchanges June 16 17 Oriole sold $12,100 of merchandise to Guiying Company, terms 2/10, 1/30, FOB destination. The cost of the merchandise sold was $6,897 The correct company paid freight costs of $241. Oriole received the balance due from Gulying. 26 (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts. Record journal entries in the order presented in the problem.) At the beginning of the current soccer season, on May 1, 2021, Fullback Sports has 99 soccer balls in inventory at $10 each. The company uses a perpetual inventory system and the contract-based approach for revenue recognition. Based on past experience, Fullback's management estimates returns at 20% of sales and has a stated return policy of 15 days from the date of sale. The following sales transactions occurred in May: May 5 Sold 15 soccer balls to Wolverine Soccer Club for $20 each, n/30. Wolverine Soccer Club returned 3 of the balls after determining it had purchased more balls than it needed. Fullback gave Wolverine a credit on its account and returned the balls to inventory. 10 Sold 35 balls at $20 each to cash customers. 12 7 of the balls purchased for cash on May 10 were returned for cash because they were damaged. The balls were scrapped. 17 Sold 30 balls to Spectre Community Club for $20 each, n/30. Collected cash from Wolverine Soccer Club for the amount owing. 7 31 Record the transactions for the month of May for Fullback Sports. (Credit account titles are automatically indented when