Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An American plane engines manufacturer has exported plane engines to the UK worth five hundred thousand UK pounds ( 5 0 0 , 0 0

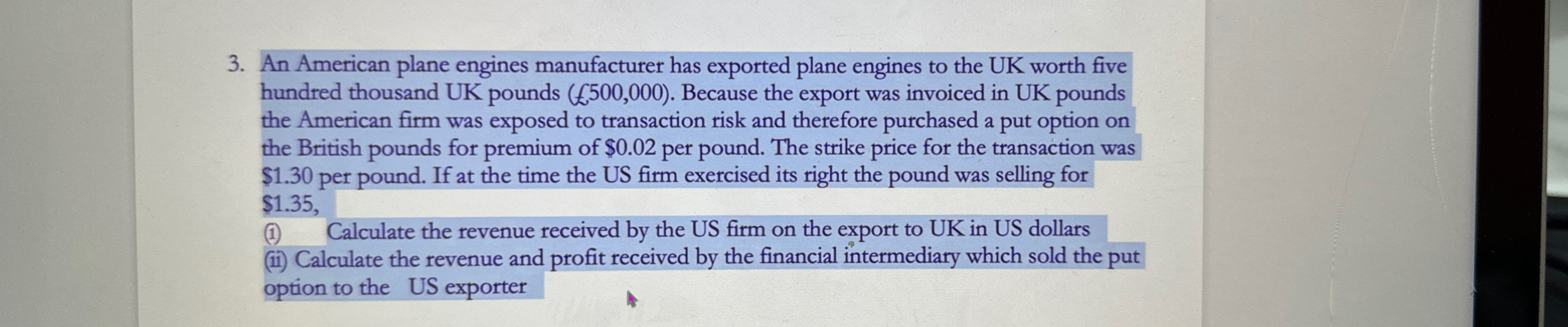

An American plane engines manufacturer has exported plane engines to the UK worth five hundred thousand UK pounds Because the export was invoiced in UK pounds the American firm was exposed to transaction risk and therefore purchased a put option on the British pounds for premium of $ per pound. The strike price for the transaction was $ per pound. If at the time the US firm exercised its right the pound was selling for $

Calculate the revenue received by the US firm on the export to UK in US dollars

ii Calculate the revenue and profit received by the financial intermediary which sold the put option to the US exporter

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started