An analysis of company performance using Dupont Analysis. Please help answer all below quetions. Thank you in advance!

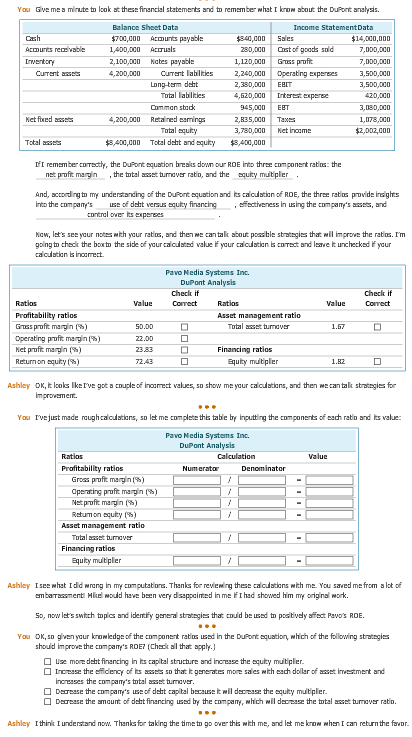

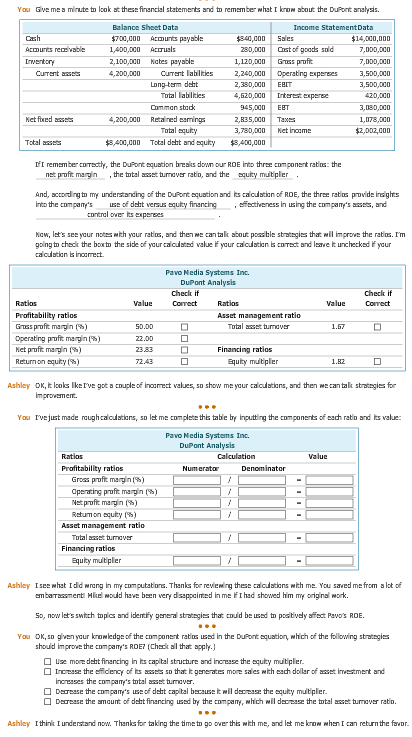

Gve me a minute look at thesefinancial statements and to remember what I know about the DuPont analysis. Balance Sheet Data Cash $700,000 Acounts payable $840,000 Sales $14,000,000 Acounts repevable 1,400,000 Arouals ost of goods sold 2,100,000 Mates payable Gmss profit ,120,000 ablities operating expenses 4,200,000 2,240,000 3,500,000 Long-term debt 2,330,000 3,500,000 ablities 4,620,000 Interest expense Comman stad 945,000 3, D30,000 Met teed assets 4,200,000 Retained earnings 2,B35.000 Total equity 3,730,000 Metinoame $8,400,000 Total debt and equity $8,400,000 If I remember comectly, the DuPont equation breaks down our RoE into three component rates: the net pmfit margi the total asset tumaver ratio, and the equity multipler And, according to my understanding of the DuPont equation and its calouation of RoE, the three ratos pmvide insghts into the company's use of debt versus equity financing effectiveness in using the company's assets, and contral over its expenses Mow, let's see yaur notes with your ratlos, and then we cantalk about possible strategies that wil improve the ratlos. I'm going to check the boxto the side of your caoulated value i your calouation is comect and leave unchecked ryour calculation is inoamect. Pavo Nedia DuPont Analysis check if check if Value Ratios Value Profitability anagementratio Gmsspmfit margin operating pmfit margin Met pmfit margin nancing ratios Return on equity Equity multiple oK, it looks lkerve got a couple of inoamed values, so show me yaur calouations, and then wecantal strategies for improvement. I've just made raugh calculations, so me com plete this table by inputting the components of each rato and its value: Pavo Nedia DuPont Analysis calculation Value Profitability ratios Denominator Gross profit margin operating pmfit margin Netpmfit margin Retumon equity anagement ratio nancing Equity multiple Isee what did wrang in my com putations. Thanksfor newewing these caouations with me. You saved me from a lot embamassment Mike woud have been very disappainted in me iIhad showed him my original work now let's switch topics and idemiy general strategies that could be used to postwely affect Pawos RDE oK,so given yaur knowledge of the component ratios used in the DuPont equation, which of the following strategies should improve the company's RoE7 (chek al that apply. use more debt financing in its capital stnucture and increase the equity multiple Increase the effdency of its asses so that more sales with each dollar of asset investment and increases the company's total asset tumawer. Derease the company's use of debt capital because it wi decrease the equity multiple Deorease the amount of debt financing used by the company, which wil decrease the total asset turmover ratio. Ashley Ithink understand now. Thanks for taking the time go over this with me, and let me know whenI can returnthe favo