Answered step by step

Verified Expert Solution

Question

1 Approved Answer

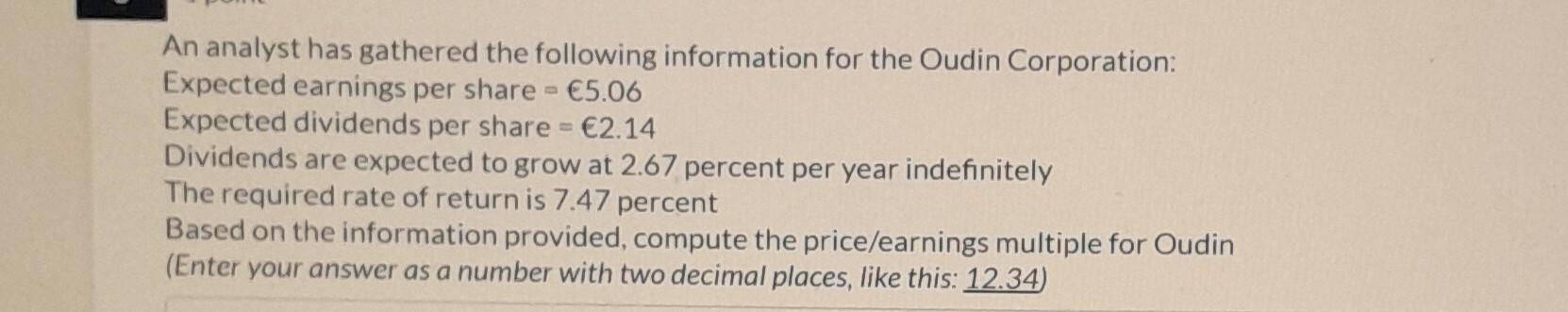

An analyst has gathered the following information for the Oudin Corporation: Expected earnings per share = 5.06 Expected dividends per share = 2.14 Dividends are

An analyst has gathered the following information for the Oudin Corporation: Expected earnings per share = 5.06 Expected dividends per share = 2.14 Dividends are expected to grow at 2.67 percent per year indefinitely The required rate of return is 7.47 percent Based on the information provided, compute the price/earnings multiple for Oudin (Enter your answer as a number with two decimal places, like this: 12.34) Enterprise value is calculated as the market value of equity minus the market value of debt and preferred stock plus short-term investments. True False For preferred stock with a constant dividend, the investor's time horizon would have no effect on the calculation of intrinsic value. True False

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started