Question

An analyst is making projections for a firm for fiscal year 2023. The analyst has the following information: In 2022, the firms sales are 1000

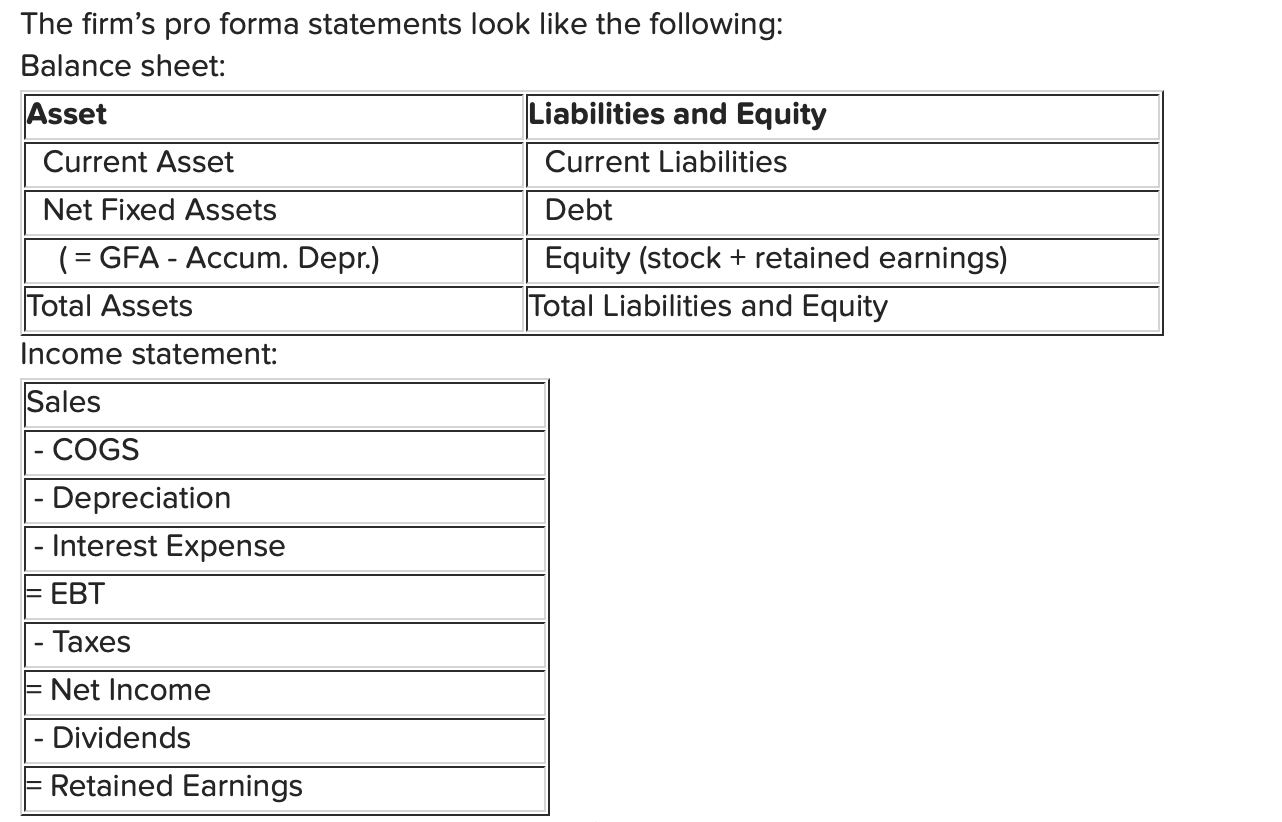

An analyst is making projections for a firm for fiscal year 2023. The analyst has the following information: In 2022, the firms sales are 1000 (in thousands) and has an accumulated depreciation of 300 (thousands). Its retained earnings (balance sheet) is 95. Sales are expected to grow by 10% per year. Cost of goods sold will be 50% of sales. 30% of net income will be paid out as dividends. Fixed assets are predicted to be 80% of sales Fixed assets will be depreciated at 10% per year. Current assets are predicted to be 10% of sales Current liabilities are predicted to be 15% of sales The firm relies on debt AND equity financing to raise capital. It faces a cost of debt of 9%. It also aims to maintain a debt-to-equity ratio of 0.3 going forward. The firm faces 40% corporate income tax rates. In this example, Depreciation Expense (t) = Depreciation Rate* Gross Fixed Assets (t) Interest Expense (t) = Interest Rate* Debt (t) The firms pro forma statements look like the following: Balance sheet:

Fill in the pro-forma statement for 2023. Compute the projected level of stock. What is the closet to?

Fill in the pro-forma statement for 2023. Compute the projected level of stock. What is the closet to?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started