Answered step by step

Verified Expert Solution

Question

1 Approved Answer

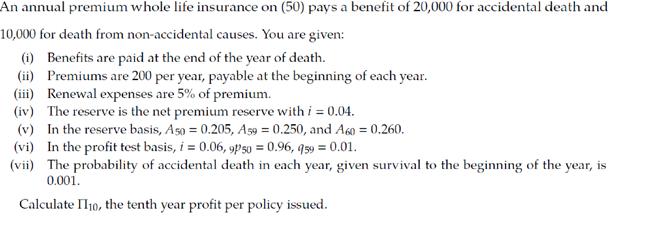

An annual premium whole life insurance on (50) pays a benefit of 20,000 for accidental death and 10,000 for death from non-accidental causes. You

An annual premium whole life insurance on (50) pays a benefit of 20,000 for accidental death and 10,000 for death from non-accidental causes. You are given: (i) Benefits are paid at the end of the year of death. (ii) Premiums are 200 per year, payable at the beginning of each year. (iii) Renewal expenses are 5% of premium. (iv) The reserve is the net premium reserve with i = 0.04. (v) In the reserve basis, Aso = 0.205, A59 = 0.250, and A60 = 0.260. (vi) In the profit test basis, i = 0.06, 9p50 = 0.96, 959 = 0.01. (vii) The probability of accidental death in each year, given survival to the beginning of the year, is 0.001. Calculate II10, the tenth year profit per policy issued.

Step by Step Solution

★★★★★

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the tenth year profit per policy issued II10 we need to consider the premiums benefits ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started