Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An appliance company has three installers. Larry earns $335 per week, Curly earns $470 per week, and Moe earns $545 per week. The company's SUTA

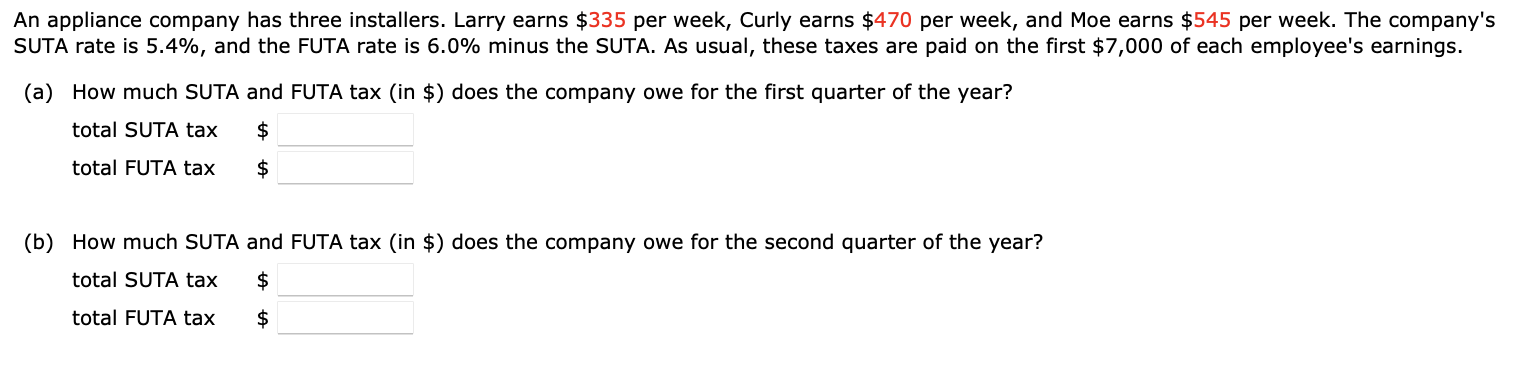

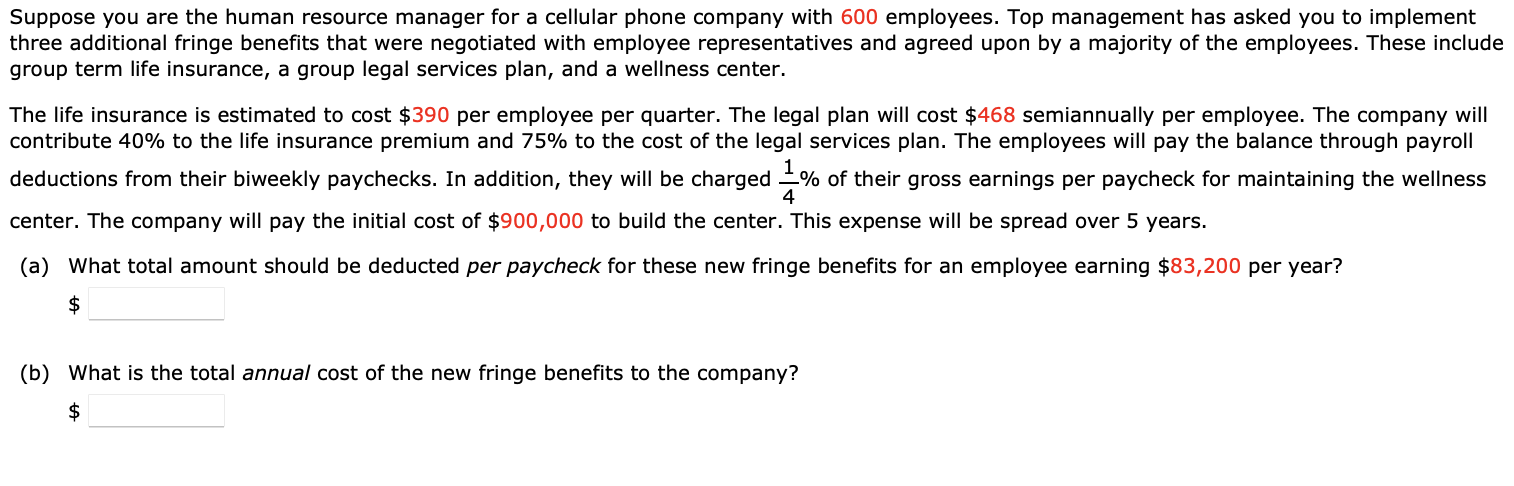

An appliance company has three installers. Larry earns $335 per week, Curly earns $470 per week, and Moe earns $545 per week. The company's SUTA rate is 5.4%, and the FUTA rate is 6.0% minus the SUTA. As usual, these taxes are paid on the first $7,000 of each employee's earnings. (a) How much SUTA and FUTA tax (in \$) does the company owe for the first quarter of the year? total SUTA tax $ total FUTA tax $ (b) How much SUTA and FUTA tax (in \$) does the company owe for the second quarter of the year? total SUTA tax $ total FUTA tax $ Suppose you are the human resource manager for a cellular phone company with 600 employees. Top management has asked you to implement three additional fringe benefits that were negotiated with employee representatives and agreed upon by a majority of the employees. These include group term life insurance, a group legal services plan, and a wellness center. The life insurance is estimated to cost $390 per employee per quarter. The legal plan will cost $468 semiannually per employee. The company will contribute 40% to the life insurance premium and 75% to the cost of the legal services plan. The employees will pay the ball deductions from their biweekly paychecks. In addition, they will be charged 41% of their gross earnings per paycheck for maintaining the wellness center. The company will pay the initial cost of $900,000 to build the center. This expense will be spread over 5 years. (a) What total amount should be deducted per paycheck for these new fringe benefits for an employee earning $83,200 per year? $ (b) What is the total annual cost of the new fringe benefits to the company? $

An appliance company has three installers. Larry earns $335 per week, Curly earns $470 per week, and Moe earns $545 per week. The company's SUTA rate is 5.4%, and the FUTA rate is 6.0% minus the SUTA. As usual, these taxes are paid on the first $7,000 of each employee's earnings. (a) How much SUTA and FUTA tax (in \$) does the company owe for the first quarter of the year? total SUTA tax $ total FUTA tax $ (b) How much SUTA and FUTA tax (in \$) does the company owe for the second quarter of the year? total SUTA tax $ total FUTA tax $ Suppose you are the human resource manager for a cellular phone company with 600 employees. Top management has asked you to implement three additional fringe benefits that were negotiated with employee representatives and agreed upon by a majority of the employees. These include group term life insurance, a group legal services plan, and a wellness center. The life insurance is estimated to cost $390 per employee per quarter. The legal plan will cost $468 semiannually per employee. The company will contribute 40% to the life insurance premium and 75% to the cost of the legal services plan. The employees will pay the ball deductions from their biweekly paychecks. In addition, they will be charged 41% of their gross earnings per paycheck for maintaining the wellness center. The company will pay the initial cost of $900,000 to build the center. This expense will be spread over 5 years. (a) What total amount should be deducted per paycheck for these new fringe benefits for an employee earning $83,200 per year? $ (b) What is the total annual cost of the new fringe benefits to the company? $ Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started