Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An approach to portfolio optimization is the scenario approach. In this, we identify a few scenarios (less than 10, say) that might occur during the

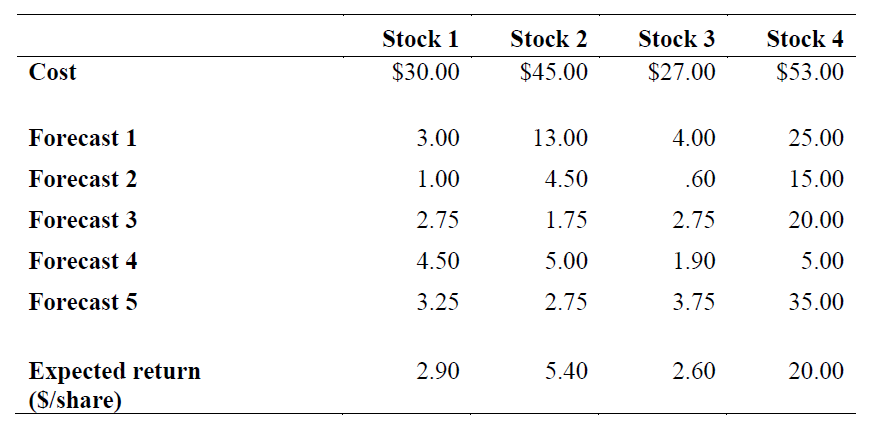

An approach to portfolio optimization is the scenario approach. In this, we identify a few scenarios (less than 10, say) that might occur during the next year. For each scenario we estimate the return on each investment. Then, we estimate the expected return and risk of the portfolio. The Sentinel Finance Company, a small firm, wishes to invest in four stocks. The cost of each stock ($ per share) and the forecasts of the return ($ per share) for each stock made by the company's five analysts are given in the following table:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started