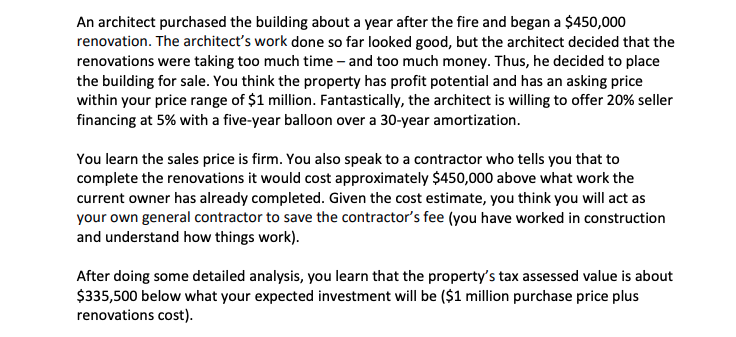

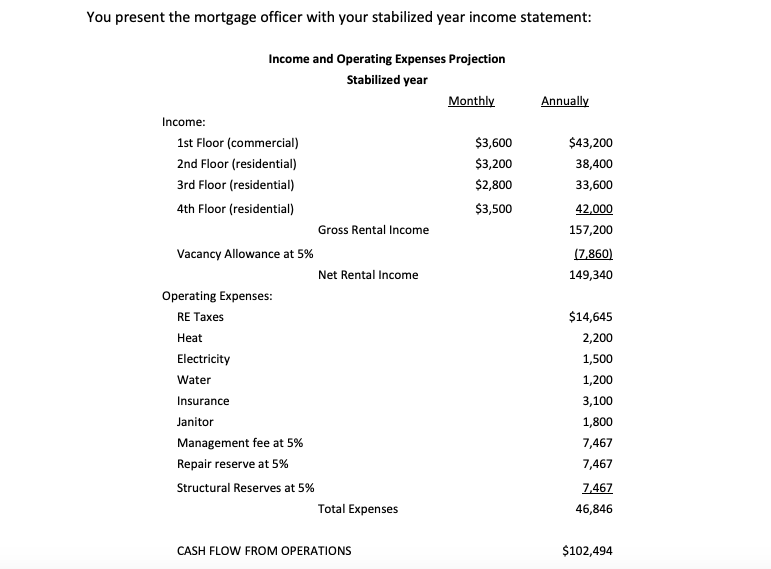

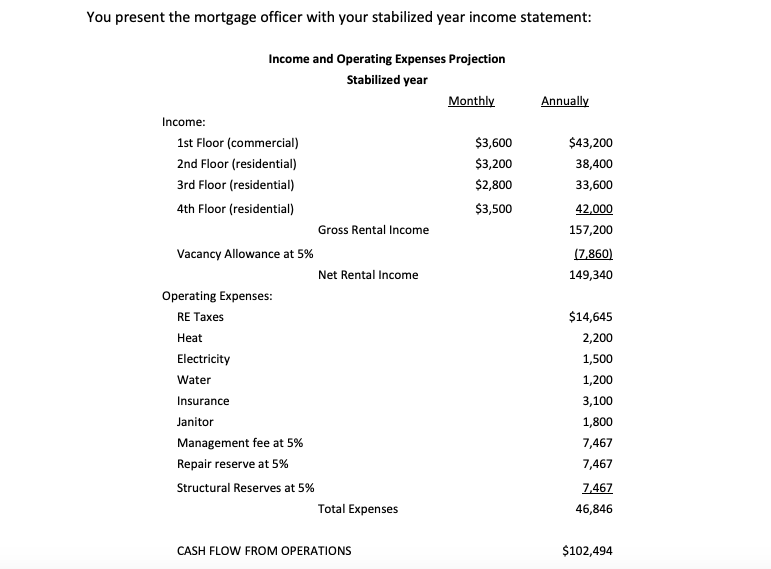

An architect purchased the building about a year after the fire and began a $450,000 renovation. The architect's work done so far looked good, but the architect decided that the renovations were taking too much time- and too much money. Thus, he decided to place the building for sale. You think the property has profit potential and has an asking price within your price range of $1 million. Fantastically, the architect is willing to offer 20% seller financing at 5% with a five-year balloon over a 30-year amortization You learn the sales price is firm. You also speak to a contractor who tells you that to complete the renovations it would cost approximately $450,000 above what work the current owner has already completed. Given the cost estimate, you think you will act as your own general contractor to save the contractor's fee (you have worked in construction and understand how things work) After doing some detailed analysis, you learn that the property's tax assessed value is about $335,500 below what your expected investment will be ($1 million purchase price plus renovations cost) You present the mortgage officer with your stabilized year income statement Income and Operating Expenses Projection Stabilized year Monthly Income 1st Floor (commercial) 2nd Floor (residential) 3rd Floor (residential) 4th Floor (residential) $3,600 $3,200 $2,800 3,500 $43,200 38,400 33,600 42,000 157,200 (7.860) 149,340 Gross Rental Income Vacancy Allowance at 5% Net Rental Income Operating Expenses: RE Taxes Heat Electricity Water Insurance Janitor Management fee at 5% Repair reserve at 5% Structural Reserves at 5% $14,645 2,200 1,500 1,200 3,100 1,800 7,467 7,467 7467 46,846 Total Expenses CASH FLOW FROM OPERATIONS 102,494 You explain your plans for the building along with your financial projections. Your underwriting analysis noted that your revenue projections are $12,000 higher than the current owner's projections-even though you plan to rent out only 75% of the residential units. At the time of the original loan, the bank had the property valued at $1.425 million, but recognizes that values in the neighborhood have steadily been increasing. You ask the bank to consider increasing the loan to $1.05 million. You argue that you project a property NOI of $102,494, which at a current market cap rate of 7% should give the bank comfort. The mortgage officer declines any loan amount increase because (1) he doesn't believe the increased revenues are achievable (partially because you will be living in one of he residential units) and (2) the limited amount of capital you plan to invest in the project. However, the mortgage officer said he would consider a loan amount increase when the building is rented and has a year or two of seasoning That said, the mortgage officer mentioned that they have a strict 75% LTV policy, which means that the property must appraise at $1.4 million to justify a $1.05 million loan. The mortgage officer also says that interest rates are dropping, so it's very possible after lease- up about a year from now, the bank could offer a 3.75% interest rate on a 30-year loan with interest-only payments for the first six months. All said, however, the mortgage officer tells you that you will personally have to sign the promissory note. When you ask why, the mortgage officer says it's the bank's policy You then speak with an attorney who questions your desire to place a written purchase offer before securing financing. He details the risks you would face should you renege on your purchase agreement. Your attorney also asks why you're are renting the units and not selling them as condominiums. You respond by saying you are hopeful of increased rents that will in turn increase the building value more, and that will give you increased profit when you decide to sell the building An architect purchased the building about a year after the fire and began a $450,000 renovation. The architect's work done so far looked good, but the architect decided that the renovations were taking too much time- and too much money. Thus, he decided to place the building for sale. You think the property has profit potential and has an asking price within your price range of $1 million. Fantastically, the architect is willing to offer 20% seller financing at 5% with a five-year balloon over a 30-year amortization You learn the sales price is firm. You also speak to a contractor who tells you that to complete the renovations it would cost approximately $450,000 above what work the current owner has already completed. Given the cost estimate, you think you will act as your own general contractor to save the contractor's fee (you have worked in construction and understand how things work) After doing some detailed analysis, you learn that the property's tax assessed value is about $335,500 below what your expected investment will be ($1 million purchase price plus renovations cost) You present the mortgage officer with your stabilized year income statement Income and Operating Expenses Projection Stabilized year Monthly Income 1st Floor (commercial) 2nd Floor (residential) 3rd Floor (residential) 4th Floor (residential) $3,600 $3,200 $2,800 3,500 $43,200 38,400 33,600 42,000 157,200 (7.860) 149,340 Gross Rental Income Vacancy Allowance at 5% Net Rental Income Operating Expenses: RE Taxes Heat Electricity Water Insurance Janitor Management fee at 5% Repair reserve at 5% Structural Reserves at 5% $14,645 2,200 1,500 1,200 3,100 1,800 7,467 7,467 7467 46,846 Total Expenses CASH FLOW FROM OPERATIONS 102,494 You explain your plans for the building along with your financial projections. Your underwriting analysis noted that your revenue projections are $12,000 higher than the current owner's projections-even though you plan to rent out only 75% of the residential units. At the time of the original loan, the bank had the property valued at $1.425 million, but recognizes that values in the neighborhood have steadily been increasing. You ask the bank to consider increasing the loan to $1.05 million. You argue that you project a property NOI of $102,494, which at a current market cap rate of 7% should give the bank comfort. The mortgage officer declines any loan amount increase because (1) he doesn't believe the increased revenues are achievable (partially because you will be living in one of he residential units) and (2) the limited amount of capital you plan to invest in the project. However, the mortgage officer said he would consider a loan amount increase when the building is rented and has a year or two of seasoning That said, the mortgage officer mentioned that they have a strict 75% LTV policy, which means that the property must appraise at $1.4 million to justify a $1.05 million loan. The mortgage officer also says that interest rates are dropping, so it's very possible after lease- up about a year from now, the bank could offer a 3.75% interest rate on a 30-year loan with interest-only payments for the first six months. All said, however, the mortgage officer tells you that you will personally have to sign the promissory note. When you ask why, the mortgage officer says it's the bank's policy You then speak with an attorney who questions your desire to place a written purchase offer before securing financing. He details the risks you would face should you renege on your purchase agreement. Your attorney also asks why you're are renting the units and not selling them as condominiums. You respond by saying you are hopeful of increased rents that will in turn increase the building value more, and that will give you increased profit when you decide to sell the building