Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An Asian option is an option whose payoffs depend on the average price of the un- derlying asset over a certain period of time

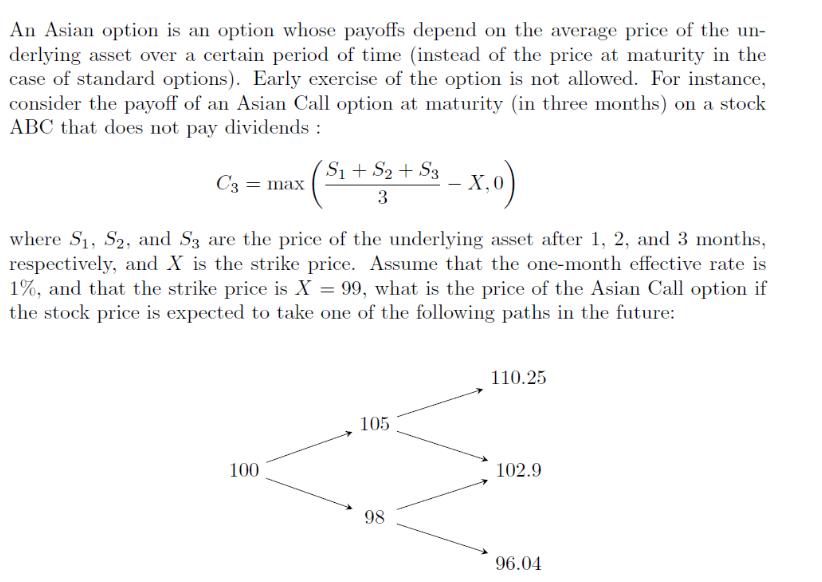

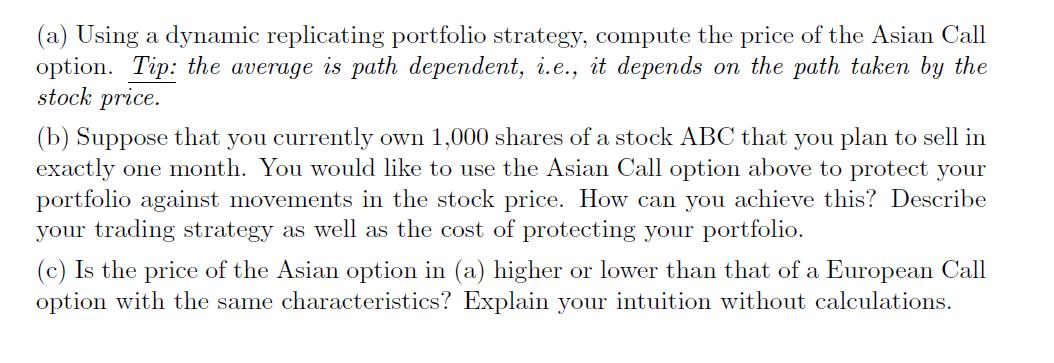

An Asian option is an option whose payoffs depend on the average price of the un- derlying asset over a certain period of time (instead of the price at maturity in the case of standard options). Early exercise of the option is not allowed. For instance, consider the payoff of an Asian Call option at maturity (in three months) on a stock ABC that does not pay dividends : C3 = max :( S + $ 100 S1 + S2 + S3 3 where S, S, and S3 are the price of the underlying asset after 1, 2, and 3 months, respectively, and X is the strike price. Assume that the one-month effective rate is 1%, and that the strike price is X = 99, what is the price of the Asian Call option if the stock price is expected to take one of the following paths in the future: :-x,0) 105 98 110.25 102.9 96.04 (a) Using a dynamic replicating portfolio strategy, compute the price of the Asian Call option. Tip: the average is path dependent, i.e., it depends on the path taken by the stock price. (b) Suppose that you currently own 1,000 shares of a stock ABC that you plan to sell in exactly one month. You would like to use the Asian Call option above to protect your portfolio against movements in the stock price. How can you achieve this? Describe your trading strategy as well as the cost of protecting your portfolio. (c) Is the price of the Asian option in (a) higher or lower than that of a European Call option with the same characteristics? Explain your intuition without calculations.

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER a To compute the price of the Asian Call option using a dynamic replicating portfolio strategy we need to consider the possible paths of the st...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started