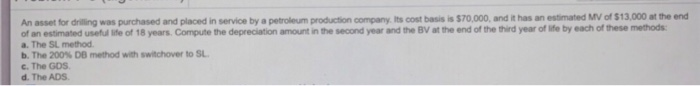

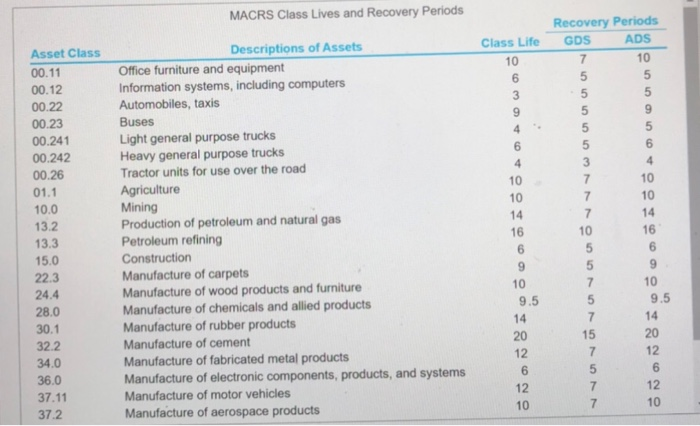

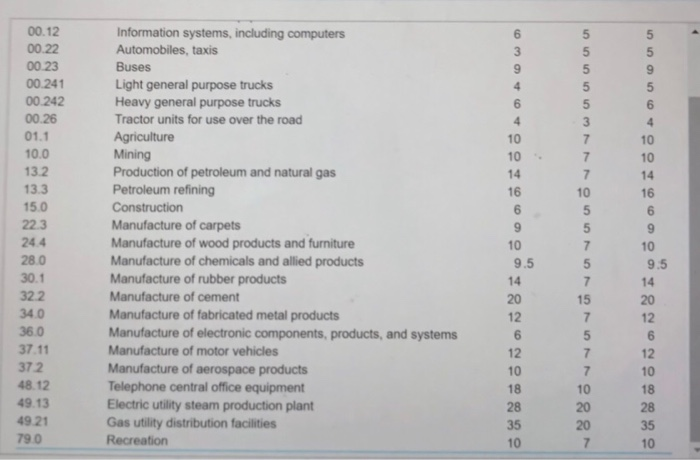

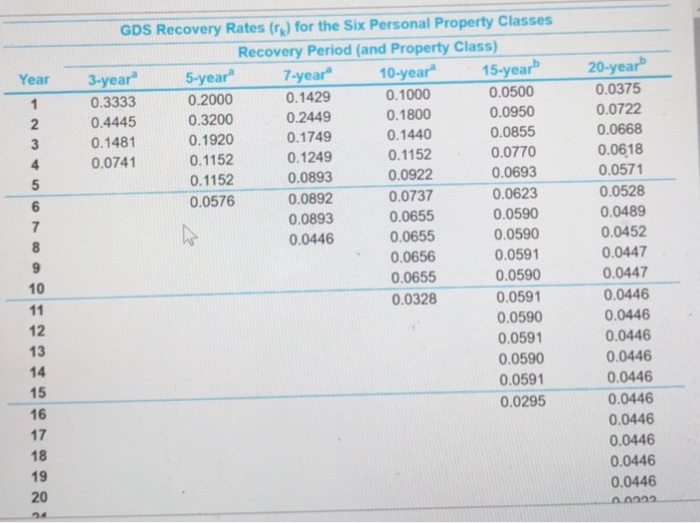

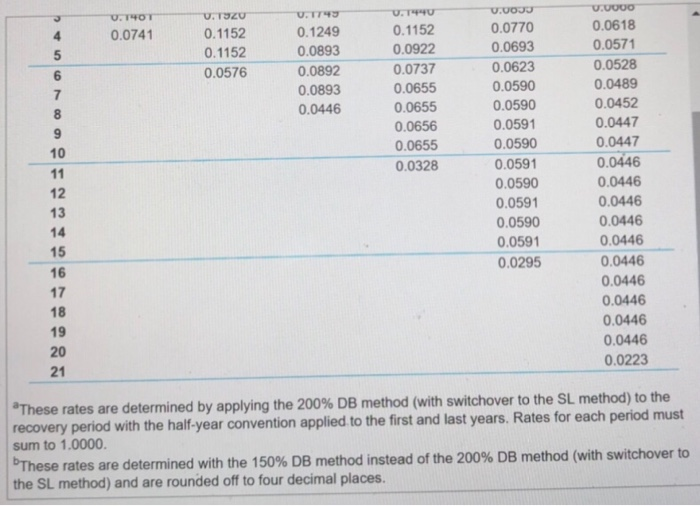

An asset for drilling was purchased and placed in service by a petroleum production company. Its cost basis is $70,000, and it has an estimated MV of $13,000 at the end of an estimated useful life of 18 years, Compute the depreciation amount in the second year and the BV at the end of the third year of life by each of these methods: a. The SL method b. The 200% DB method with switchover to SL c. The GOS d. The ADS MACRS Class Lives and Recovery Periods Recovery Periods GOS ADS 10 5 5 9 5 6 4 10 10 14 Asset Class 00.11 00.12 00.22 00.23 00.241 00.242 00.26 01.1 10.0 13.2 13.3 15.0 22.3 24.4 28.0 30.1 32.2 34.0 36.0 37.11 37.2 Descriptions of Assets Office furniture and equipment Information systems, including computers Automobiles, taxis Buses Light general purpose trucks Heavy general purpose trucks Tractor units for use over the road Agriculture Mining Production of petroleum and natural gas Petroleum refining Construction Manufacture of carpets Manufacture of wood products and furniture Manufacture of chemicals and allied products Manufacture of rubber products Manufacture of cement Manufacture of fabricated metal products Manufacture of electronic components, products, and systems Manufacture of motor vehicles Manufacture of aerospace products Class Life 10 6 3 9 4 6 4 10 10 14 16 6 9 10 9.5 14 20 12 6 12 10 7 5 5 5 5 5 3 7 7 7 10 5 5 7 5 7 15 7 5 7 7 16 6 9 10 9.5 14 20 12 6 12 10 5 6 3 9 9 5 6 4 10 10 14 16 6 9 00.12 00.22 00.23 00.241 00.242 00.26 01.1 10.0 13.2 13.3 15.0 223 24.4 28.0 30.1 322 34.0 36.0 37.11 372 48.12 49.13 49.21 790 Information systems, including computers Automobiles, taxis Buses Light general purpose trucks Heavy general purpose trucks Tractor units for use over the road Agriculture Mining Production of petroleum and natural gas Petroleum refining Construction Manufacture of carpets Manufacture of wood products and furniture Manufacture of chemicals and allied products Manufacture of rubber products Manufacture of cement Manufacture of fabricated metal products Manufacture of electronic components, products, and systems Manufacture of motor vehicles Manufacture of aerospace products Telephone central office equipment Electric utility steam production plant Gas utility distribution facilities Recreation 4 6 4 10 10 14 16 6 9 10 9.5 14 20 12 6 12 10 18 28 35 10 5 5 5 5 5 3 7 7 7 10 5 5 7 5 7 15 7 5 7 7 10 20 20 7 10 9.5 14 20 12 6 12 10 18 28 35 10 Year 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 GDS Recovery Rates (r) for the Six Personal Property Classes Recovery Period (and Property Class) 3-year 5-year 7-year 10-year 15-year 0.3333 0.2000 0.1429 0.1000 0.0500 0.4445 0.3200 0.2449 0.1800 0.0950 0.1481 0.1920 0.1749 0.1440 0.0855 0.0741 0.1152 0.1249 0.1152 0.0770 0.1152 0.0893 0.0922 0.0693 0.0576 0.0892 0.0737 0.0623 0.0893 0.0655 0.0590 0.0446 0.0655 0.0590 0.0656 0.0591 0.0655 0.0590 0.0328 0.0591 0.0590 0.0591 0.0590 0.0591 0.0295 20-year 0.0375 0.0722 0.0668 0.0618 0.0571 0.0528 0.0489 0.0452 0.0447 0.0447 0.0446 0.0446 0.0446 0.0446 0.0446 0.0446 0.0446 0.0446 0.0446 0.0446 16 17 18 19 20 U. TOT 0.0741 U. TOZU 0.1152 0.1152 0.0576 U. 1749 0.1249 0.0893 0.0892 0.0893 0.0446 U. TU 0.1152 0.0922 0.0737 0.0655 0.0655 0.0656 0.0655 0.0328 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 V.VOJU 0.0770 0.0693 0.0623 0.0590 0.0590 0.0591 0.0590 0.0591 0.0590 0.0591 0.0590 0.0591 0.0295 V.DUO 0.0618 0.0571 0.0528 0.0489 0.0452 0.0447 0.0447 0.0446 0.0446 0.0446 0.0446 0.0446 0.0446 0.0446 0.0446 0.0446 0.0446 0.0223 These rates are determined by applying the 200% DB method (with switchover to the SL method) to the recovery period with the half-year convention applied to the first and last years. Rates for each period must sum to 1.0000 These rates are determined with the 150% DB method instead of the 200% DB method (with switchover to the SL method) and are rounded off to four decimal places. An asset for drilling was purchased and placed in service by a petroleum production company. Its cost basis is $70,000, and it has an estimated MV of $13,000 at the end of an estimated useful life of 18 years, Compute the depreciation amount in the second year and the BV at the end of the third year of life by each of these methods: a. The SL method b. The 200% DB method with switchover to SL c. The GOS d. The ADS MACRS Class Lives and Recovery Periods Recovery Periods GOS ADS 10 5 5 9 5 6 4 10 10 14 Asset Class 00.11 00.12 00.22 00.23 00.241 00.242 00.26 01.1 10.0 13.2 13.3 15.0 22.3 24.4 28.0 30.1 32.2 34.0 36.0 37.11 37.2 Descriptions of Assets Office furniture and equipment Information systems, including computers Automobiles, taxis Buses Light general purpose trucks Heavy general purpose trucks Tractor units for use over the road Agriculture Mining Production of petroleum and natural gas Petroleum refining Construction Manufacture of carpets Manufacture of wood products and furniture Manufacture of chemicals and allied products Manufacture of rubber products Manufacture of cement Manufacture of fabricated metal products Manufacture of electronic components, products, and systems Manufacture of motor vehicles Manufacture of aerospace products Class Life 10 6 3 9 4 6 4 10 10 14 16 6 9 10 9.5 14 20 12 6 12 10 7 5 5 5 5 5 3 7 7 7 10 5 5 7 5 7 15 7 5 7 7 16 6 9 10 9.5 14 20 12 6 12 10 5 6 3 9 9 5 6 4 10 10 14 16 6 9 00.12 00.22 00.23 00.241 00.242 00.26 01.1 10.0 13.2 13.3 15.0 223 24.4 28.0 30.1 322 34.0 36.0 37.11 372 48.12 49.13 49.21 790 Information systems, including computers Automobiles, taxis Buses Light general purpose trucks Heavy general purpose trucks Tractor units for use over the road Agriculture Mining Production of petroleum and natural gas Petroleum refining Construction Manufacture of carpets Manufacture of wood products and furniture Manufacture of chemicals and allied products Manufacture of rubber products Manufacture of cement Manufacture of fabricated metal products Manufacture of electronic components, products, and systems Manufacture of motor vehicles Manufacture of aerospace products Telephone central office equipment Electric utility steam production plant Gas utility distribution facilities Recreation 4 6 4 10 10 14 16 6 9 10 9.5 14 20 12 6 12 10 18 28 35 10 5 5 5 5 5 3 7 7 7 10 5 5 7 5 7 15 7 5 7 7 10 20 20 7 10 9.5 14 20 12 6 12 10 18 28 35 10 Year 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 GDS Recovery Rates (r) for the Six Personal Property Classes Recovery Period (and Property Class) 3-year 5-year 7-year 10-year 15-year 0.3333 0.2000 0.1429 0.1000 0.0500 0.4445 0.3200 0.2449 0.1800 0.0950 0.1481 0.1920 0.1749 0.1440 0.0855 0.0741 0.1152 0.1249 0.1152 0.0770 0.1152 0.0893 0.0922 0.0693 0.0576 0.0892 0.0737 0.0623 0.0893 0.0655 0.0590 0.0446 0.0655 0.0590 0.0656 0.0591 0.0655 0.0590 0.0328 0.0591 0.0590 0.0591 0.0590 0.0591 0.0295 20-year 0.0375 0.0722 0.0668 0.0618 0.0571 0.0528 0.0489 0.0452 0.0447 0.0447 0.0446 0.0446 0.0446 0.0446 0.0446 0.0446 0.0446 0.0446 0.0446 0.0446 16 17 18 19 20 U. TOT 0.0741 U. TOZU 0.1152 0.1152 0.0576 U. 1749 0.1249 0.0893 0.0892 0.0893 0.0446 U. TU 0.1152 0.0922 0.0737 0.0655 0.0655 0.0656 0.0655 0.0328 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 V.VOJU 0.0770 0.0693 0.0623 0.0590 0.0590 0.0591 0.0590 0.0591 0.0590 0.0591 0.0590 0.0591 0.0295 V.DUO 0.0618 0.0571 0.0528 0.0489 0.0452 0.0447 0.0447 0.0446 0.0446 0.0446 0.0446 0.0446 0.0446 0.0446 0.0446 0.0446 0.0446 0.0223 These rates are determined by applying the 200% DB method (with switchover to the SL method) to the recovery period with the half-year convention applied to the first and last years. Rates for each period must sum to 1.0000 These rates are determined with the 150% DB method instead of the 200% DB method (with switchover to the SL method) and are rounded off to four decimal places