Answered step by step

Verified Expert Solution

Question

1 Approved Answer

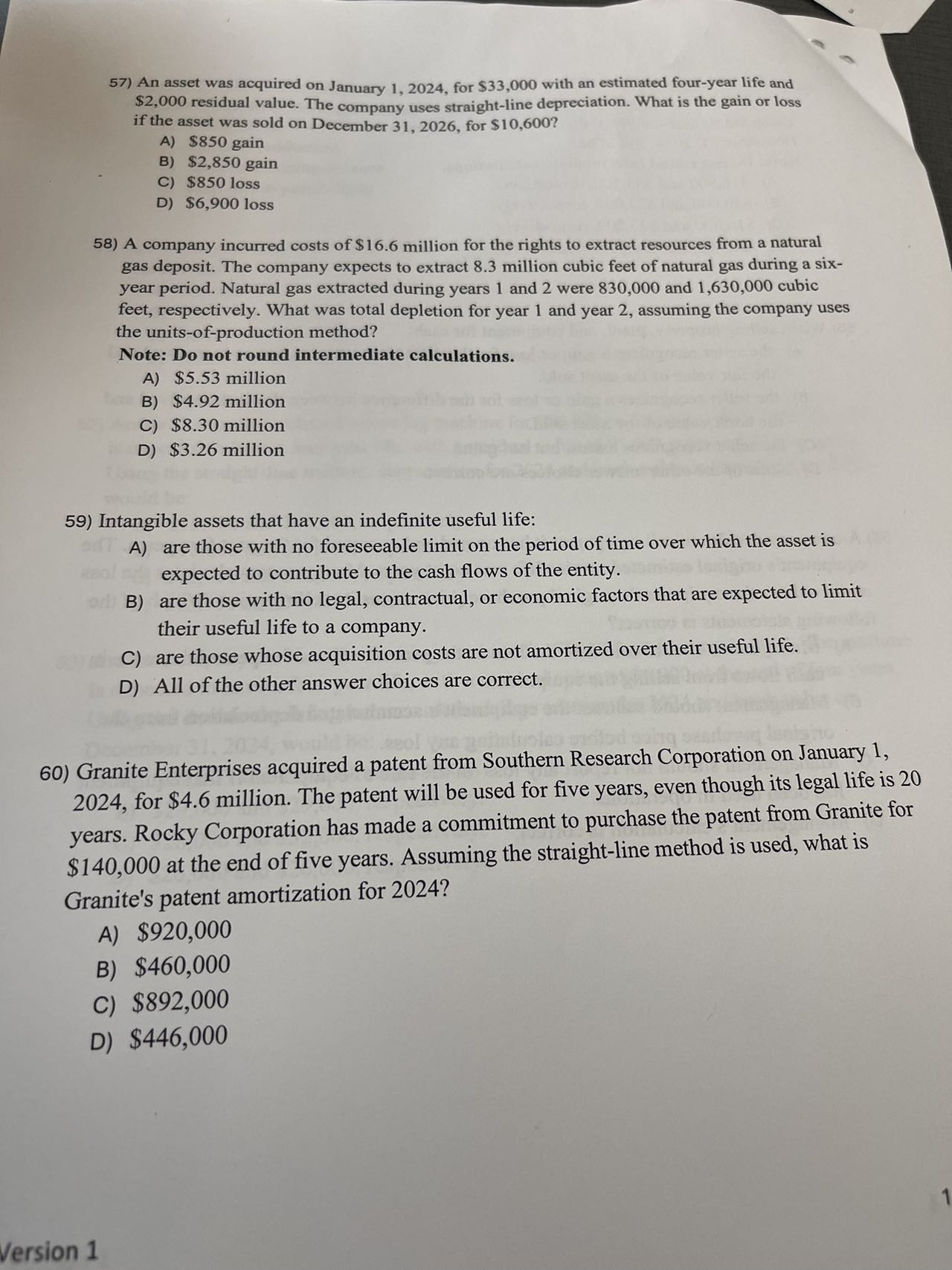

An asset was acquired on January 1 , 2 0 2 4 , for $ 3 3 , 0 0 0 with an estimated four

An asset was acquired on January for $ with an estimated fouryear life and

$ residual value. The company uses straightline depreciation. What is the gain or loss

if the asset was sold on December for $

A $ gain

B $ gain

C $ loss

D $ loss

A company incurred costs of $ million for the rights to extract resources from a natural

gas deposit. The company expects to extract million cubic feet of natural gas during a six

year period. Natural gas extracted during years and were and cubic

feet, respectively. What was total depletion for year and year assuming the company uses

the unitsofproduction method?

Note: Do not round intermediate calculations.

A $ million

B $ million

C $ million

D $ million

Intangible assets that have an indefinite useful life:

A are those with no foreseeable limit on the period of time over which the asset is

expected to contribute to the cash flows of the entity.

B are those with no legal, contractual, or economic factors that are expected to limit

their useful life to a company.

C are those whose acquisition costs are not amortized over their useful life.

D All of the other answer choices are correct.

Granite Enterprises acquired a patent from Southern Research Corporation on January

for $ million. The patent will be used for five years, even though its legal life is

years. Rocky Corporation has made a commitment to purchase the patent from Granite for

$ at the end of five years. Assuming the straightline method is used, what is

Granite's patent amortization for

A $

B $

C $

D $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started