Question

An Australian importer has received goods from China and will pay 2 million Chinese yuan (CNY) in one year. Also, the importer has the

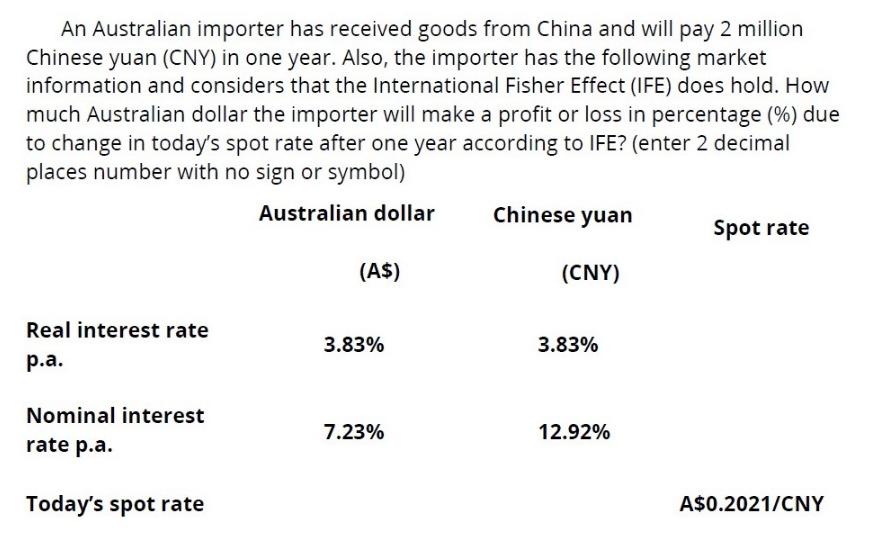

An Australian importer has received goods from China and will pay 2 million Chinese yuan (CNY) in one year. Also, the importer has the following market information and considers that the International Fisher Effect (IFE) does hold. How much Australian dollar the importer will make a profit or loss in percentage (%) due to change in today's spot rate after one year according to IFE? (enter 2 decimal places number with no sign or symbol) Australian dollar Real interest rate p.a. Nominal interest rate p.a. Today's spot rate (A$) 3.83% 7.23% Chinese yuan (CNY) 3.83% 12.92% Spot rate A$0.2021/CNY

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Heres how to calculate the importers profit or loss in percentage due to the expected change in spot ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting and Reporting a Global Perspective

Authors: Michel Lebas, Herve Stolowy, Yuan Ding

4th edition

978-1408066621, 1408066629, 1408076861, 978-1408076866

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App