Answered step by step

Verified Expert Solution

Question

1 Approved Answer

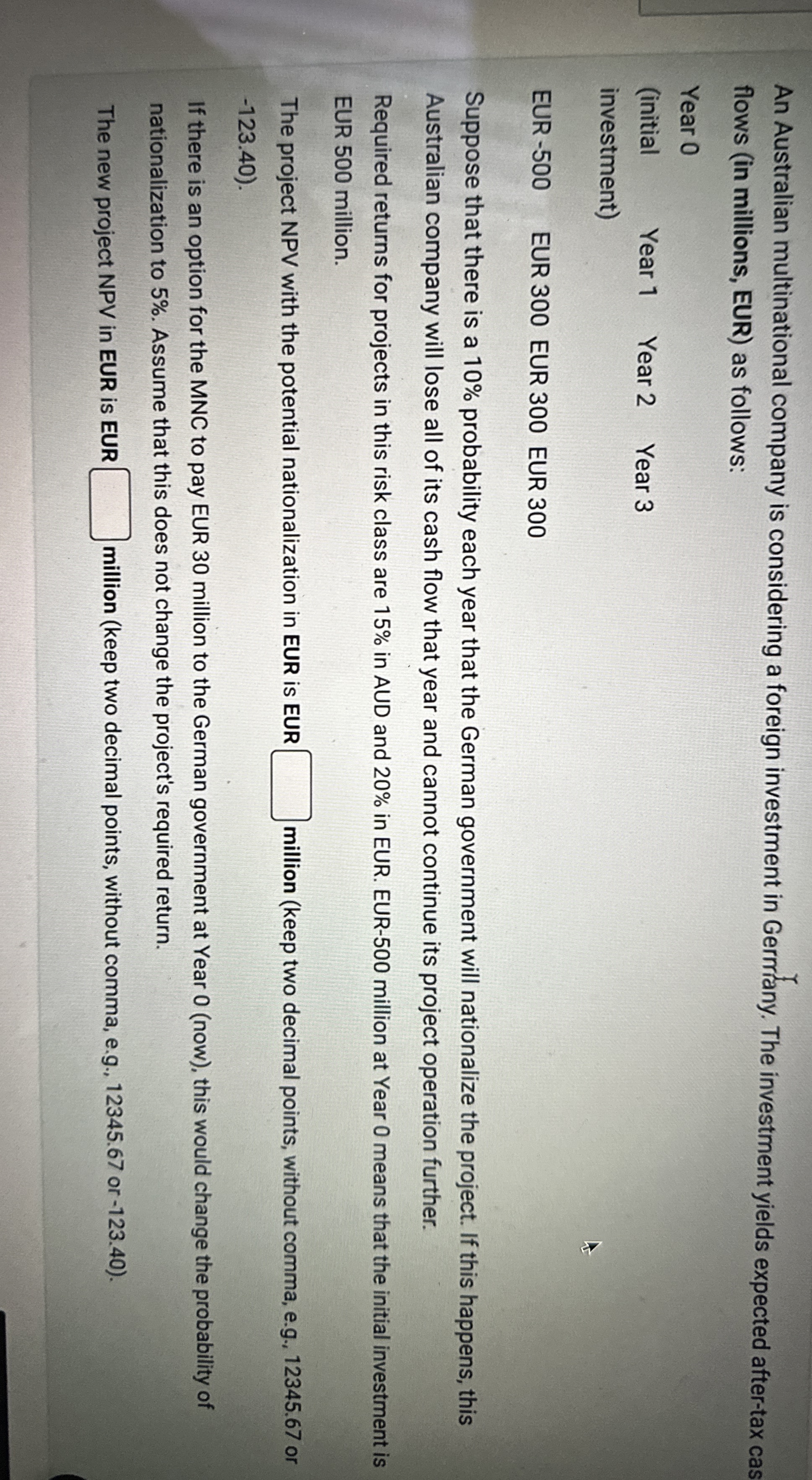

An Australian multinational company is considering a foreign investment in Gerrrany. The investment yields expected after - tax cas flows ( in millions, EUR )

An Australian multinational company is considering a foreign investment in Gerrrany. The investment yields expected aftertax cas flows in millions, EUR as follows:

Year

initial Year Year Year

investment

EUR EUR EUR EUR

Suppose that there is a probability each year that the German government will nationalize the project. If this happens, this Australian company will lose all of its cash flow that year and cannot continue its project operation further.

Required returns for projects in this risk class are in AUD and in EUR. EUR million at Year means that the initial investment is EUR million.

The project NPV with the potential nationalization in EUR is EUR million keep two decimal points, without comma, eg or

If there is an option for the MNC to pay EUR million to the German government at Year now this would change the probability of nationalization to Assume that this does not change the project's required return.

The new project NPV in EUR is EUR million keep two decimal points, without comma, eg or

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started