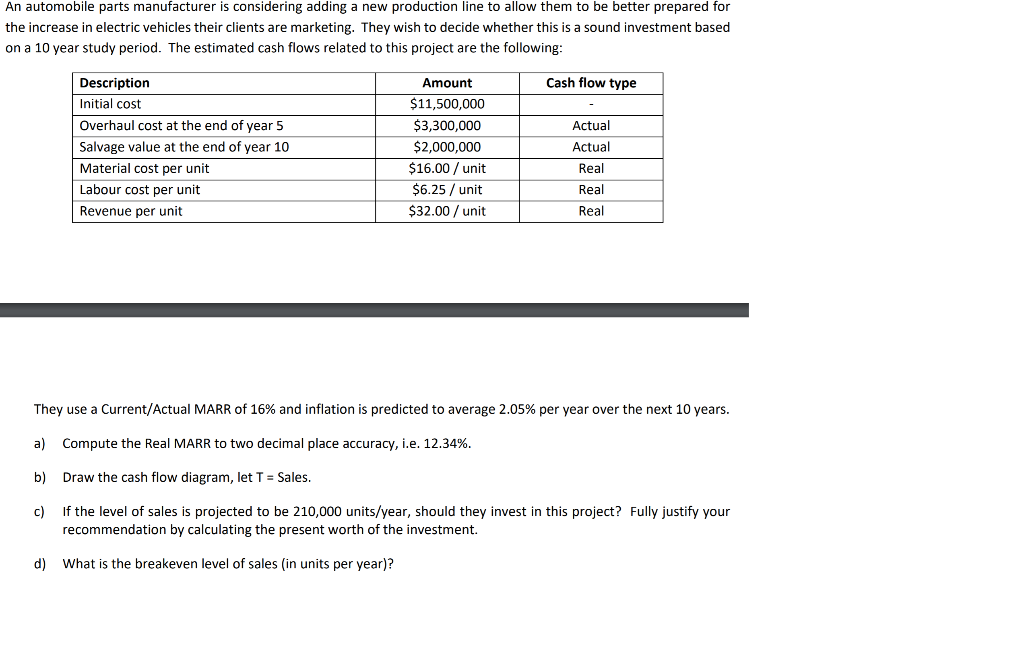

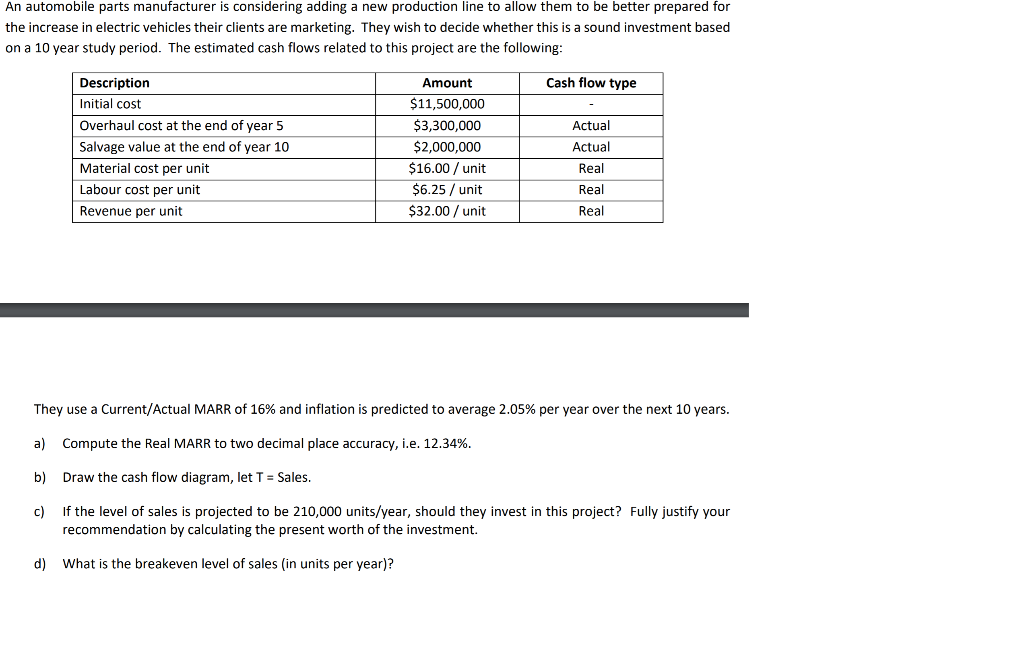

An automobile parts manufacturer is considering adding a new production line to allow them to be better prepared for the increase in electric vehicles their clients are marketing. They wish to decide whether this is a sound investment based on a 10 year study period. The estimated cash flows related to this project are the following: Cash flow type Description Initial cost Overhaul cost at the end of year 5 Salvage value at the end of year 10 Material cost per unit Labour cost per unit Revenue per unit Amount $11,500,000 $3,300,000 $2,000,000 $16.00/unit $6.25 / unit $32.00 / unit Actual Actual Real Real Real They use a Current/Actual MARR of 16% and inflation is predicted to average 2.05% per year over the next 10 years. a) Compute the Real MARR to two decimal place accuracy, i.e. 12.34%. b) Draw the cash flow diagram, let T = Sales. c) If the level of sales is projected to be 210,000 units/year, should they invest in this project? Fully justify your recommendation by calculating the present worth of the investment. d) What is the breakeven level of sales in units per year)? An automobile parts manufacturer is considering adding a new production line to allow them to be better prepared for the increase in electric vehicles their clients are marketing. They wish to decide whether this is a sound investment based on a 10 year study period. The estimated cash flows related to this project are the following: Cash flow type Description Initial cost Overhaul cost at the end of year 5 Salvage value at the end of year 10 Material cost per unit Labour cost per unit Revenue per unit Amount $11,500,000 $3,300,000 $2,000,000 $16.00/unit $6.25 / unit $32.00 / unit Actual Actual Real Real Real They use a Current/Actual MARR of 16% and inflation is predicted to average 2.05% per year over the next 10 years. a) Compute the Real MARR to two decimal place accuracy, i.e. 12.34%. b) Draw the cash flow diagram, let T = Sales. c) If the level of sales is projected to be 210,000 units/year, should they invest in this project? Fully justify your recommendation by calculating the present worth of the investment. d) What is the breakeven level of sales in units per year)