Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An earthwork contractor is considering to purchase a new excavator which will cost $130,000 including tax and transportation expenses. Answer the following questions about

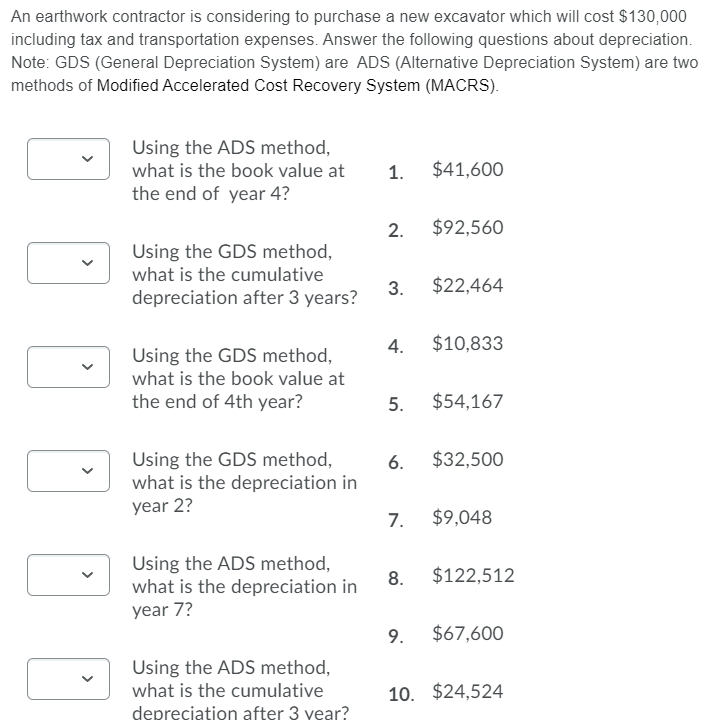

An earthwork contractor is considering to purchase a new excavator which will cost $130,000 including tax and transportation expenses. Answer the following questions about depreciation. Note: GDS (General Depreciation System) are ADS (Alternative Depreciation System) are two methods of Modified Accelerated Cost Recovery System (MACRS). Using the ADS method, what is the book value at the end of year 4? Using the GDS method, what is the cumulative depreciation after 3 years? Using the GDS method, what is the book value at the end of 4th year? Using the GDS method, what is the depreciation in year 2? Using the ADS method, what is the depreciation in year 7? Using the ADS method, what is the cumulative depreciation after 3 year? 1. 2. 3. 4. 6. 7. 8. $41,600 5. $54,167 9. $92,560 $22,464 $10,833 $32,500 $9,048 $122,512 $67,600 10. $24,524

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a Using the ADS method the book value at the end of year 4 would be 50400 The depreciation of the ex...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started