Answered step by step

Verified Expert Solution

Question

1 Approved Answer

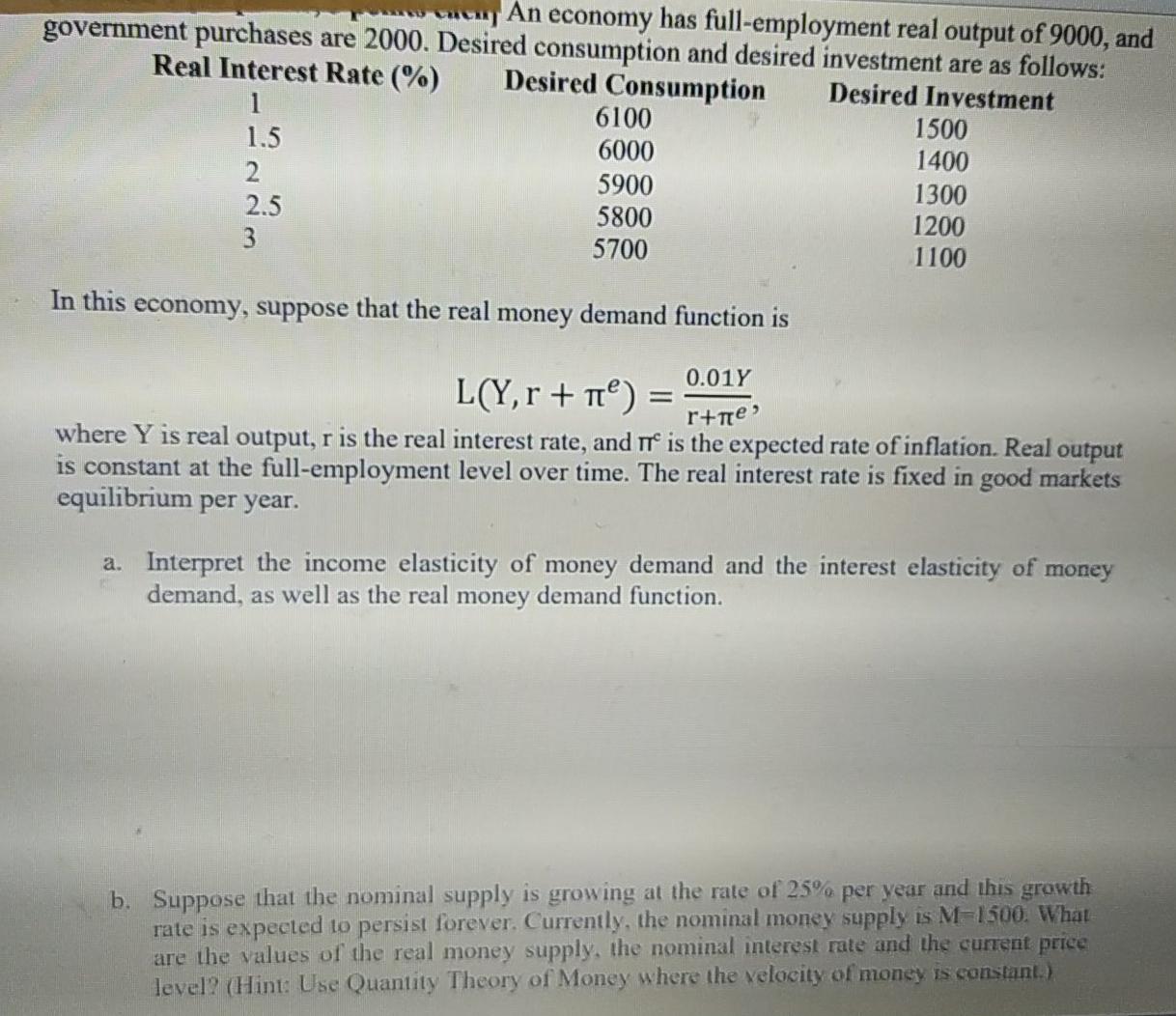

An economy has full-employment real output of 9000, and government purchases are 2000. Desired consumption and desired investment are as follows: Real Interest Rate (%)

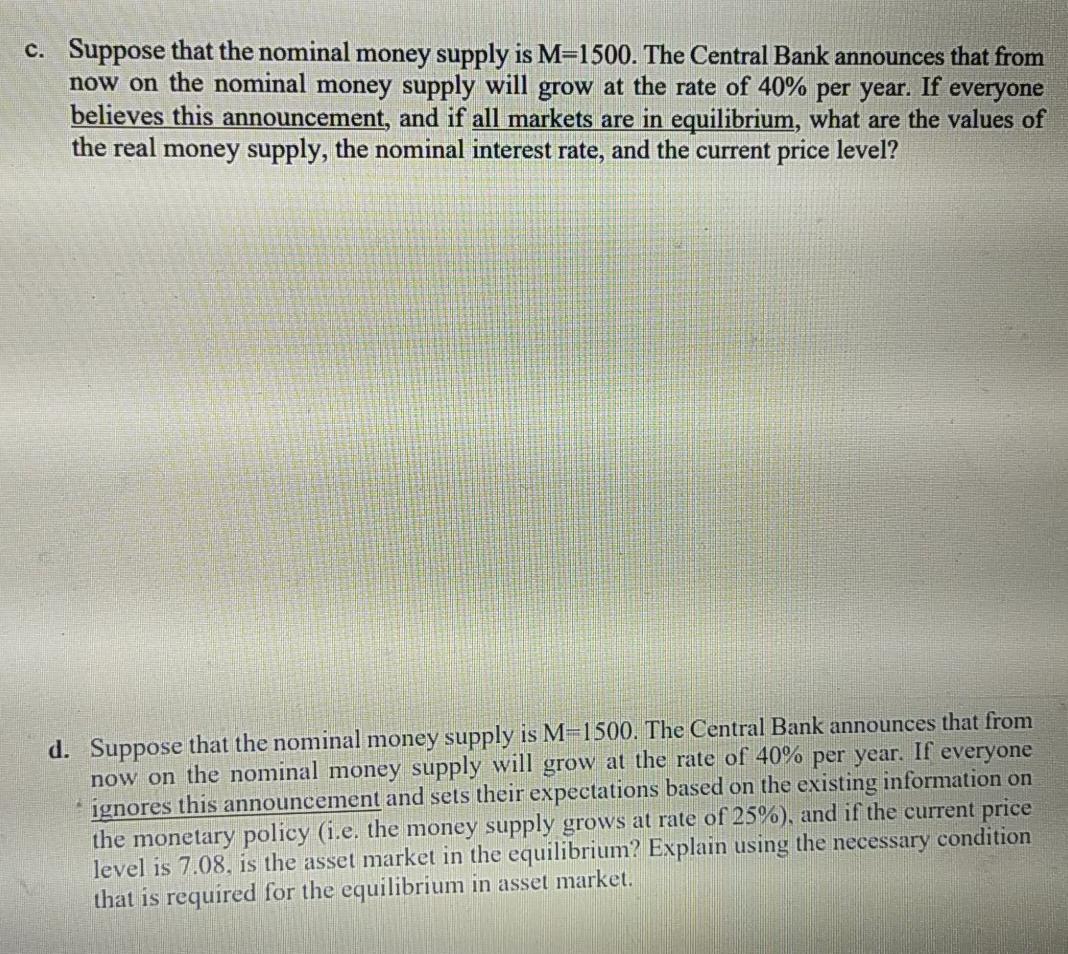

An economy has full-employment real output of 9000, and government purchases are 2000. Desired consumption and desired investment are as follows: Real Interest Rate (%) Desired Consumption Desired Investment 1 6100 1500 1.5 6000 1400 2 5900 1300 2.5 5800 1200 3 5700 1100 In this economy, suppose that the real money demand function is r+te 0.01Y L(Y,r + r) where Y is real output, r is the real interest rate, and it is the expected rate of inflation. Real output is constant at the full-employment level over time. The real interest rate is fixed in good markets equilibrium per year. a. Interpret the income elasticity of money demand and the interest elasticity of money demand, as well as the real money demand function. b. Suppose that the nominal supply is growing at the rate of 25% per year and this growth rate is expected to persist forever. Currently, the nominal money supply is M=1500. What are the values of the real money supply, the nominal interest rate and the current price level? (Hint: Use Quantity Theory of Money where the velocity of money is constant.) c. Suppose that the nominal money supply is M=1500. The Central Bank announces that from now on the nominal money supply will grow at the rate of 40% per year. If everyone believes this announcement, and if all markets are in equilibrium, what are the values of the real money supply, the nominal interest rate, and the current price level? d. Suppose that the nominal money supply is M-1500. The Central Bank announces that from now on the nominal money supply will grow at the rate of 40% per year. If everyone ignores this announcement and sets their expectations based on the existing information on the monetary policy (i.e. the money supply grows at rate of 25%), and if the current price level is 7.08, is the asset market in the equilibrium? Explain using the necessary condition that is required for the equilibrium in asset market. An economy has full-employment real output of 9000, and government purchases are 2000. Desired consumption and desired investment are as follows: Real Interest Rate (%) Desired Consumption Desired Investment 1 6100 1500 1.5 6000 1400 2 5900 1300 2.5 5800 1200 3 5700 1100 In this economy, suppose that the real money demand function is r+te 0.01Y L(Y,r + r) where Y is real output, r is the real interest rate, and it is the expected rate of inflation. Real output is constant at the full-employment level over time. The real interest rate is fixed in good markets equilibrium per year. a. Interpret the income elasticity of money demand and the interest elasticity of money demand, as well as the real money demand function. b. Suppose that the nominal supply is growing at the rate of 25% per year and this growth rate is expected to persist forever. Currently, the nominal money supply is M=1500. What are the values of the real money supply, the nominal interest rate and the current price level? (Hint: Use Quantity Theory of Money where the velocity of money is constant.) c. Suppose that the nominal money supply is M=1500. The Central Bank announces that from now on the nominal money supply will grow at the rate of 40% per year. If everyone believes this announcement, and if all markets are in equilibrium, what are the values of the real money supply, the nominal interest rate, and the current price level? d. Suppose that the nominal money supply is M-1500. The Central Bank announces that from now on the nominal money supply will grow at the rate of 40% per year. If everyone ignores this announcement and sets their expectations based on the existing information on the monetary policy (i.e. the money supply grows at rate of 25%), and if the current price level is 7.08, is the asset market in the equilibrium? Explain using the necessary condition that is required for the equilibrium in asset market

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started