Question

An Edmonton-based financial institution intends to design three different currency call options. More information is provided below. Foreign Currency (fc) Spot Rate (CAD/fc) Exercise

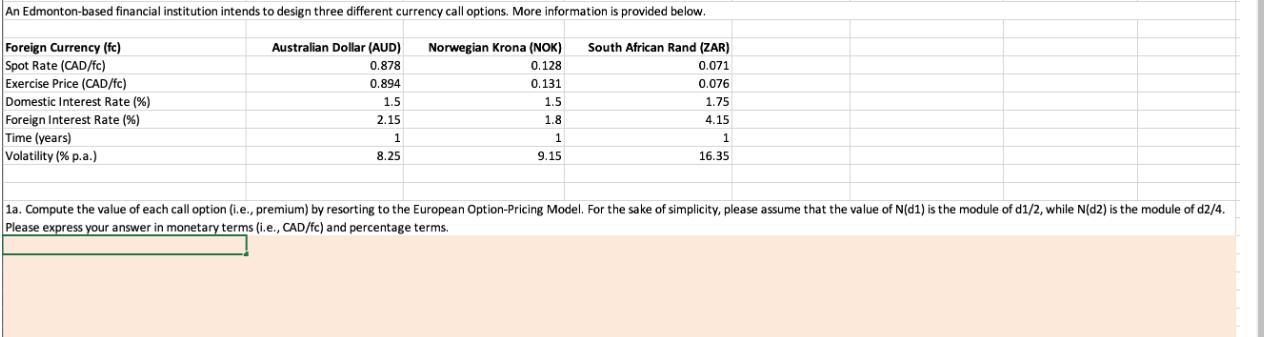

An Edmonton-based financial institution intends to design three different currency call options. More information is provided below. Foreign Currency (fc) Spot Rate (CAD/fc) Exercise Price (CAD/fc) Domestic Interest Rate (%) Foreign Interest Rate (%) Time (years) Volatility (% p.a.) Australian Dollar (AUD) 0.878 Norwegian Krona (NOK) 0.128 South African Rand (ZAR) 0.071 0.894 0.131 0.076 1.5 1.5 1.75 2.15 1.8 1 8.25 1 9.15 4.15 1 16.35 1a. Compute the value of each call option (i.e., premium) by resorting to the European Option-Pricing Model. For the sake of simplicity, please assume that the value of N(d1) is the module of d1/2, while N(d2) is the module of d2/4. Please express your answer in monetary terms (i.e., CAD/fc) and percentage terms.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting Information For Decisions

Authors: Robert w Ingram, Thomas L Albright

6th Edition

9780324313413, 324672705, 324313411, 978-0324672701

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App