Answered step by step

Verified Expert Solution

Question

1 Approved Answer

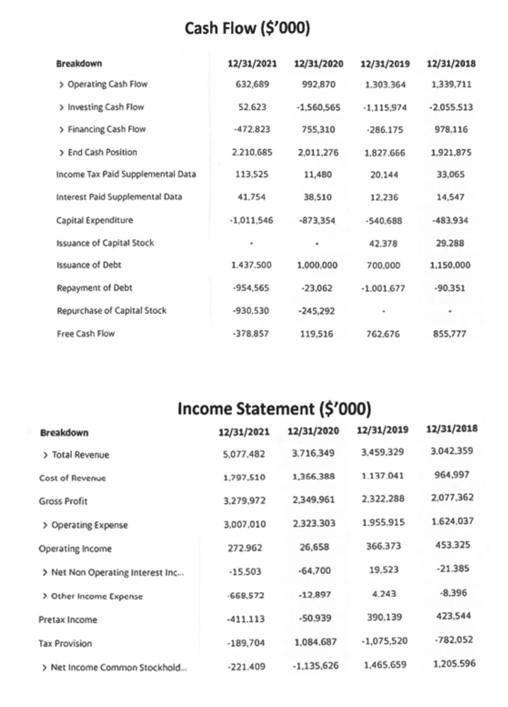

Cash Flow ($'000) 12/31/2021 12/31/2020 12/31/2019 12/31/2018 Breakdown > Operating Cash Flow 632,689 992,870 1.303.364 1.339,711 > Investing Cash Flow 52.623 +1,560,565 -1,115,974 -2.055.513

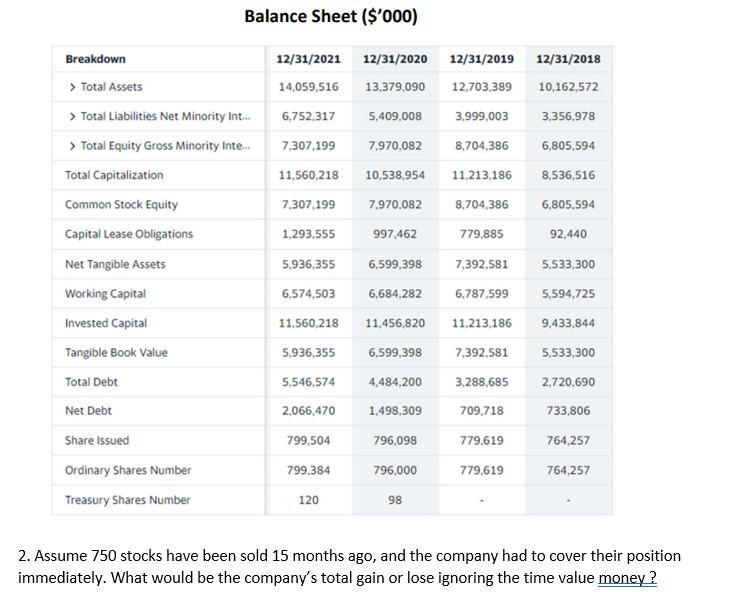

Cash Flow ($'000) 12/31/2021 12/31/2020 12/31/2019 12/31/2018 Breakdown > Operating Cash Flow 632,689 992,870 1.303.364 1.339,711 > Investing Cash Flow 52.623 +1,560,565 -1,115,974 -2.055.513 > Financing Cash Flow -472.823 755,310 -286.175 978,116 > End Cash Position 2.210,685 2,011,276 1.827.666 1.921.875 Income Tax Paid Supplemental Data 113.525 11,480 20.144 33,065 Interest Paid Supplemental Data 41.754 38.510 12.236 14,547 Capital Expenditure -1,011,546 -873,354 -540.688 -483.934 Issuance of Capital Stock 42.378 29.288 Issuance of Debt 1.437.500 1,000,000 700.000 1.150,000 Repayment of Debt -954,565 -23,062 -1.001,677 -90.351 Repurchase of Capital Stock -930,530 -245,292 Free Cash Flow -378.857 119,516 762.676 855.777 Breakdown > Total Revenue Cost of Revenue Income Statement ($'000) 12/31/2021 12/31/2020 12/31/2019 12/31/2018 5,077,482 3.716.349 3.459.329 3.042.359 1.797.510 1,366.388 1.137.041 964,997 Gross Profit 3.279.972 2.349.961 2.322.288 2.077,362 > Operating Expense 3.007.010 2.323.303 1.955.915 1.624.037 Operating Income 272.962 26,658 366.373 453.325 > Net Non Operating Interest Inc... -15.503 -64.700 19.523 -21.385 > Other Income Expense -668,572 -12.897 4.243 -8.396 Pretax Income -411.113 -50.939 390.139 423.544 Tax Provision -189,704 1.084.687 -1,075,520 -782.052 > Net Income Common Stockhold.... -221.409 -1.135,626 1.465.659 1.205.596 Breakdown > Total Assets Balance Sheet ($'000) 12/31/2021 12/31/2020 12/31/2019 12/31/2018 14,059,516 13,379,090 12,703,389 10,162,572 > Total Liabilities Net Minority Int... 6,752,317 5,409,008 3,999,003 3,356,978 > Total Equity Gross Minority Inte... Total Capitalization 7,307,199 7,970,082 8,704,386 6,805,594 11,560,218 10,538,954 11,213,186 8,536,516 Common Stock Equity 7,307,199 7,970,082 8,704,386 6,805,594 Capital Lease Obligations 1,293,555 997,462 779,885 92,440 Net Tangible Assets 5.936,355 6,599,398 7,392,581 5,533,300 Working Capital 6,574,503 6,684,282 6,787,599 5,594,725 Invested Capital 11,560,218 11,456,820 11,213,186 9,433,844 Tangible Book Value 5,936,355 6,599,398 7,392,581 5,533,300 Total Debt 5,546,574 4,484,200 3,288,685 2,720,690 Net Debt 2,066,470 1,498,309 709,718 733,806 Share Issued 799.504 796,098 779,619 764,257 Ordinary Shares Number 799,384 796,000 779,619 764,257 Treasury Shares Number 120 98 2. Assume 750 stocks have been sold 15 months ago, and the company had to cover their position immediately. What would be the company's total gain or lose ignoring the time value money?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started