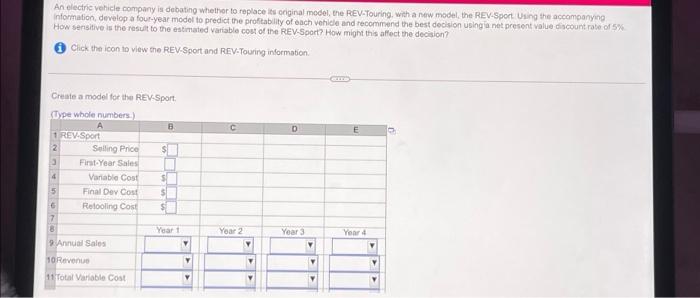

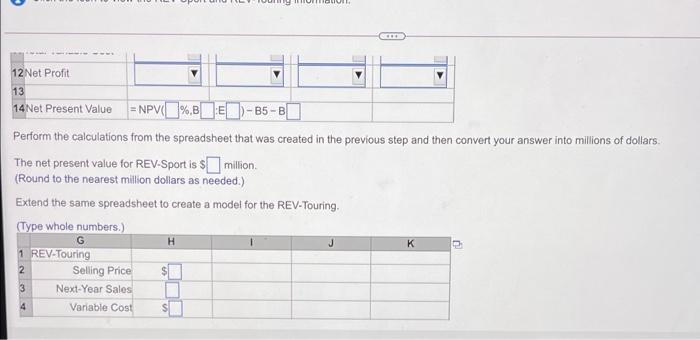

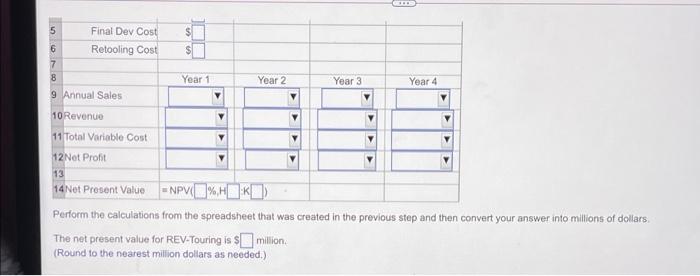

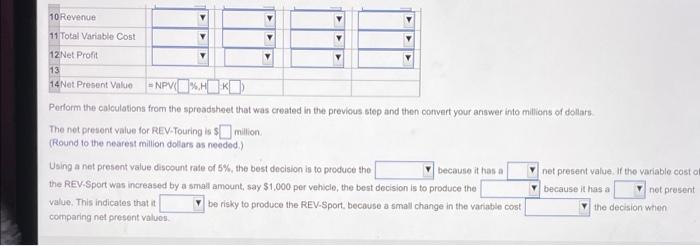

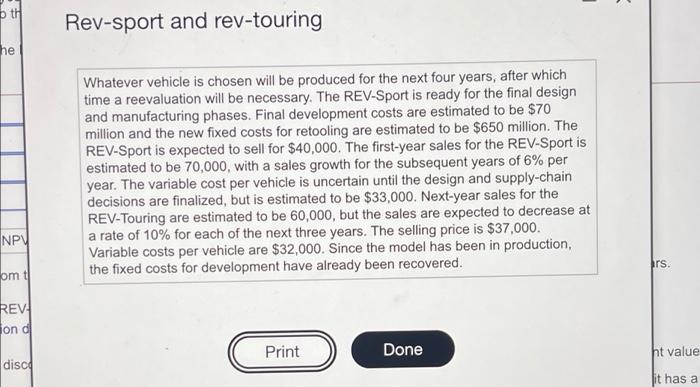

An electric vehicle company is debating whether to replace its original model, the REV-Touring, with a new model, the REV-Sport Using the accompanying Information, develop a four-year model to predict the profitability of each vehicle and recommend the best decision using a net present Value discount rate of 5% How sensitive is the result to the estimated variable cost of the REV-Sport? How might this affect the decision? Click the icon to view the REV-Sport and REV-Touring information Create a model for the REV. Sport B C E SI type whole numbers REV Sport 2 Selling Price 3 First Year Sales 4 Variable Cost 5 Final Dev Cost 6 Relooling Cost 7 8 9 Annual Sales SL S Year 1 Year 2 Year Year 4 NORevenue Y 1% Total Variable Cost 12 Net Profit 13 14Net Present Value =NPV( %B3:)-B5-BL Perform the calculations from the spreadsheet that was created in the previous step and then convert your answer into millions of dollars. The net present value for REV-Sport is $ million (Round to the nearest million dollars as needed.) Extend the same spreadsheet to create a model for the REV-Touring (Type whole numbers.) 1 REV-Touring Selling Price G H J K 2 3 Next-Year Sales Variable Cost Final Dev Cost Retooling Cost D 0 0 0 6 7 8 Year 1 Year 2 Year 3 Year 4 9 Annual Sales 10 Revenue 11 Total Variable Cost 12 Not Pront 13 14 Not Present Value - NPV %HOKU Perform the calculations from the spreadsheet that was created in the previous step and then convert your answer into millions of dollars. The not present value for REV-Touring is $million (Round to the nearest million dollars as needed.) 10 Revenue 11 Total Variable Cost 12Net Profit 13 14Net Present Value - NPV (HK) Perform the calculations from the spreadtheet that was created in the previous step and then convert your answer into millions of dollars The not present value for REV.Touring is $ million (Round to the nearest million dollars as needed) Using a not present value discount rate of 5%, the best decision is to produce the because it has a not present value. If the variable costo the REV-Sport was increased by a small amount, say $1,000 per vehicle, the best decision is to produce the because it has a y not present value. This indicates that it be risky to produce the REV-Sport, because a small change in the variable cost the decision when comparing net present values biti Rev-sport and rev-touring he Whatever vehicle is chosen will be produced for the next four years, after which time a reevaluation will be necessary. The REV-Sport is ready for the final design and manufacturing phases. Final development costs are estimated to be $70 million and the new fixed costs for retooling are estimated to be $650 million. The REV-Sport is expected to sell for $40,000. The first-year sales for the REV-Sport is estimated to be 70,000, with a sales growth for the subsequent years of 6% per year. The variable cost per vehicle is uncertain until the design and supply-chain decisions are finalized, but is estimated to be $33,000. Next-year sales for the REV-Touring are estimated to be 60,000, but the sales are expected to decrease at a rate of 10% for each of the next three years. The selling price is $37,000. Variable costs per vehicle are $32,000. Since the model has been in production, the fixed costs for development have already been recovered. NPV rs. omt REV! on d Print Done ht value disco it has a