Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An eleven month forward contract is issued on 1 March 2008 on a stock with a price of 10 per share at that date.

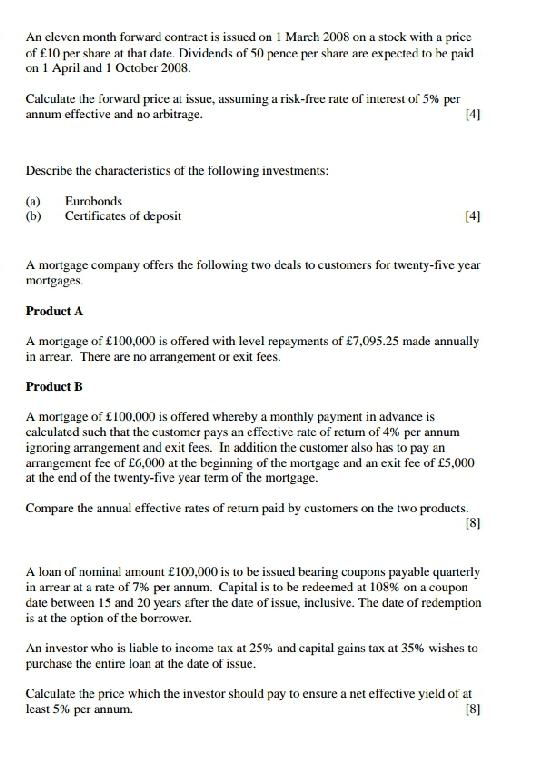

An eleven month forward contract is issued on 1 March 2008 on a stock with a price of 10 per share at that date. Dividends of 50 pence per share are expected to be paid on 1 April and 1 October 2008. Calculate the forward price at issue, assuming a risk-free rate of interest of 5% per annum effective and no arbitrage. [4] Describe the characteristics of the following investments: Furchonds Certificates of deposit (b) A mortgage company offers the following two deals to customers for twenty-five year mortgages Product A A mortgage of 100,000 is offered with level repayments of 7,095.25 made annually in arrear. There are no arrangement or exit fees. Product B A mortgage of 100,000 is offered whereby a monthly payment in advance is calculated such that the customer pays an effective rate of retum of 4% per annum ignoring arrangement and exit fees. In addition the customer also has to pay an arrangement fee of 6,000 at the beginning of the mortgage and an exit fee of 5,000 at the end of the twenty-five year term of the mortgage. Compare the annual effective rates of return paid by customers on the two products. [8] A loan of nominal amount 100,000 is to be issued bearing coupons payable quarterly in arrear at a rate of 7% per annum. Capital is to be redeemed at 108% on a coupon date between 15 and 20 years after the date of issue, inclusive. The date of redemption is at the option of the borrower. An investor who is liable to income tax at 25% and capital gains tax at 35% wishes to purchase the entire loan at the date of issue. Calculate the price which the investor should pay to ensure a net effective yield of at least 5% per annum. [8]

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

lets address each question one by one and calculate the required values Question 1 Forward Price Calculation To calculate the forward price at issue we need to consider the dividends and the riskfree ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started