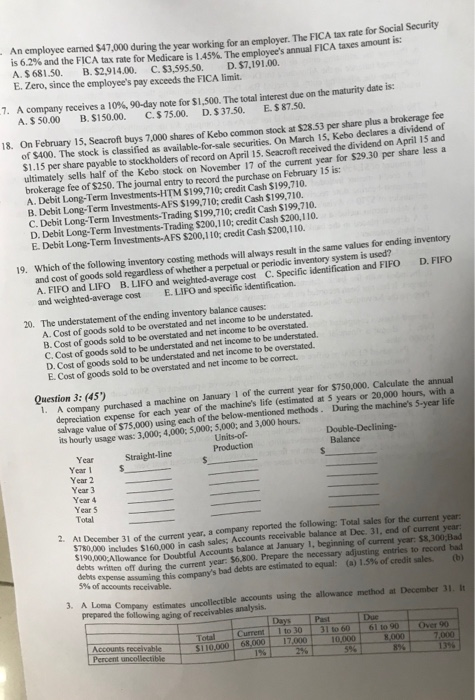

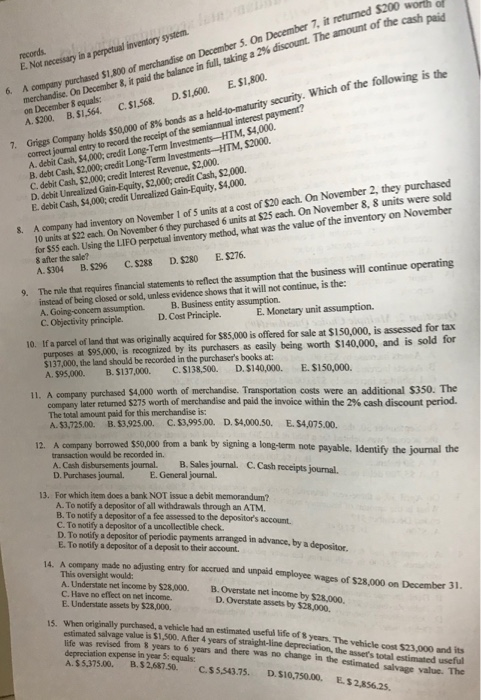

. An employee earned $47.000 during the year working for an employer. The FICA tax rate for Social Security amount is: is 0.2% and the FICA tax rate for Medicare is 1.45%. The employee's annual FICA tancami A. S 681.50. B. $2,914,00. C. $3.595.50. D. $7,191.00. E. Zero, since the employee's pay exceeds the FICA limit. 7. A company receives a 10%, 90-day note for $1,500. The total interest due on the maturity date is A. S 50.00 B. $150.00. C. $ 75.00. D. $37.50. E. $87.50. 18. On February 15, Seacroft buys 7,000 shares of Kebo common stock at $28.53 per share plus a brokerage fee of $400. The stock is classified as available-for-sale securities. On March 15, Kebo declares a dividend of $1.15 per share payable to stockholders of record on April 15. Scacroft received the dividend on April 15 and ultimately sells half of the kebo stock on November 17 of the current year for $29,30 per share less a brokerage fee of $250. The journal entry to record the purchase on February 15 is: A. Debit Long-Term Investments-HTM $199,710; credit Cash $199,710. B. Debit Long-Term Investments-AFS $199,710; credit Cash $199,710. C. Debit Long-Term Investments-Trading $199,710; credit Cash $199,710. D. Debit Long-Term Investments-Trading $200,110; credit Cash $200,110. E. Debit Long-Term Investments-AFS $200,110, credit Cash $200,110. 19. Which of the following inventory costing methods will always result in the same values for ending inventory and cost of goods sold regardless of whether a perpetual or periodic inventory system is used? A. FIFO and LIFO B. LIFO and weighted-average cost C. Specific identification and FIFO D. FIFO and weighted average cost E. LIFO and specific identification 20. The understatement of the ending inventory balance causes: A. Cost of goods sold to be overstated and net income to be understated. B. Cost of goods sold to be overstated and net income to be overstated. C. Cost of goods sold to be understated and net income to be understated. D. Cost of goods sold to be understated and not income to be overstated. E. Cost of goods sold to be overstated and net income to be correct. Question 3: (45) 1. A company purchased a machine on January 1 of the current year for $750,000. Calculate the annual depreciation expense for each year of the machine's life (estimated at 5 years or 20.000 hours with a salvage value of $75.000) using each of the below-mentioned methods. During the machine's 5-year life its hourly usage was: 3.000; 4,000; 5,000; 5.000, and 3,000 hours. Units-of- Double-Declining- Production Balance Year Straight-line S Year! Year 2 Year 3 Year 4 Years Total Al December 31 of the current year, a company reported the following: Total sales for the current year: $750,000 Includes $160.000 in cash sales Accounts receivable balance at Dec. Jl. end of current year: $190,000 Allowance for Doubtful Accounts balance at January 1, beginning of current year: 58,300 Bad debts written off durine the current year: $6,800. Prepare the necessary adjusting entries to record had (a) 1.5% of credit sales. (b) Scots expense assuming this company's bad debts are estimated to equal: 5% of accounts receivable. A Loma Company i n collectible accounts using the allowance method at December 31 prepared the following sing of receivables analysis. Days Pasl Due Total Current to 30 3 1 to 60 61 to 90 Over 90 Accounts receivable $110.000 68.000 17.000 10.000 8.000 7,000 Percent uncollectible 89 ned $200 worth of records E. Not necessary in a perpetual inventory system A company purchased $1.800 of merchandise on December 5. On December 7, it returned $200 worth merchandise. On December & it paid the balance in full, taking a 2% discount. The amount of the cash E. $1,800 D. $1,600. C. $1,568. TOOL crece Invest on December 8 equals: A. 5200. B. 51.564 Griggs Company holds 550,000 of 8% bonds as a held-to-maturity security. Which of the following is the correct joumal entry to record the receipt of the semiannual interest payment? A. debit Cash, 84,000credit Long-Term Investments-HTM, S4,000. B. debt Cash $2,000 credit Long-Term Investments --HTM, $2000 C. debit Cash, $2.000; credit Interest Revenue, $2,000 D. debit Unrealized Gain-Equity. $2,000, credit Cash, $2,000 E. debit Cash, $4.000;credit Unrealized Gain-Equity, $4,000. S2602.00 A company had inventory on November 1 of 5 units at a cost of $20 each. On November 2, they purchased 10 units at $22 each. On November 6 they purchased 6 units at $25 each. On November 8, 8 units were sold for $55 each. Using the LIFO perpetual inventory method, what was the value of the inventory on November 8 after the sale? A. 5304 B. $296 C.5288 D. $280 E. $276. 9. The rule that requires financial statements to reflect the assumption that the business will continue operating Instead of being closed or sold, unless evidence shows that it will not continue, is the: A. Going-concem assumption B. Business entity assumption. c. Objectivity principle. D. Cost Principle. E. Monetary unit assumption. 10. If a parcel of land that was originally acquired for $85,000 is offered for sale at $150,000, is assessed for tax purposes at $95.000, is recognized by its purchasers as easily being worth $140,000, and is sold for $137,000, the land should be recorded in the purchaser's books at: A. 595,000. B. $137.000. C. $138.500. D. $140,000. E. $150,000 11. A company purchased $4,000 worth of merchandise. Transportation costs were an additional $350. The company later returned $275 worth of merchandise and paid the invoice within the 2% cash discount period. The total amount paid for this merchandise is: A. $3.725,00. B. $3.925.00. C. $3.995.00. D. $4,000.50. E. $4,075,00. 12 A company borrowed $50,000 from a bank by signing a long-term note payable. Identify the journal the transaction would be recorded in. A. Cash disbursements journal. B. Sales journal. C.Cash receipts journal D. Purchases journal. E. General journal. 13. For which item does a bank NOT issue a debit memorandum? A. To notify a depositor of all withdrawals through an ATM B. To notify a depositor of a fee assessed to the depositor's account C. To notify a depositor of a uncollectible check. D. To potify a depositor of periodic payments arranged in advance, by a de E. To notify a depositor of a deposit to their account. de no adsting entry for accrued and and employee wages of $28.000. This oversight would A Understate net income by $28.000. B.Overstadie net income by S2000 C. Have no effect on net income. D. Overstate assets by $28.000 E. Understate assets by $28.000. December 31. h o lly purchased, a vehicle had an estimated usctune of years. The vehicle 10 dits tedavage value is $1.500. After 4 years of straight-line depreciation, the vised from 3 years to 6 years and there was no change in the estimated in the asset's total estimated useful value The depreciation expense in year 3:equals A. $5.375.00. B. $2.68750. C.55.543.75. D. $10,750.00. E$285625