Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An employee has gross earnings of $300, withholdings $15 for FICA taxes;and s30 for income taxes. The employer also pays $15 for FICA taxes;and $10

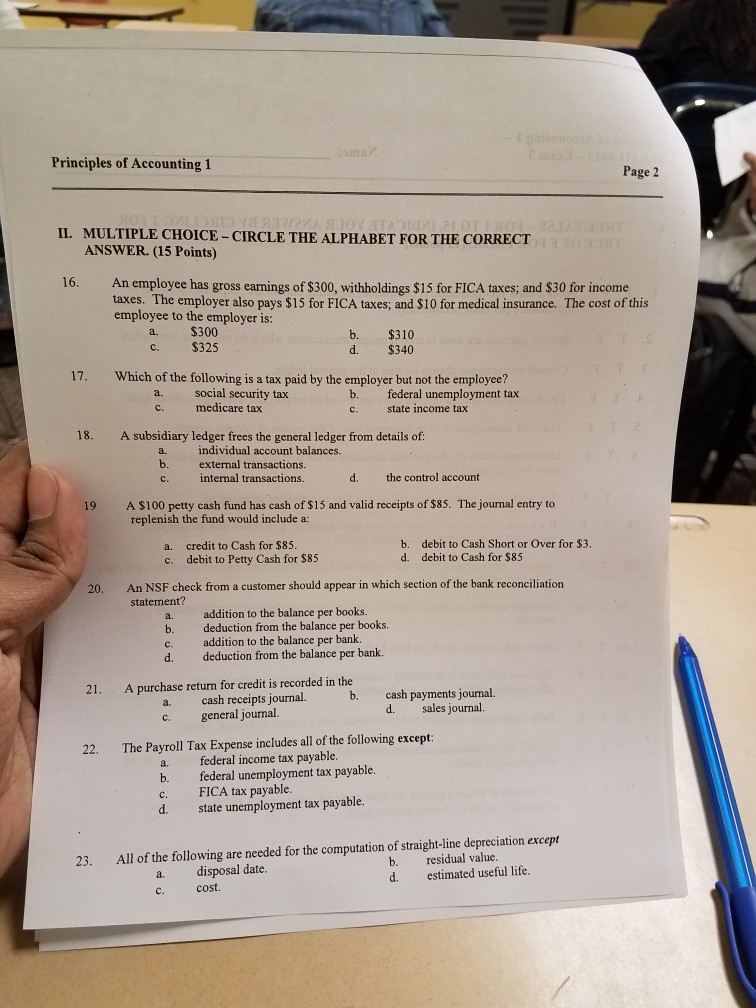

An employee has gross earnings of $300, withholdings $15 for FICA taxes;and s30 for income taxes. The employer also pays $15 for FICA taxes;and $10 for medical insurance. The cost of this employee to the employer is $300 $310 $325 $340 Which of the following is a tax paid by the employer but not the employee? social security tax federal unemployment tax medicare tax state income tax A subsidiary ledger frees the general ledger from details of: individual account balances. external transactions. internal transactions the control account A $100 petty cash fund has cash of $15 and valid receipts of $85. The journal entry to replenish the fund would include a: credit to Cash for $85 debit to Cash Short or Over for $3 debit to Petty Cash for $85 debit to Cash for $85 An NSF check from a customer should appear in which section of the bank reconciliation statement? addition to the balance per books. deduction from the balance per books. addition to the balance per bank. deduction from the balance per bank. A purchase return for credit is recorded in the cash receipts journal cash payments journal. general journal. sales journal. The Payroll Tax Expense includes all of the following except: federal income tax payable. federal unemployment tax payable. FICA tax payable. state unemployment tax payable. All of the following are needed for the computation of straight-line depreciation except disposal date. residual value. cost. estimated useful life

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started