Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An employee of a furniture retail store chain of 10 stores is soon about to retire and he, along with the investment fund managing his

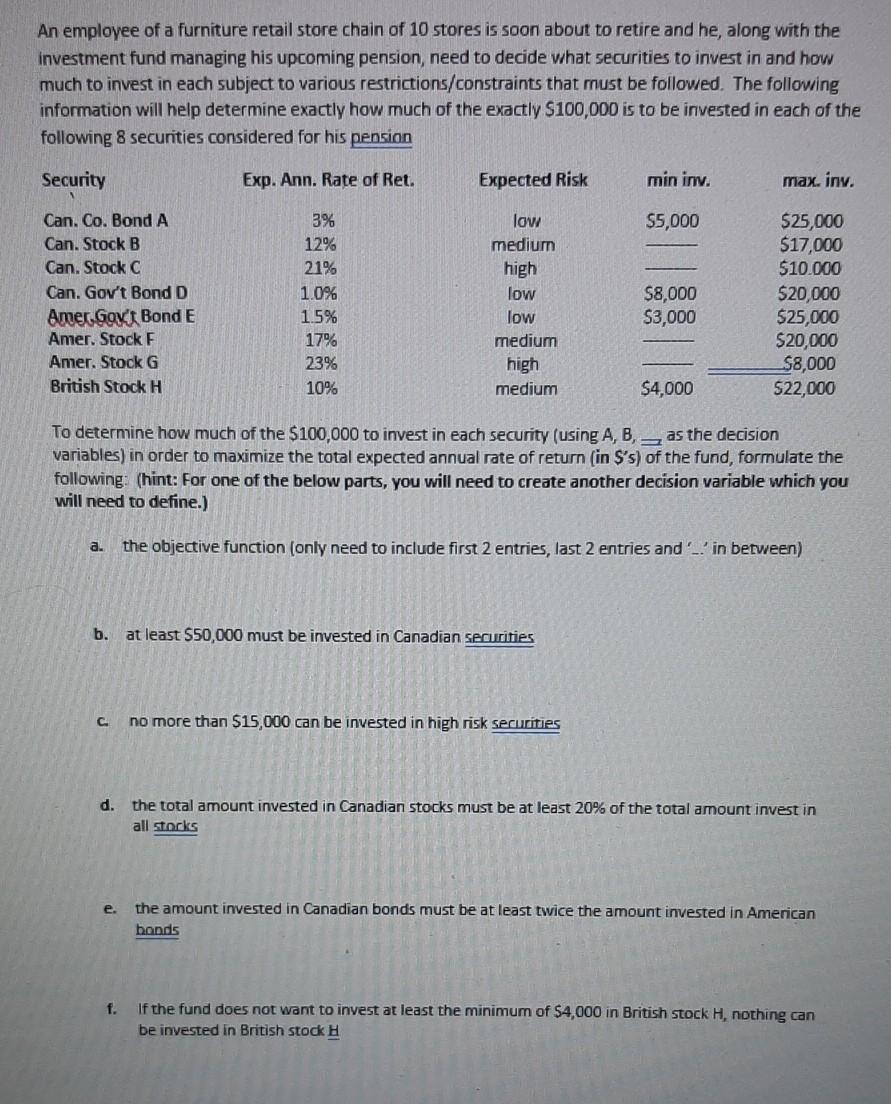

An employee of a furniture retail store chain of 10 stores is soon about to retire and he, along with the investment fund managing his upcoming pension, need to decide what securities to invest in and how much to invest in each subject to various restrictions/constraints that must be followed. The following information will help determine exactly how much of the exactly $100,000 is to be invested in each of the following 8 securities considered for his pension Security Exp. Ann. Rate of Ret. Expected Risk min inv. max. iny. $5,000 Can. Co. Bond A Can. Stock B Can. Stock C Can. Gov't Bond D Amer. Goxt Bond E Amer. Stock F Amer. Stock G British Stock H 3% 12% 21% 1.0% 1.5% 17% 23% 10% low mediurn high low low medium high medium $8,000 $3,000 525,000 517,000 $10.000 $20,000 525,000 $20,000 S8,000 522,000 $4,000 To determine how much of the $100,000 to invest in each security (using A, B, as the decision variables) in order to maximize the total expected annual rate of return (in S's) of the fund, formulate the following: (hint: For one of the below parts, you will need to create another decision variable which you will need to define.) a. the objective function (only need to include first 2 entries, last 2 entries and '_' in between) b. at least 550,000 must be invested in Canadian securities C no more than $15,000 can be invested in high risk securities d. the total amount invested in Canadian Stocks must be at least 20% of the total amount invest in all stocks e. the amount invested in Canadian bonds must be at least twice the amount invested in American bonds f. If the fund does not want to invest at least the minimum of $4,000 in British stock H, nothing can be invested in British stock H

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started