Answered step by step

Verified Expert Solution

Question

1 Approved Answer

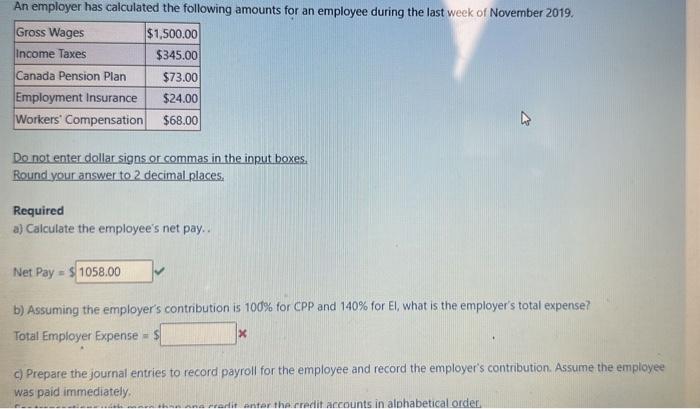

An employer has calculated the following amounts for an employee during the last week of November 2019. $1,500.00 $345.00 Gross Wages Income Taxes Canada Pension

An employer has calculated the following amounts for an employee during the last week of November 2019. $1,500.00 $345.00 Gross Wages Income Taxes Canada Pension Plan Employment Insurance Workers' Compensation $73.00 $24.00 $68.00 Do not enter dollar signs or commas in the input boxes. Round your answer to 2 decimal places. Required a) Calculate the employee's net pay.. Net Pay=$1058.00 b) Assuming the employer's contribution is 100% for CPP and 140% for El, what is the employer's total expense? Total Employer Expense = $ x c) Prepare the journal entries to record payroll for the employee and record the employer's contribution. Assume the employee was paid immediately. credit enter the credit accounts in alphabetical order.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started