Answered step by step

Verified Expert Solution

Question

1 Approved Answer

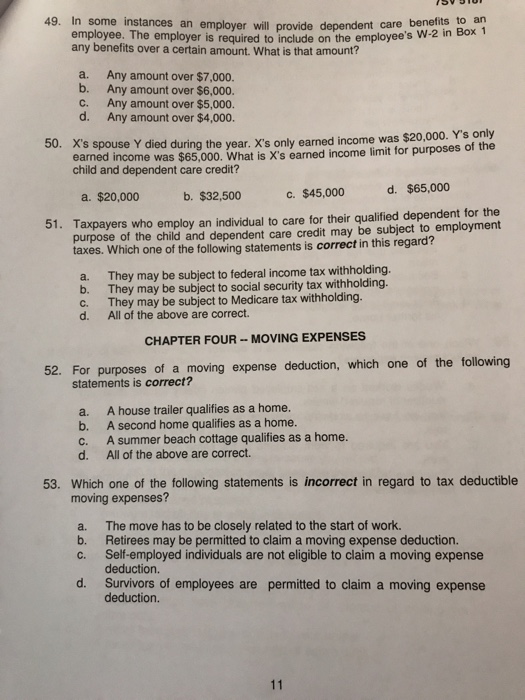

an employer will provide dependent care benefits to an Box 1 49. In some instances employee. The employer is required to include on the employee's

an employer will provide dependent care benefits to an Box 1 49. In some instances employee. The employer is required to include on the employee's W-2 in any benefits over a certain amount. What is that amount? a. Any amount over $7,000. b. Any amount over $6,000 C. Any amount over $5,000. d. Any amount over $4,000. X's spouse Y died during the year. 's only earned income was $20,000. Y's only earned income was $65,000. What is X's earned income limit for purposes of the 50. child and dependent care credit? c. $45,000 d. $65,000 a. $20,000 b. $32,500 51. Taxpayers who employ an individual to care for their qualified dependent for the purpose of the child and dependent care credit may be subject to employment taxes. Which one of the following statements is correct in this regard? a. They may be subject to federal income tax withholding. b. They may be subject to social security tax withholding. c. They may be subject to Medicare tax withholding. d. All of the above are correct. CHAPTER FOUR - MOVING EXPENSES 52. For purposes of a moving expense deduction, which one of the following statements is correct? a. A house trailer qualifies as a home. b. A second home qualifies as a home. C. A summer beach cottage qualifies as a home. d. All of the above are correct. 53. Which one of the following statements is incorrect in regard to tax deductible moving expenses? a. The move has to be closely related to the start of work. b. Retirees may be permitted to claim a moving expense deduction. c. Self-employed individuals are not eligible to claim a moving expense deduction d. Survivors of employees are permitted to claim a moving expense deductiorn

an employer will provide dependent care benefits to an Box 1 49. In some instances employee. The employer is required to include on the employee's W-2 in any benefits over a certain amount. What is that amount? a. Any amount over $7,000. b. Any amount over $6,000 C. Any amount over $5,000. d. Any amount over $4,000. X's spouse Y died during the year. 's only earned income was $20,000. Y's only earned income was $65,000. What is X's earned income limit for purposes of the 50. child and dependent care credit? c. $45,000 d. $65,000 a. $20,000 b. $32,500 51. Taxpayers who employ an individual to care for their qualified dependent for the purpose of the child and dependent care credit may be subject to employment taxes. Which one of the following statements is correct in this regard? a. They may be subject to federal income tax withholding. b. They may be subject to social security tax withholding. c. They may be subject to Medicare tax withholding. d. All of the above are correct. CHAPTER FOUR - MOVING EXPENSES 52. For purposes of a moving expense deduction, which one of the following statements is correct? a. A house trailer qualifies as a home. b. A second home qualifies as a home. C. A summer beach cottage qualifies as a home. d. All of the above are correct. 53. Which one of the following statements is incorrect in regard to tax deductible moving expenses? a. The move has to be closely related to the start of work. b. Retirees may be permitted to claim a moving expense deduction. c. Self-employed individuals are not eligible to claim a moving expense deduction d. Survivors of employees are permitted to claim a moving expense deductiorn

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started