Question

An engineer is evaluating the purchase of a machine at a cost of $25,000 for a construction project. investment in the company. This machine is

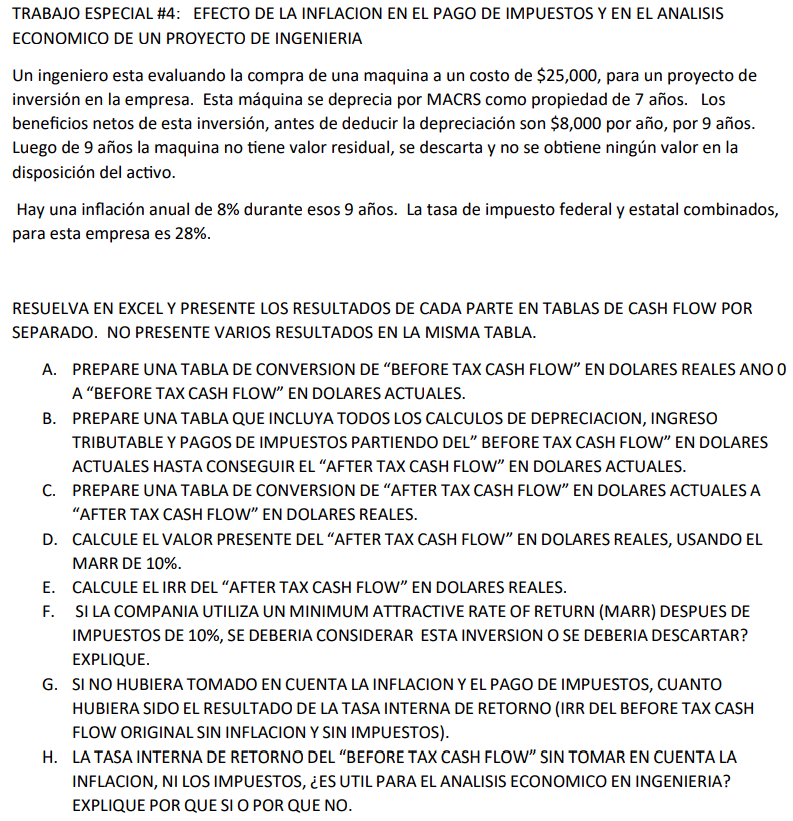

An engineer is evaluating the purchase of a machine at a cost of $25,000 for a construction project. investment in the company. This machine is depreciated by MACRS as a 7-year property. The Net benefits from this investment, before deducting depreciation, are $8,000 per year for 9 years. After 9 years the machine has no residual value, it is discarded and no value is obtained in the disposal of the asset. There is an annual inflation of 8% during those 9 years. The combined federal and state tax rate, for this company it is 28%. RESOLVE IN EXCEL AND PRESENT THE RESULTS OF EACH PART IN CASH FLOW TABLES BY SEPARATE. DO NOT PRESENT SEVERAL RESULTS IN THE SAME TABLE. A. PREPARE A CONVERSION TABLE OF BEFORE TAX CASH FLOW IN REAL DOLLARS YEAR 0 TO BEFORE TAX CASH FLOW IN CURRENT DOLLARS. B. PREPARE A TABLE THAT INCLUDES ALL CALCULATIONS OF DEPRECIATION, INCOME TAXABLE AND TAX PAYMENTS BASED ON THE "BEFORE TAX CASH FLOW" IN DOLLARS CURRENT UNTIL THE "AFTER TAX CASH FLOW" IS ACHIEVED IN CURRENT DOLLARS. C. PREPARE A CONVERSION TABLE OF AFTER TAX CASH FLOW IN CURRENT DOLLARS A AFTER TAX CASH FLOW IN REAL DOLLARS. D. CALCULATE THE PRESENT VALUE OF THE AFTER TAX CASH FLOW IN REAL DOLLARS, USING THE MARR OF 10%. E. CALCULATE THE IRR OF THE AFTER TAX CASH FLOW IN REAL DOLLARS. F. IF THE COMPANY USES A MINIMUM ATTRACTIVE RATE OF RETURN (MARR) AFTER 10% TAXES, SHOULD THIS INVESTMENT BE CONSIDERED OR DISCARDED? EXPLAIN. G. IF INFLATION AND THE PAYMENT OF TAXES HAD NOT BEEN TAKEN INTO ACCOUNT, HOW MUCH IT WOULD HAVE BEEN THE RESULT OF THE INTERNAL RATE OF RETURN (IRR OF THE BEFORE TAX CASH ORIGINAL FLOW WITHOUT INFLATION AND WITHOUT TAXES). H. THE INTERNAL RATE OF RETURN OF THE BEFORE TAX CASH FLOW WITHOUT TAKING INTO ACCOUNT THE INFLATION, NOR TAXES, IS IT USEFUL FOR ECONOMIC ANALYSIS IN ENGINEERING? EXPLAIN WHY OR WHY NO.

There is no more informatio available to provide.

ECONOMICO DE UN PROYECTO DE INGENIERIA Un ingeniero esta evaluando la compra de una maquina a un costo de $25,000, para un proyecto de inversin en la empresa. Esta mquina se deprecia por MACRS como propiedad de 7 aos. Los beneficios netos de esta inversin, antes de deducir la depreciacin son $8,000 por ao, por 9 aos. Luego de 9 aos la maquina no tiene valor residual, se descarta y no se obtiene ningn valor en la disposicin del activo. Hay una inflacin anual de 8% durante esos 9 aos. La tasa de impuesto federal y estatal combinados, para esta empresa es 28%. RESUELVA EN EXCEL Y PRESENTE LOS RESULTADOS DE CADA PARTE EN TABLAS DE CASH FLOW POR SEPARADO. NO PRESENTE VARIOS RESULTADOS EN LA MISMA TABLA. A. PREPARE UNA TABLA DE CONVERSION DE "BEFORE TAX CASH FLOW" EN DOLARES REALES ANO 0 A BEFORE TAX CASH FLOW" EN DOLARES ACTUALES. B. PREPARE UNA TABLA QUE INCLUYA TODOS LOS CALCULOS DE DEPRECIACION, INGRESO TRIBUTABLE Y PAGOS DE IMPUESTOS PARTIENDO DEL" BEFORE TAX CASH FLOW" EN DOLARES ACTUALES HASTA CONSEGUIR EL "AFTER TAX CASH FLOW" EN DOLARES ACTUALES. C. PREPARE UNA TABLA DE CONVERSION DE "AFTER TAX CASH FLOW" EN DOLARES ACTUALES A "AFTER TAX CASH FLOW" EN DOLARES REALES. D. CALCULE EL VALOR PRESENTE DEL "AFTER TAX CASH FLOW" EN DOLARES REALES, USANDO EL MARR DE 10\%. E. CALCULE EL IRR DEL "AFTER TAX CASH FLOW" EN DOLARES REALES. F. SI LA COMPANIA UTILIZA UN MINIMUM ATTRACTIVE RATE OF RETURN (MARR) DESPUES DE IMPUESTOS DE 10\%, SE DEBERIA CONSIDERAR ESTA INVERSION O SE DEBERIA DESCARTAR? EXPLIQUE. G. SI NO HUBIERA TOMADO EN CUENTA LA INFLACION Y EL PAGO DE IMPUESTOS, CUANTO HUBIERA SIDO EL RESULTADO DE LA TASA INTERNA DE RETORNO (IRR DEL BEFORE TAX CASH FLOW ORIGINAL SIN INFLACION Y SIN IMPUESTOS). H. LA TASA INTERNA DE RETORNO DEL "BEFORE TAX CASH FLOW" SIN TOMAR EN CUENTA LA INFLACION, NI LOS IMPUESTOS, ES UTIL PARA EL ANALISIS ECONOMICO EN INGENIERIA? EXPLIQUE POR QUE SI O POR QUE NO

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started