Answered step by step

Verified Expert Solution

Question

1 Approved Answer

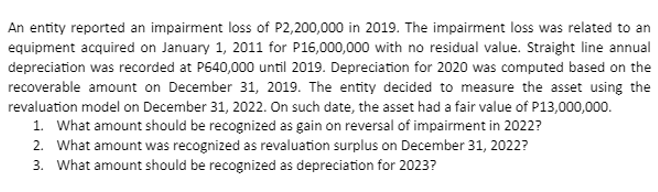

An entity reported an impairment loss of P2,200,000 in 2019. The impairment loss was related to an equipment acquired on January 1, 2011 for

An entity reported an impairment loss of P2,200,000 in 2019. The impairment loss was related to an equipment acquired on January 1, 2011 for P16,000,000 with no residual value. Straight line annual depreciation was recorded at P640,000 until 2019. Depreciation for 2020 was computed based on the recoverable amount on December 31, 2019. The entity decided to measure the asset using the revaluation model on December 31, 2022. On such date, the asset had a fair value of P13,000,000. 1. What amount should be recognized as gain on reversal of impairment in 2022? 2. What amount was recognized as revaluation surplus on December 31, 2022? 3. What amount should be recognized as depreciation for 2023?

Step by Step Solution

★★★★★

3.51 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the amount recognized as gain on the reversal of impairment in 2022 we need to compare ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started