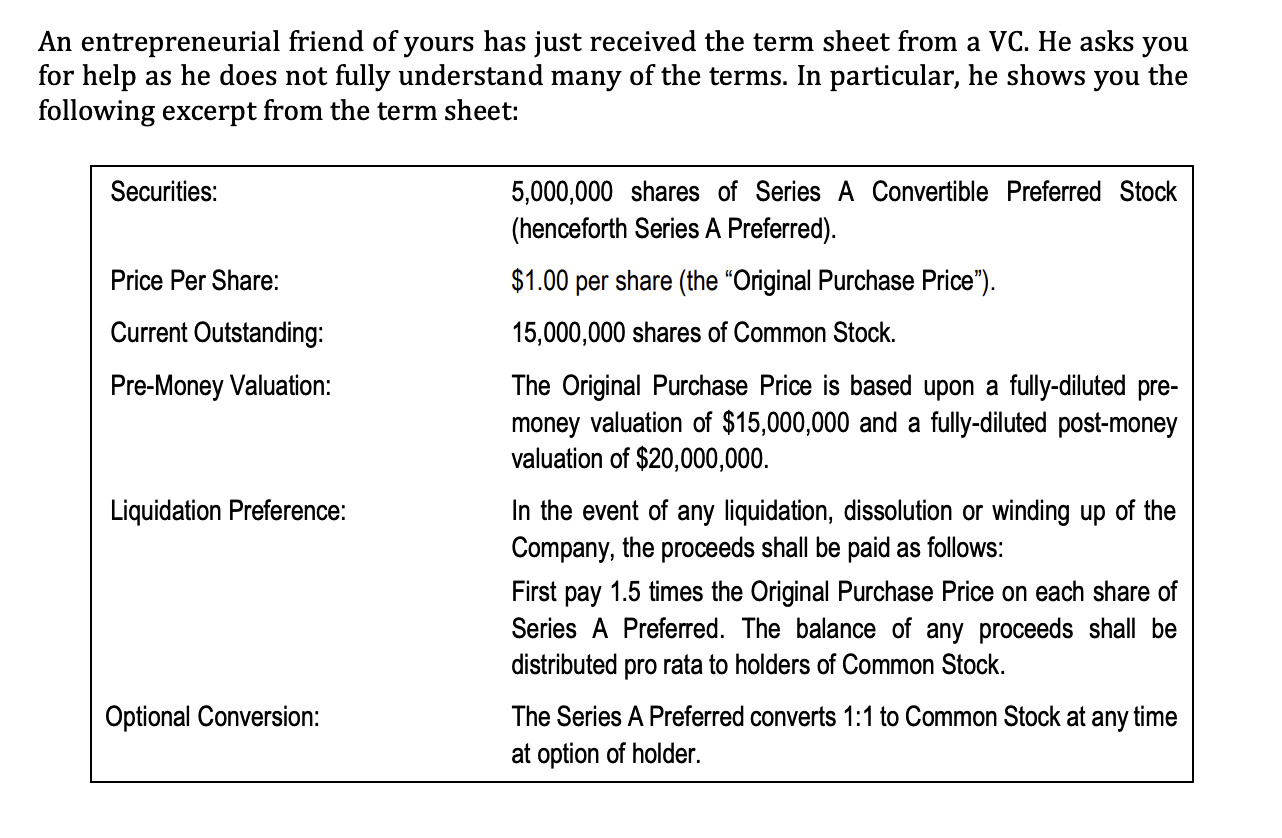

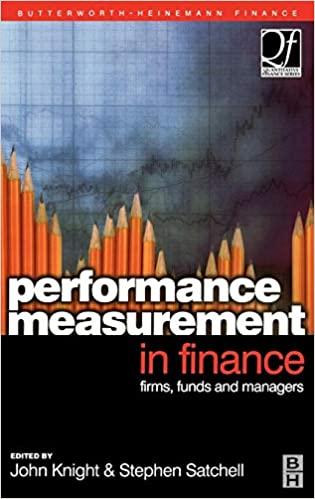

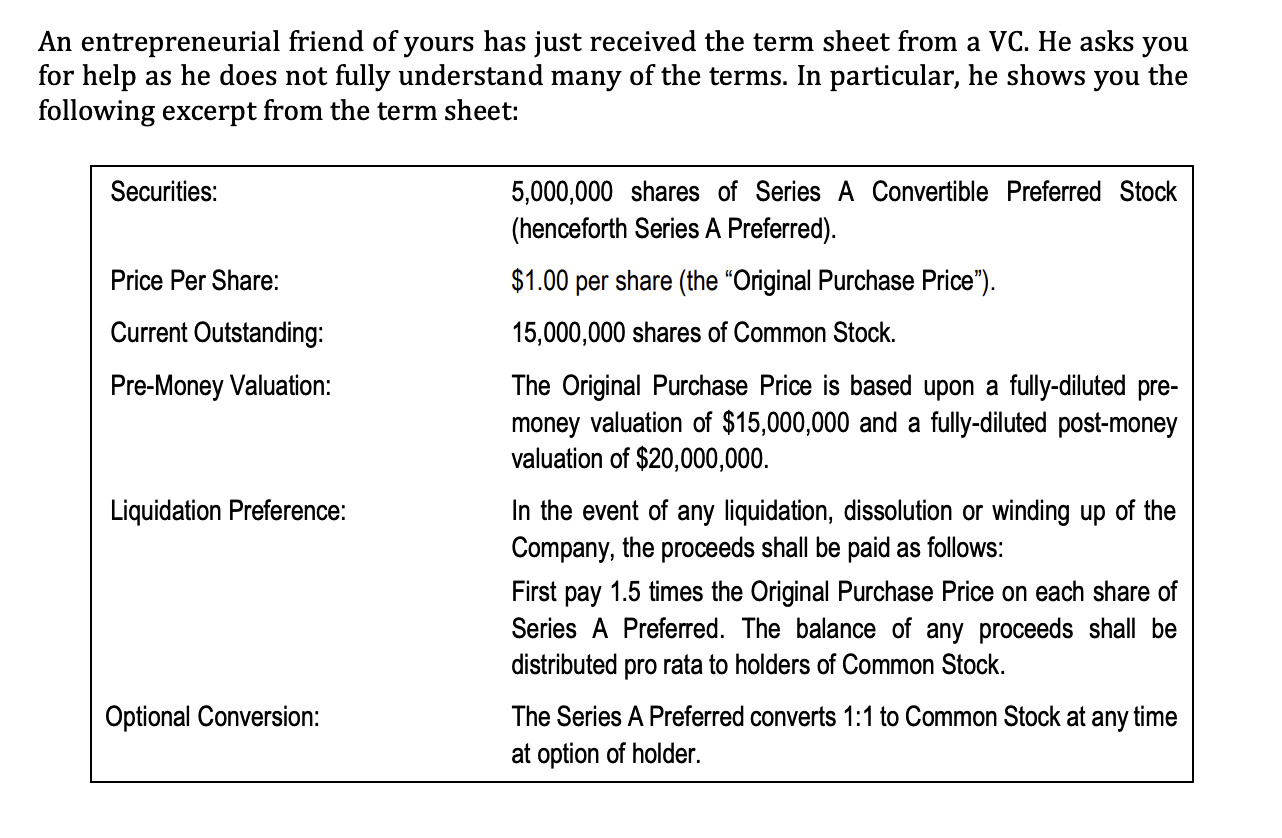

An entrepreneurial friend of yours has just received the term sheet from a VC. He asks you for help as he does not fully understand many of the terms. In particular, he shows following excerpt from the term sheet: you the Securities: 5,000,000 shares of Series A Convertible Preferred Stock (henceforth Series A Preferred). $1.00 per share (the Original Purchase Price). Price Per Share: Current Outstanding: 15,000,000 shares of Common Stock. Pre-Money Valuation: Liquidation Preference: The Original Purchase Price is based upon a fully-diluted pre- money valuation of $15,000,000 and a fully-diluted post-money valuation of $20,000,000. In the event of any liquidation, dissolution or winding up of the Company, the proceeds shall be paid as follows: First pay 1.5 times the Original Purchase Price on each share of Series A Preferred. The balance of any proceeds shall be distributed pro rata to holders of Common Stock. The Series A Preferred converts 1:1 to Common Stock at any time at option of holder. Optional Conversion: a) To help your friend understand the terms of the deal, create a diagram that shows the payoffs to the VC as a function of the firm's future liquidation value. Make sure you label all relevant items in that diagram. b) Your friend also wants to hear some numbers. In particular, he wants you to tell him how much he (the entrepreneur) will receive in two specific liquidation scenarios: A liquidation value of 10 million and a liquidation value of 50 million. c) Once he understands the terms, your friend is very enthusiastic and tells you wow, the VC thinks that my shares have a total value of $15 million today! Do you agree with his assessment of the current valuation of common stock? An entrepreneurial friend of yours has just received the term sheet from a VC. He asks you for help as he does not fully understand many of the terms. In particular, he shows following excerpt from the term sheet: you the Securities: 5,000,000 shares of Series A Convertible Preferred Stock (henceforth Series A Preferred). $1.00 per share (the Original Purchase Price). Price Per Share: Current Outstanding: 15,000,000 shares of Common Stock. Pre-Money Valuation: Liquidation Preference: The Original Purchase Price is based upon a fully-diluted pre- money valuation of $15,000,000 and a fully-diluted post-money valuation of $20,000,000. In the event of any liquidation, dissolution or winding up of the Company, the proceeds shall be paid as follows: First pay 1.5 times the Original Purchase Price on each share of Series A Preferred. The balance of any proceeds shall be distributed pro rata to holders of Common Stock. The Series A Preferred converts 1:1 to Common Stock at any time at option of holder. Optional Conversion: a) To help your friend understand the terms of the deal, create a diagram that shows the payoffs to the VC as a function of the firm's future liquidation value. Make sure you label all relevant items in that diagram. b) Your friend also wants to hear some numbers. In particular, he wants you to tell him how much he (the entrepreneur) will receive in two specific liquidation scenarios: A liquidation value of 10 million and a liquidation value of 50 million. c) Once he understands the terms, your friend is very enthusiastic and tells you wow, the VC thinks that my shares have a total value of $15 million today! Do you agree with his assessment of the current valuation of common stock