Answered step by step

Verified Expert Solution

Question

1 Approved Answer

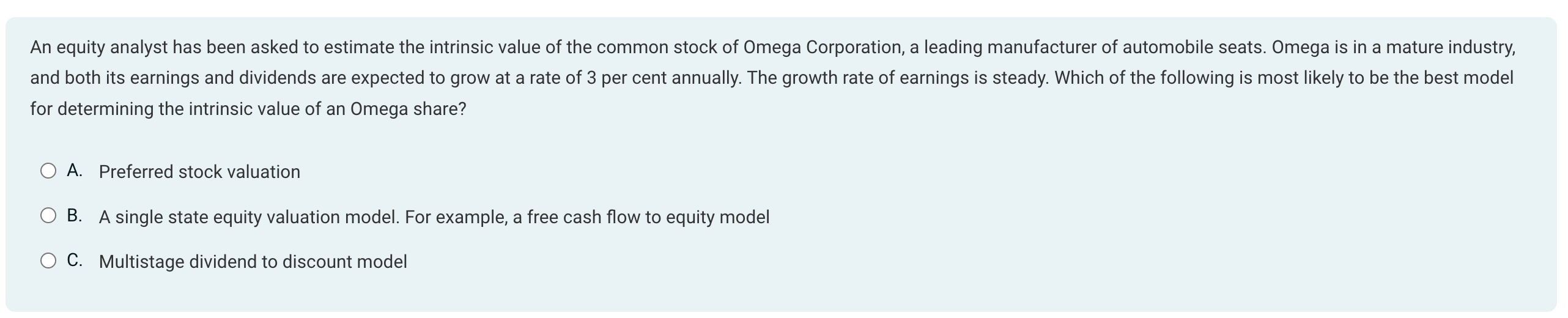

An equity analyst has been asked to estimate the intrinsic value of the common stock of Omega Corporation, a leading manufacturer of automobile seats. Omega

An equity analyst has been asked to estimate the intrinsic value of the common stock of Omega Corporation, a leading manufacturer of automobile seats. Omega is in a mature industry,

and both its earnings and dividends are expected to grow at a rate of per cent annually. The growth rate of earnings is steady. Which of the following is most likely to be the best model

for determining the intrinsic value of an Omega share?

A Preferred stock valuation

B A single state equity valuation model. For example, a free cash flow to equity model

C Multistage dividend to discount model

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started