Answered step by step

Verified Expert Solution

Question

1 Approved Answer

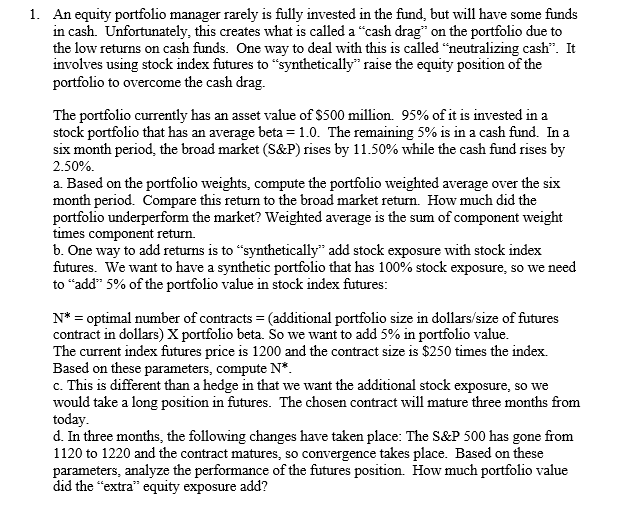

An equity portfolio manager rarely is fully invested in the fund, but will have some funds in cash. Unfortunately, this creates what is called a

An equity portfolio manager rarely is fully invested in the fund, but will have some funds

in cash. Unfortunately, this creates what is called a "cash drag" on the portfolio due to

the low returns on cash funds. One way to deal with this is called "neutralizing cash". It

involves using stock index futures to "synthetically" raise the equity position of the

portfolio to overcome the cash drag.

The portfolio currently has an asset value of $ million. of it is invested in a

stock portfolio that has an average beta The remaining is in a cash fund. In a

six month period, the broad market S&P rises by while the cash fund rises by

a Based on the portfolio weights, compute the portfolio weighted average over the six

month period. Compare this return to the broad market return. How much did the

portfolio underperform the market? Weighted average is the sum of component weight

times component return.

b One way to add returns is to "synthetically" add stock exposure with stock index

futures. We want to have a synthetic portfolio that has stock exposure, so we need

to "add" of the portfolio value in stock index futures:

optimal number of contracts additional portfolio size in dollars size of futures

contract in dollars portfolio beta. So we want to add in portfolio value.

The current index futures price is and the contract size is $ times the index.

Based on these parameters, compute

c This is different than a hedge in that we want the additional stock exposure, so we

would take a long position in futures. The chosen contract will mature three months from

today.

d In three months, the following changes have taken place: The S&P has gone from

to and the contract matures, so convergence takes place. Based on these

parameters, analyze the performance of the futures position. How much portfolio value

did the "extra" equity exposure add?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started