Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An examination of the accounting records revealed the following additional informationapplicable to 2016:a) Land costing $15,000 was sold for $15,000b) A mortgage note was issued

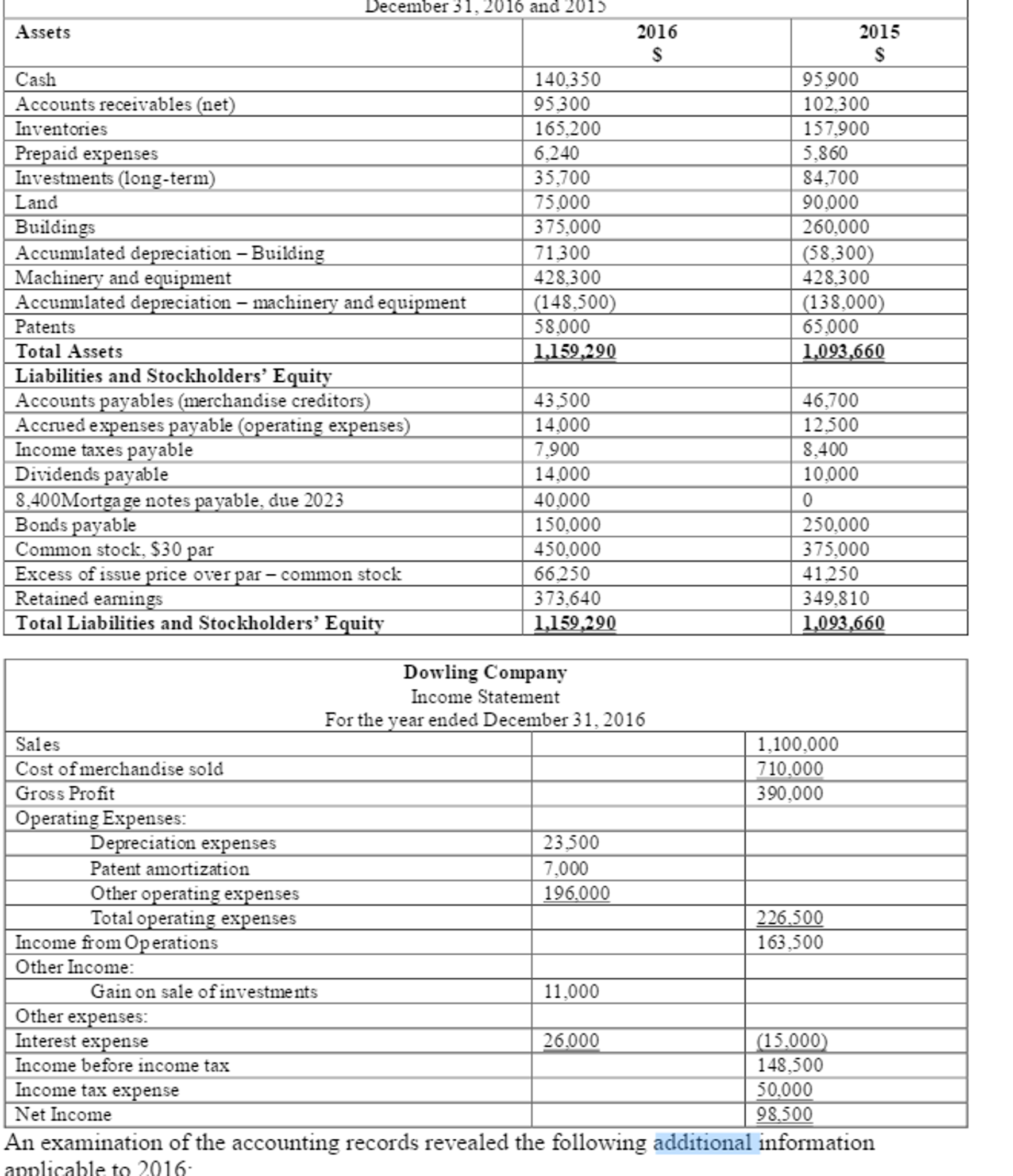

An examination of the accounting records revealed the following additional informationapplicable to 2016:a) Land costing $15,000 was sold for $15,000b) A mortgage note was issued for $40,000c) A building costing $115,000 was constructedd) 2,500 shares of common stock were issued at $40 in exchange for the bonds payablee) Cash dividends declared were $74,670

Instruction: ? Use the above information to complete the statement of cash flow using the indirect and direct method.

December 31. 2016 and 2015 2016 2015 95900 102.300 157,900 140,350 95300 165.200 6.240 35.700 75.000 375,000 71300 428.300 148,500 58.000 1159,290 Accounts receivables (net Inventories Prepaid expenses Investments (long-term 84.700 90,000 260,000 58.300 428.300 Buildings Accunmlated depreciation Building Machinery and equipment Accunmlated depreciation - machinery and equipment Patents Total Assets Liabilities and Stockholders' Eguitv Accounts payables (merchandise creditors Accrued expenses payable (operating expenses Income taxes payable Dividends payable 8.400Mortgage notes payable, due 2023 Bonds payable Common stock. $30 par Excess of issue price over par- common stock Retained eamings Total Liabilities and Stockholders' Equit 138.000 65.000 1,093,660 43.500 14.000 46,700 12.500 14.000 40.000 150,000 450,000 66.250 373.640 1159,290 10,000 250,000 375,000 41250 349.810 1,093,660 Dowling Company Income Statement For the vear ended December 31, 2016 Cost ofmerchandise sold Gross Profit Operating Expenses 1,100,000 710,000 390,000 23.500 Depreciation expenses Patent amortization Other operating expenses Total operating expenses 196.000 226.500 163.500 Income from Operations Other Income: Gain on sale ofinvestments 11,000 Other expenses: Interest expense Income before income tax Income tax expense Net Income 15.000 148,500 50,000 98.500 26.000 An examination of the accounting records revealed the following additional information apnlicable to 2016Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started