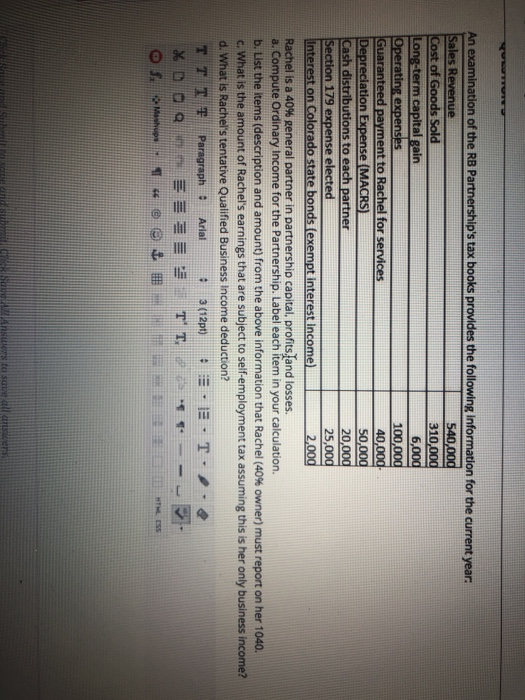

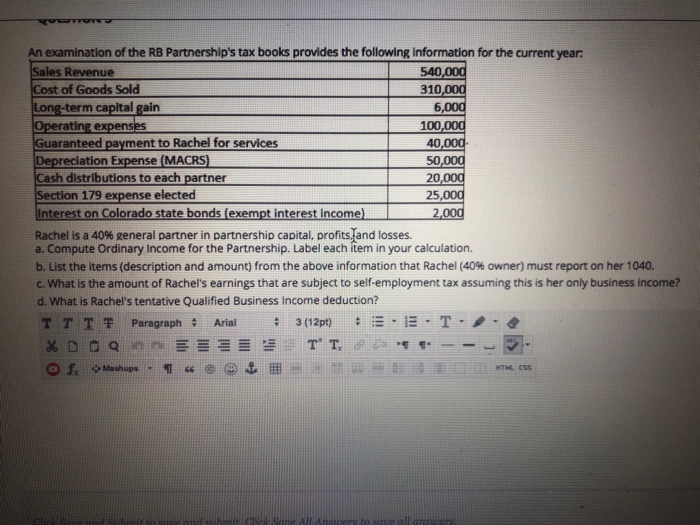

An examination of the RB Partnership's tax books provides the following information for the current year: . Rachel is a 40% general partner in partnership capital, profits, and losses. a. Compute Ordinary Income for the Partnership. Label each item in your calculation. b. List the items (description and amount) from the above information that Rachel (40% owner) must report on her 1040. c. What is the amount of Rachel's earnings that are subject to self-employment tax assuming this is her only business income? d. What is Rachel's tentative Qualified Business Income deduction?

An examination of the RB Partnership's tax books provides the following Information for the current year: Sales Revenue 540,000 Cost of Goods Sold 310,000 Long-term capital gain 6,000 Operating expenses 100,000 Guaranteed payment to Rachel for services 40,000 Depreciation Expense (MACRS) 50,000 Cash distributions to each partner 20,000 Section 179 expense elected 25,000 Interest on Colorado state bonds (exempt interest Income) 2,000 Rachel is a 40% general partner in partnership capital, profits, and losses. a. Compute Ordinary Income for the Partnership. Label each item in your calculation. b. List the items (description and amount) from the above information that Rachel (40% owner) must report on her 1040. c. What is the amount of Rachel's earnings that are subject to self-employment tax assuming this is her only business income? d. What is Rachel's tentative Qualified Business Income deduction? T T T Paragraph Arial : 3 (12pt) . E T. %DO QE SETT OS Mashups @ CS Sacen swers to save all answers An examination of the RB Partnership's tax books provides the following information for the current year. Sales Revenue 540,000 Cost of Goods Sold 310,000 Long-term capital gain 6,000 Operating expenses 100,000 Guaranteed payment to Rachel for services 40,000 Depreciation Expense MACRS) 50,000 Cash distributions to each partner 20,000 Section 179 expense elected 25,000 Interest on Colorado state bonds (exempt interest Income) 2.000 Rachel is a 40% general partner in partnership capital, profits and losses. a. Compute Ordinary Income for the Partnership. Label each item in your calculation. b. List the items (description and amount) from the above information that Rachel (40% owner) must report on her 1040. What is the amount of Rachel's earnings that are subject to self-employment tax assuming this is her only business incomel d. What is Rachel's tentative Qualified Business Income deduction? TT TF Paragraph : Arial 3 (12pt) - E . T. . %DOQE T T. -- -- > @ fx Mashups - 14 An examination of the RB Partnership's tax books provides the following Information for the current year: Sales Revenue 540,000 Cost of Goods Sold 310,000 Long-term capital gain 6,000 Operating expenses 100,000 Guaranteed payment to Rachel for services 40,000 Depreciation Expense (MACRS) 50,000 Cash distributions to each partner 20,000 Section 179 expense elected 25,000 Interest on Colorado state bonds (exempt interest Income) 2,000 Rachel is a 40% general partner in partnership capital, profits, and losses. a. Compute Ordinary Income for the Partnership. Label each item in your calculation. b. List the items (description and amount) from the above information that Rachel (40% owner) must report on her 1040. c. What is the amount of Rachel's earnings that are subject to self-employment tax assuming this is her only business income? d. What is Rachel's tentative Qualified Business Income deduction? T T T Paragraph Arial : 3 (12pt) . E T. %DO QE SETT OS Mashups @ CS Sacen swers to save all answers An examination of the RB Partnership's tax books provides the following information for the current year. Sales Revenue 540,000 Cost of Goods Sold 310,000 Long-term capital gain 6,000 Operating expenses 100,000 Guaranteed payment to Rachel for services 40,000 Depreciation Expense MACRS) 50,000 Cash distributions to each partner 20,000 Section 179 expense elected 25,000 Interest on Colorado state bonds (exempt interest Income) 2.000 Rachel is a 40% general partner in partnership capital, profits and losses. a. Compute Ordinary Income for the Partnership. Label each item in your calculation. b. List the items (description and amount) from the above information that Rachel (40% owner) must report on her 1040. What is the amount of Rachel's earnings that are subject to self-employment tax assuming this is her only business incomel d. What is Rachel's tentative Qualified Business Income deduction? TT TF Paragraph : Arial 3 (12pt) - E . T. . %DOQE T T. -- -- > @ fx Mashups - 14