Answered step by step

Verified Expert Solution

Question

1 Approved Answer

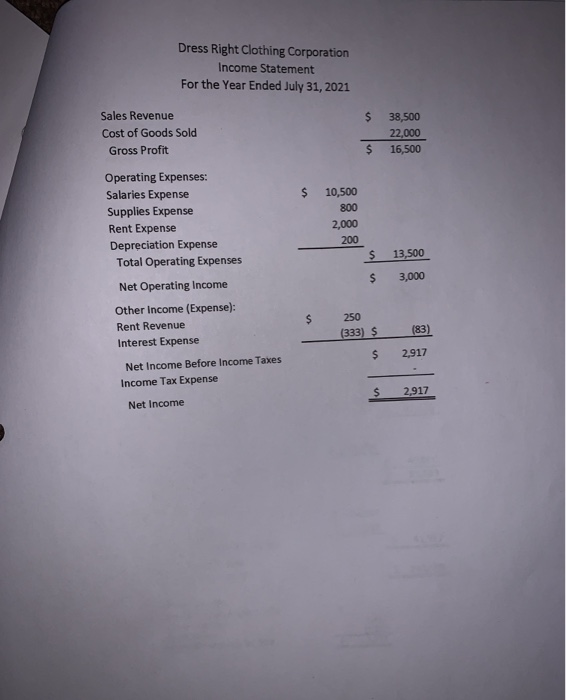

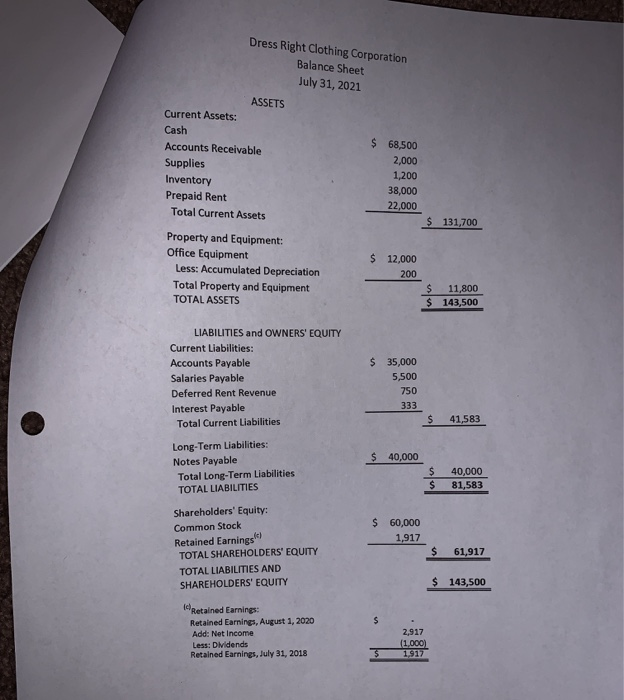

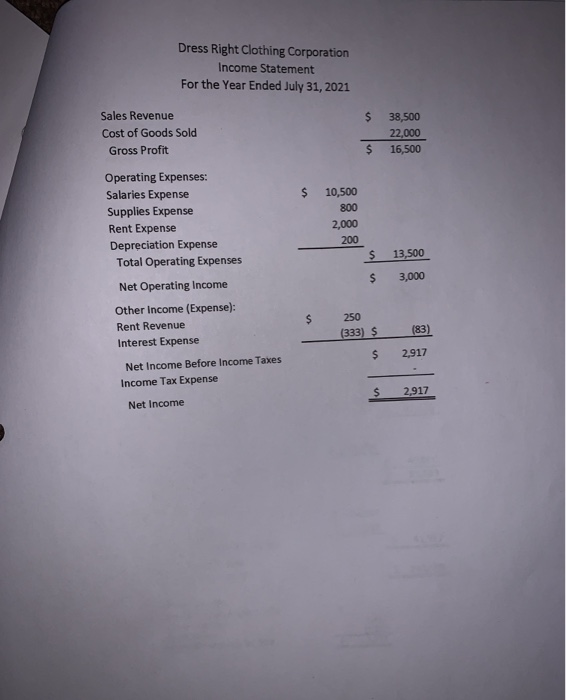

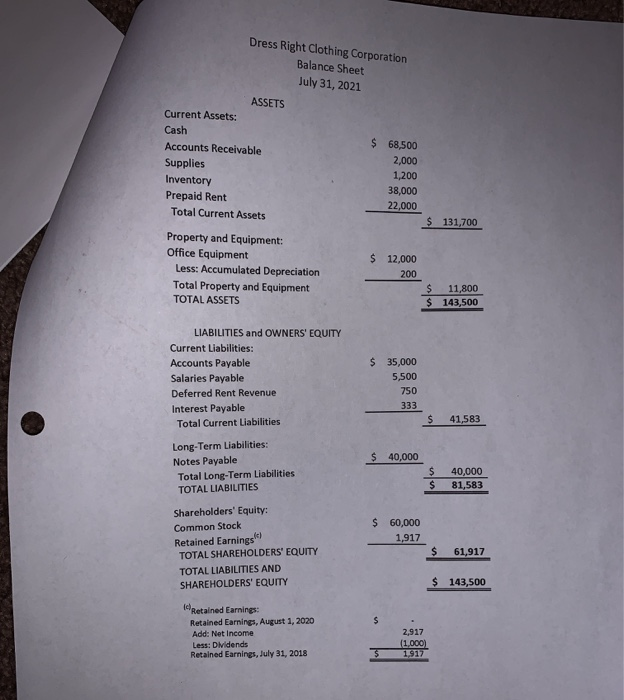

an example for that ACCT 115 Fall 2019 Use this packet to prepare/practice preparing a multiple-step income statement and a classified balance sheet. Samples are

an example for that

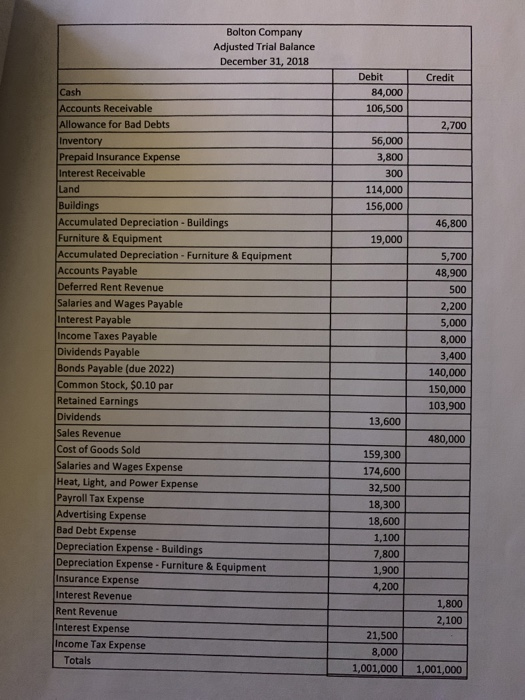

ACCT 115 Fall 2019 Use this packet to prepare/practice preparing a multiple-step income statement and a classified balance sheet. Samples are provided for reference. Bolton Company Adjusted Trial Balance December 31, 2018 Credit Debit 84,000 106,500 2,700 56,000 3,800 300 114,000 156,000 46,800 19,000 5,700 48,900 500 Cash Accounts Receivable Allowance for Bad Debts Inventory Prepaid Insurance Expense Interest Receivable Land Buildings Accumulated Depreciation - Buildings Furniture & Equipment Accumulated Depreciation - Furniture & Equipment Accounts Payable Deferred Rent Revenue Salaries and Wages Payable Interest Payable Income Taxes Payable Dividends Payable Bonds Payable (due 2022) Common Stock, $0.10 par Retained Earnings Dividends Sales Revenue Cost of Goods Sold Salaries and Wages Expense Heat, Light, and Power Expense Payroll Tax Expense Advertising Expense Bad Debt Expense Depreciation Expense - Buildings Depreciation Expense - Furniture & Equipment Insurance Expense Interest Revenue Rent Revenue Interest Expense Income Tax Expense Totals 2,200 5,000 8,000 3,400 140,000 150,000 103,900 13,600 480,000 159,300 174,600 32.500 18,300 18,600 1.100 7,800 1,900 4,200 2,100 21,500 8,000 1,001,000 1,001,000 Bolton Company Income Statement For the Year Ended December 31, 2018 Bolton Company Balance Sheet December 31, 2018 Dress Right Clothing Corporation Income Statement For the Year Ended July 31, 2021 $ Sales Revenue Cost of Goods Sold Gross Profit 38,500 22,000 16,500 $ $ Operating Expenses: Salaries Expense Supplies Expense Rent Expense Depreciation Expense Total Operating Expenses 10,500 800 2,000 200 $ $ 13,500 3,000 $ Net Operating Income Other Income (Expense): Rent Revenue Interest Expense Net Income Before Income Taxes Income Tax Expense Net Income 250 (333) $ $ (83) 2,917 $ 2,917 Dress Right Clothing Corporation Balance Sheet July 31, 2021 $ ASSETS Current Assets: Cash Accounts Receivable Supplies Inventory Prepaid Rent Total Current Assets 68,500 2,000 1,200 38,000 22,000 $ 131,700 $ 12,000 Property and Equipment: Office Equipment Less: Accumulated Depreciation Total Property and Equipment TOTAL ASSETS 200 $ $ 11,800 143,500 LIABILITIES and OWNERS' EQUITY Current Liabilities: Accounts Payable Salaries Payable Deferred Rent Revenue Interest Payable Total Current Liabilities $ 35,000 5,500 750 333 $ 41,583 $ 40,000 Long-Term Liabilities: Notes Payable Total Long-Term Liabilities TOTAL LIABILITIES $ $ 40,000 81,583 $ 60,000 1,917 Shareholders' Equity: Common Stock Retained Earnings TOTAL SHAREHOLDERS' EQUITY TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY $ 61.917 $ 143,500 Retained Earnings: Retained Earnings, August 1, 2020 Add: Net Income Less: Dividends Retained Earnings, July 31, 2018 2,917 (1.000) 1917 ACCT 115 Fall 2019 Use this packet to prepare/practice preparing a multiple-step income statement and a classified balance sheet. Samples are provided for reference. Bolton Company Adjusted Trial Balance December 31, 2018 Credit Debit 84,000 106,500 2,700 56,000 3,800 300 114,000 156,000 46,800 19,000 5,700 48,900 500 Cash Accounts Receivable Allowance for Bad Debts Inventory Prepaid Insurance Expense Interest Receivable Land Buildings Accumulated Depreciation - Buildings Furniture & Equipment Accumulated Depreciation - Furniture & Equipment Accounts Payable Deferred Rent Revenue Salaries and Wages Payable Interest Payable Income Taxes Payable Dividends Payable Bonds Payable (due 2022) Common Stock, $0.10 par Retained Earnings Dividends Sales Revenue Cost of Goods Sold Salaries and Wages Expense Heat, Light, and Power Expense Payroll Tax Expense Advertising Expense Bad Debt Expense Depreciation Expense - Buildings Depreciation Expense - Furniture & Equipment Insurance Expense Interest Revenue Rent Revenue Interest Expense Income Tax Expense Totals 2,200 5,000 8,000 3,400 140,000 150,000 103,900 13,600 480,000 159,300 174,600 32.500 18,300 18,600 1.100 7,800 1,900 4,200 2,100 21,500 8,000 1,001,000 1,001,000 Bolton Company Income Statement For the Year Ended December 31, 2018 Bolton Company Balance Sheet December 31, 2018 Dress Right Clothing Corporation Income Statement For the Year Ended July 31, 2021 $ Sales Revenue Cost of Goods Sold Gross Profit 38,500 22,000 16,500 $ $ Operating Expenses: Salaries Expense Supplies Expense Rent Expense Depreciation Expense Total Operating Expenses 10,500 800 2,000 200 $ $ 13,500 3,000 $ Net Operating Income Other Income (Expense): Rent Revenue Interest Expense Net Income Before Income Taxes Income Tax Expense Net Income 250 (333) $ $ (83) 2,917 $ 2,917 Dress Right Clothing Corporation Balance Sheet July 31, 2021 $ ASSETS Current Assets: Cash Accounts Receivable Supplies Inventory Prepaid Rent Total Current Assets 68,500 2,000 1,200 38,000 22,000 $ 131,700 $ 12,000 Property and Equipment: Office Equipment Less: Accumulated Depreciation Total Property and Equipment TOTAL ASSETS 200 $ $ 11,800 143,500 LIABILITIES and OWNERS' EQUITY Current Liabilities: Accounts Payable Salaries Payable Deferred Rent Revenue Interest Payable Total Current Liabilities $ 35,000 5,500 750 333 $ 41,583 $ 40,000 Long-Term Liabilities: Notes Payable Total Long-Term Liabilities TOTAL LIABILITIES $ $ 40,000 81,583 $ 60,000 1,917 Shareholders' Equity: Common Stock Retained Earnings TOTAL SHAREHOLDERS' EQUITY TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY $ 61.917 $ 143,500 Retained Earnings: Retained Earnings, August 1, 2020 Add: Net Income Less: Dividends Retained Earnings, July 31, 2018 2,917 (1.000) 1917

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started