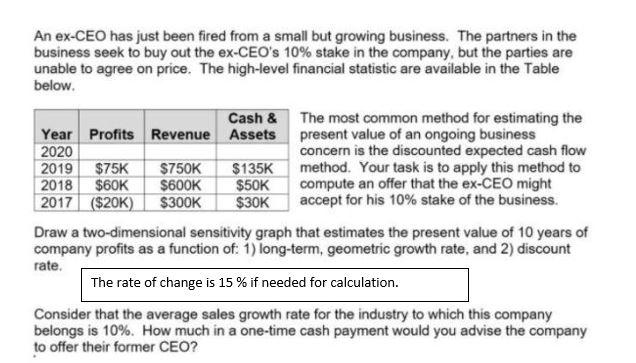

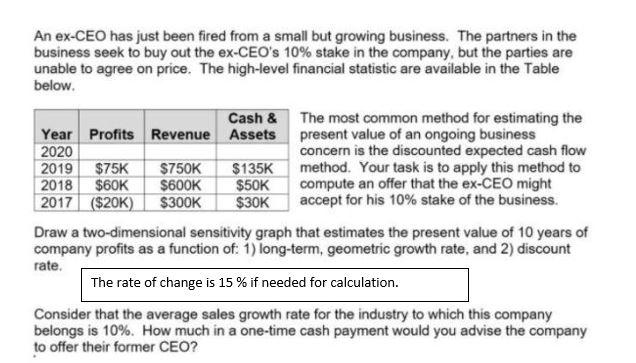

An ex-CEO has just been fired from a small but growing business. The partners in the business seek to buy out the ex-CEO's 10% stake in the company, but the parties are unable to agree on price. The high-level financial statistic are available in the Table below. Cash & The most common method for estimating the Year Profits Revenue Assets present value of an ongoing business 2020 concern is the discounted expected cash flow 2019 $75K $750K $135K method. Your task is to apply this method to 2018 $60K $600K $50K compute an offer that the ex-CEO might 2017 ($20K) $300K $30K accept for his 10% stake of the business. Draw a two-dimensional sensitivity graph that estimates the present value of 10 years of company profits as a function of: 1) long-term, geometric growth rate, and 2) discount rate. The rate of change is 15 % if needed for calculation. Consider that the average sales growth rate for the industry to which this company belongs is 10%. How much in a one-time cash payment would you advise the company to offer their former CEO? An ex-CEO has just been fired from a small but growing business. The partners in the business seek to buy out the ex-CEO's 10% stake in the company, but the parties are unable to agree on price. The high-level financial statistic are available in the Table below. Cash & The most common method for estimating the Year Profits Revenue Assets present value of an ongoing business 2020 concern is the discounted expected cash flow 2019 $75K $750K $135K method. Your task is to apply this method to 2018 $60K $600K $50K compute an offer that the ex-CEO might 2017 ($20K) $300K $30K accept for his 10% stake of the business. Draw a two-dimensional sensitivity graph that estimates the present value of 10 years of company profits as a function of: 1) long-term, geometric growth rate, and 2) discount rate. The rate of change is 15 % if needed for calculation. Consider that the average sales growth rate for the industry to which this company belongs is 10%. How much in a one-time cash payment would you advise the company to offer their former CEO