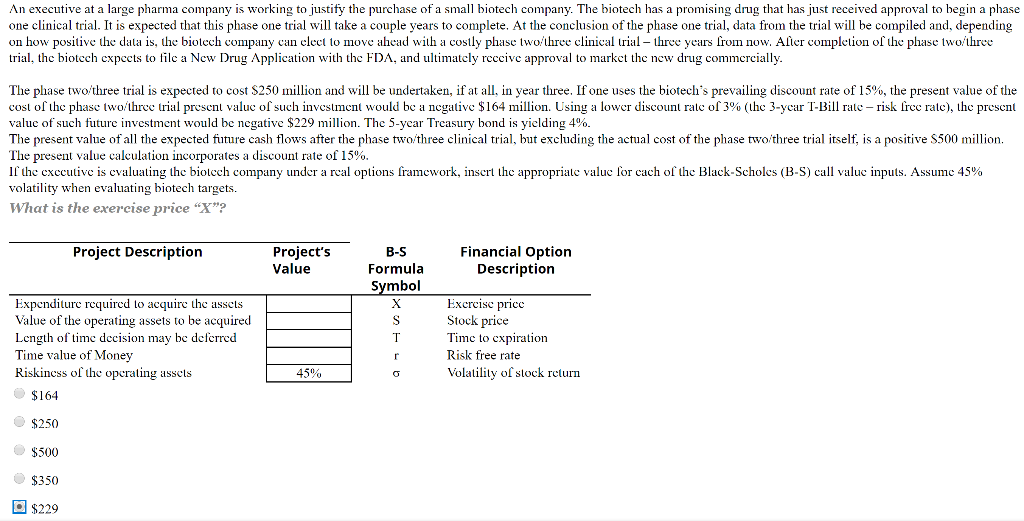

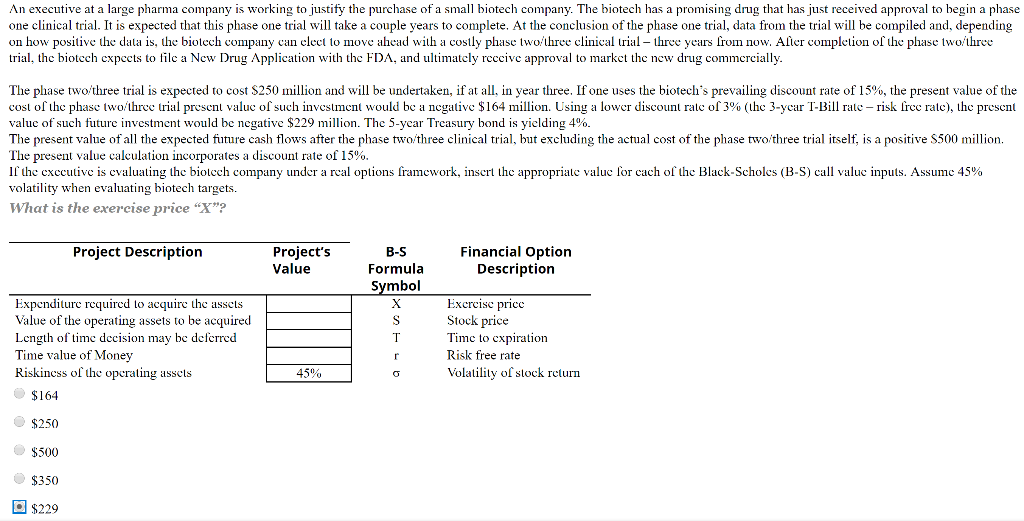

An executive at a large pharma company is working to justify the purchase of a small biotech company. The biotech has a promising drug that has just received approval to begin a phase one clinical trial. It is expected that this phase one trial will take a couple years to complete. At the conclusion of the phase one trial, data from the trial will be compiled and, depending on how positive the data is, the biotech company can elect to move ahead with a costly phase lwo/three clinical trial - three years from now. Aller completion of the phase lwo/three trial, thc biotech expects to file a New Drug Application with the FDA, and ultimately receive approval to market the new drug commercially. The phase two/three trial is expected to cost $250 million and will be undertaken, if at all, in year three. If one uses the biotech's prevailing discount rate of 15%, the present value of the cost of the phase two three trial present value of such investment would be a negative $164 million. Using a lower discount ralc of 3% (the 3-year T-Bill ralc - risk free rate), the present value of such future investment would be negative $229 million. The 5-year Treasury bond is yielding 4%. The present value of all the expected future cash flows after the phase two three clinical trial, but excluding the actual cost of the phase two three trial itself, is a positive S500 million. The present value calculation incorporates a discount rate of 15% If the executive is evaluating the biolcch company under a real options framework, insert the approprialc value for cach of the Black-Scholes (B-S) call value inputs. Assume 45% volatility when evaluating biotech targets. What is the exercise price "X"? Project Description Project's Value B-S Formula Symbol Financial Option Description Expenditure required to acquire the assets Value of the operating assets to be acquired Length of time decision may be deferred Time value of Money Riskincss of the operating assets $164 Excrcise price Stock price Time to expiration Risk free rate Volatility of stock return $250 $500 $350 $229 An executive at a large pharma company is working to justify the purchase of a small biotech company. The biotech has a promising drug that has just received approval to begin a phase one clinical trial. It is expected that this phase one trial will take a couple years to complete. At the conclusion of the phase one trial, data from the trial will be compiled and, depending on how positive the data is, the biotech company can elect to move ahead with a costly phase lwo/three clinical trial - three years from now. Aller completion of the phase lwo/three trial, thc biotech expects to file a New Drug Application with the FDA, and ultimately receive approval to market the new drug commercially. The phase two/three trial is expected to cost $250 million and will be undertaken, if at all, in year three. If one uses the biotech's prevailing discount rate of 15%, the present value of the cost of the phase two three trial present value of such investment would be a negative $164 million. Using a lower discount ralc of 3% (the 3-year T-Bill ralc - risk free rate), the present value of such future investment would be negative $229 million. The 5-year Treasury bond is yielding 4%. The present value of all the expected future cash flows after the phase two three clinical trial, but excluding the actual cost of the phase two three trial itself, is a positive S500 million. The present value calculation incorporates a discount rate of 15% If the executive is evaluating the biolcch company under a real options framework, insert the approprialc value for cach of the Black-Scholes (B-S) call value inputs. Assume 45% volatility when evaluating biotech targets. What is the exercise price "X"? Project Description Project's Value B-S Formula Symbol Financial Option Description Expenditure required to acquire the assets Value of the operating assets to be acquired Length of time decision may be deferred Time value of Money Riskincss of the operating assets $164 Excrcise price Stock price Time to expiration Risk free rate Volatility of stock return $250 $500 $350 $229