Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An existing factory must be enlarged or replaced to accommodate new production machinery. The structure was built at acost of Php 2.6 million. Its

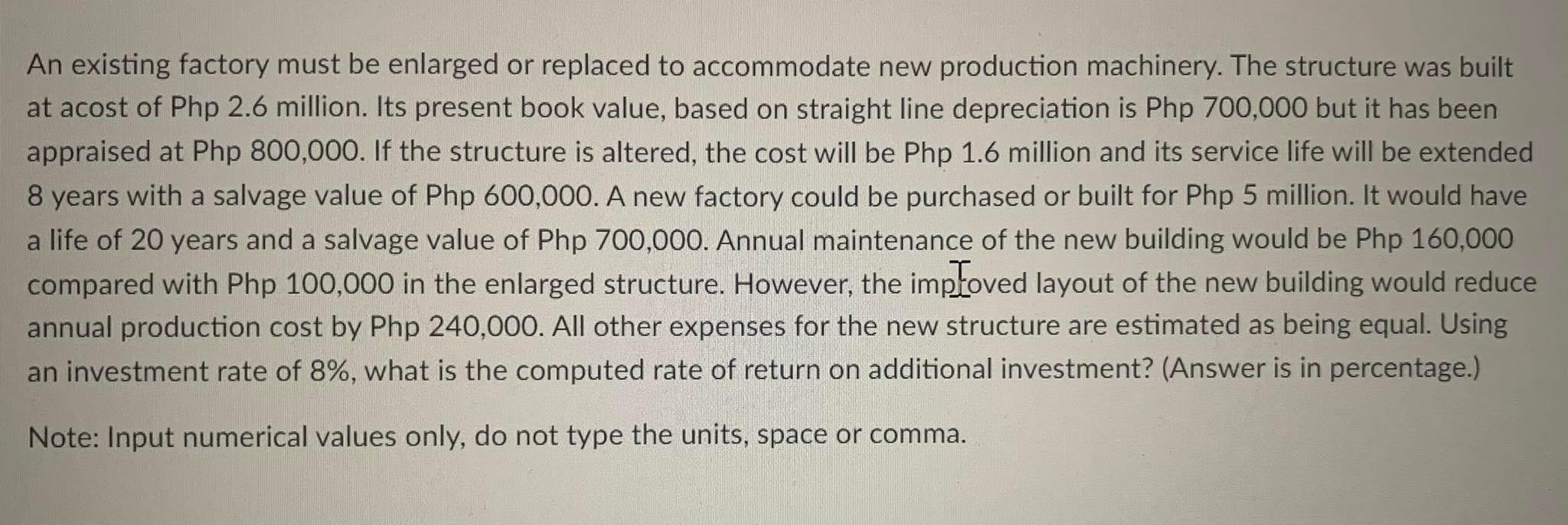

An existing factory must be enlarged or replaced to accommodate new production machinery. The structure was built at acost of Php 2.6 million. Its present book value, based on straight line depreciation is Php 700,000 but it has been appraised at Php 800,000. If the structure is altered, the cost will be Php 1.6 million and its service life will be extended 8 years with a salvage value of Php 600,000. A new factory could be purchased or built for Php 5 million. It would have a life of 20 years and a salvage value of Php 700,000. Annual maintenance of the new building would be Php 160,000 compared with Php 100,000 in the enlarged structure. However, the imptoved layout of the new building would reduce annual production cost by Php 240,000. All other expenses for the new structure are estimated as being equal. Using an investment rate of 8%, what is the computed rate of return on additional investment? (Answer is in percentage.) Note: Input numerical values only, do not type the units, space or comma.

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Enlarged building Annual costs Depreciation P800000 P1600000 P600000 FA 8 8 3D P180...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started