Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An existing machine can produce a cash inflow of $5,500 a year for 2 years and then will give up the ghost. The current salvage

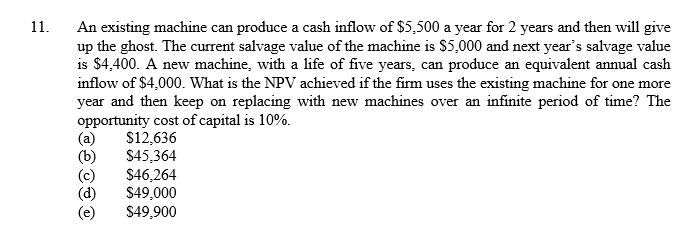

An existing machine can produce a cash inflow of $5,500 a year for 2 years and then will give up the ghost. The current salvage value of the machine is $5,000 and next years salvage value is $4,400. A new machine, with a life of five years, can produce an equivalent annual cash inflow of $4,000. What is the NPV achieved if the firm uses the existing machine for one more year and then keep on replacing with new machines over an infinite period of time? The opportunity cost of capital is 10%.

Answer is B

11. An existing machine can produce a cash inflow of $5,500 a year for 2 years and then will give up the ghost. The current salvage value of the machine is $5,000 and next year's salvage value is $4,400. A new machine, with a life of five years, can produce an equivalent annual cash inflow of $4,000. What is the NPV achieved if the firm uses the existing machine for one more year and then keep on replacing with new machines over an infinite period of time? The opportunity cost of capital is 10%. (a) $12,636 $45,364 (c) $46,264 $49,000 (e) $49,900 (6) (d)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started