Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An existing robot can be kept it 52.300 is spent now to upgrade it for future service requirements. Aternatively, the company can purchase a new

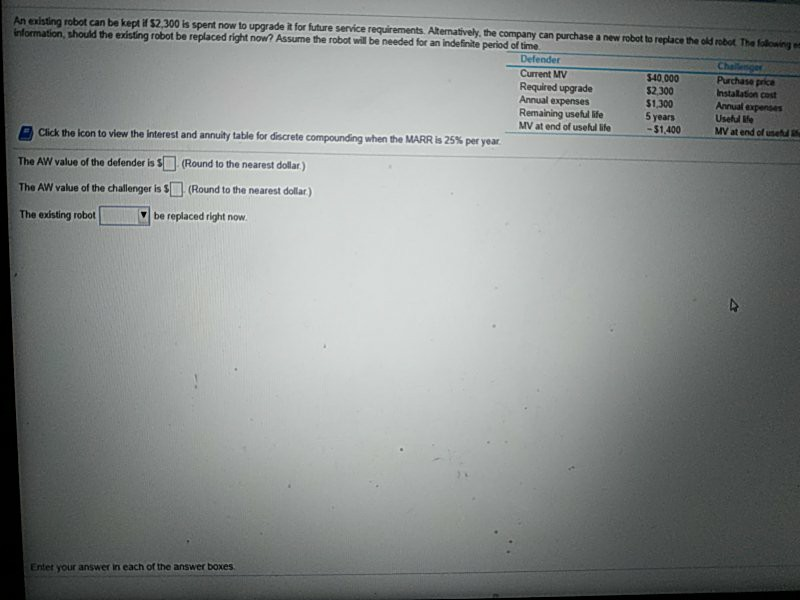

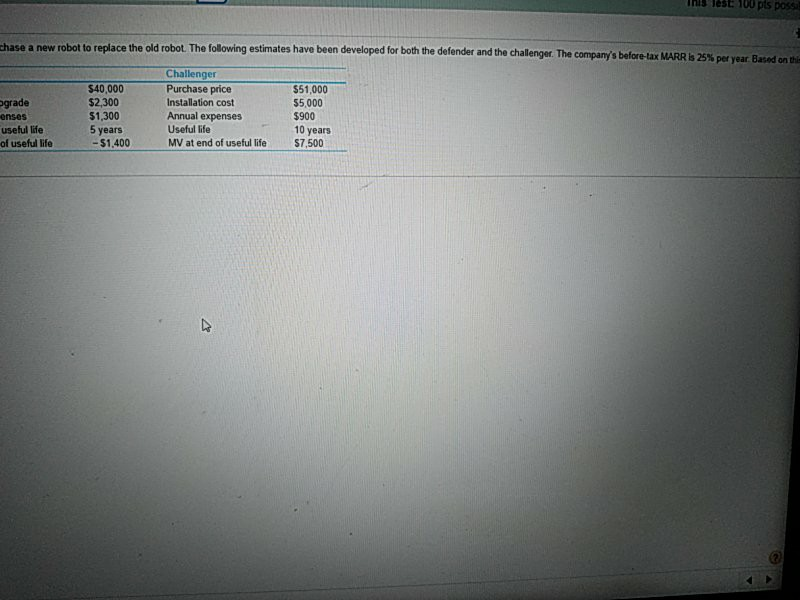

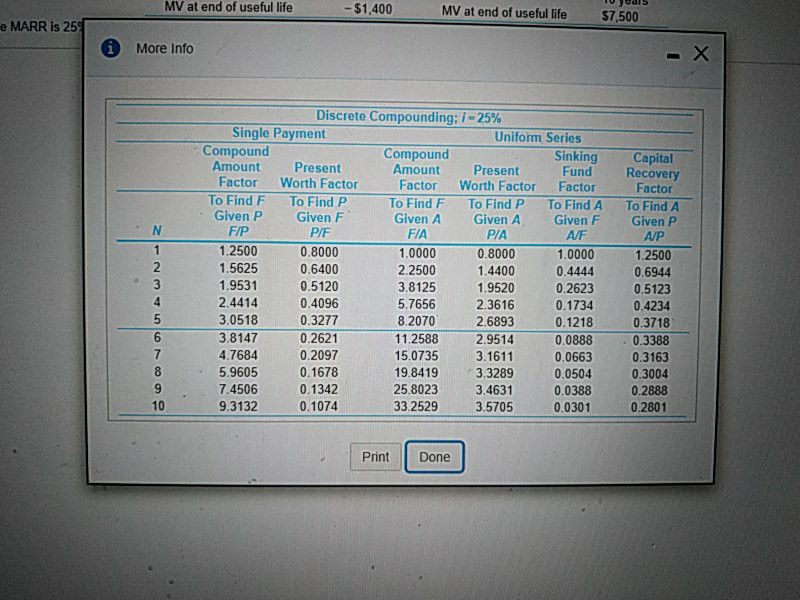

An existing robot can be kept it 52.300 is spent now to upgrade it for future service requirements. Aternatively, the company can purchase a new robot to replace the old robot. The following Information, should the existing robot be replaced right now? Assume the robot will be needed for an indefinite period of time Defender Challenges Current MV $40,000 Purchase prica Required upgrade $2,300 Instalation cost Annual expenses $1,300 Annual expenses Remaining useful life 5 years Use the MV at end of useful life - 51,400 MV at end of use Click the icon to view the Interest and annuity table for discrete compounding when the MARR is 25% per year The AW value of the defender is (Round to the nearest dollar) The AW value of the challenger is $(Round to the nearest dollar) The existing robot be replaced right now. Enter your answer in each of the answer boxes ses 100 pts poss chase a new robot to replace the old robot. The following estimates have been developed for both the defender and the challenger. The company's before-tax MARR IS 25% per year. Based on thi $40,000 $2,300 $1,300 Challenger Purchase price Installation cost Annual expenses Useful life MV at end of useful life $51,000 55,000 $900 grade enses useful lide of useful life 5 years 10 years - $1,400 $7,500 MV at end useful life - $1,400 MV at end of useful life $7,500 e MARR is 25 i More Info -X N 1 2 3 4 5 6 7 8 9 10 Discrete Compounding; 1 -25% Single Payment Uniform Series Compound Compound Sinking Amount Present Amount Present Fund Factor Worth Factor Factor Worth Factor Factor To Find F To Find P To Find F To Find P To Find A Given P Given F Given A Given A Given F FIP P/F FIA P/A A/F 1.2500 0.8000 1.0000 0.8000 1.0000 1.5625 0.6400 2.2500 1.4400 0.4444 1.9531 0.5120 3.8125 1.9520 0.2623 2.4414 0.4096 5.7656 2.3616 0.1734 3.0518 0.3277 8.2070 2.6893 0.1218 3.8147 0.2621 11.2588 2.9514 0.0888 4.7684 0.2097 15.0735 3.1611 0.0663 5.9605 0.1678 19.8419 3.3289 0.0504 7.4506 0.1342 25.8023 3.4631 0.0388 9.3132 0.1074 33.2529 3.5705 0.0301 Capital Recovery Factor To Find A Given P 1.2500 0.6944 0.5123 0.4234 0.3718 0.3388 0.3163 0.3004 0.2888 0.2801 Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started