Answered step by step

Verified Expert Solution

Question

1 Approved Answer

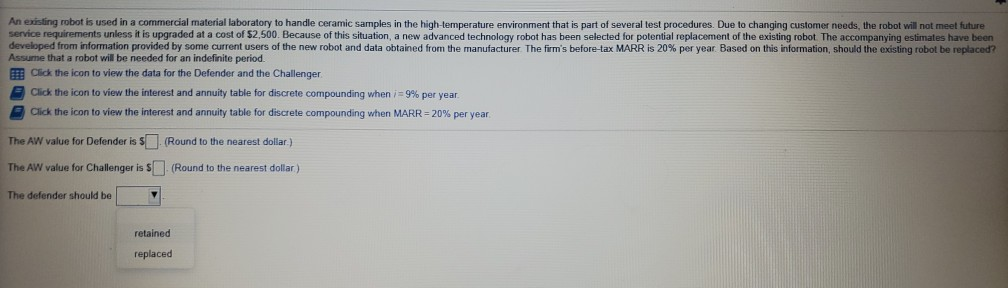

An existing robot is used in a commercial material laboratory to handle ceramic samples in the high-temperature environment that is part of several test procedures.

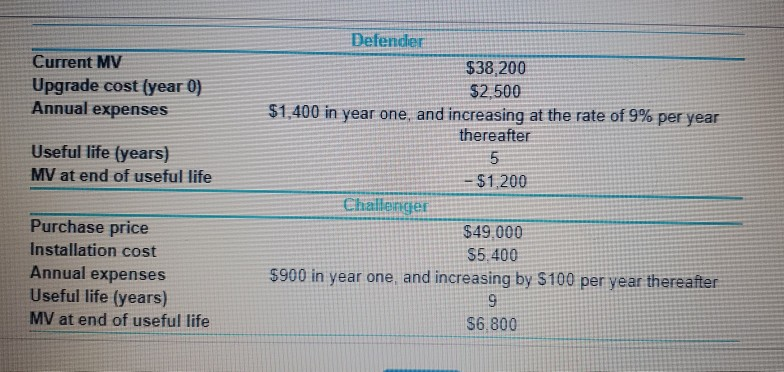

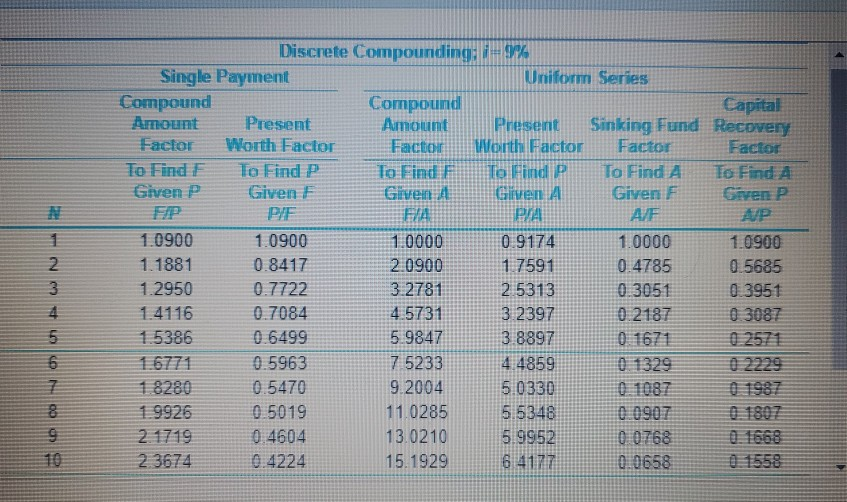

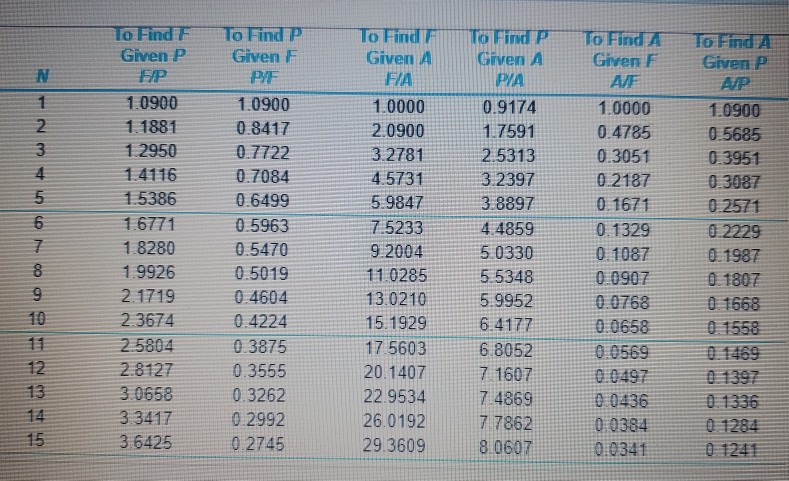

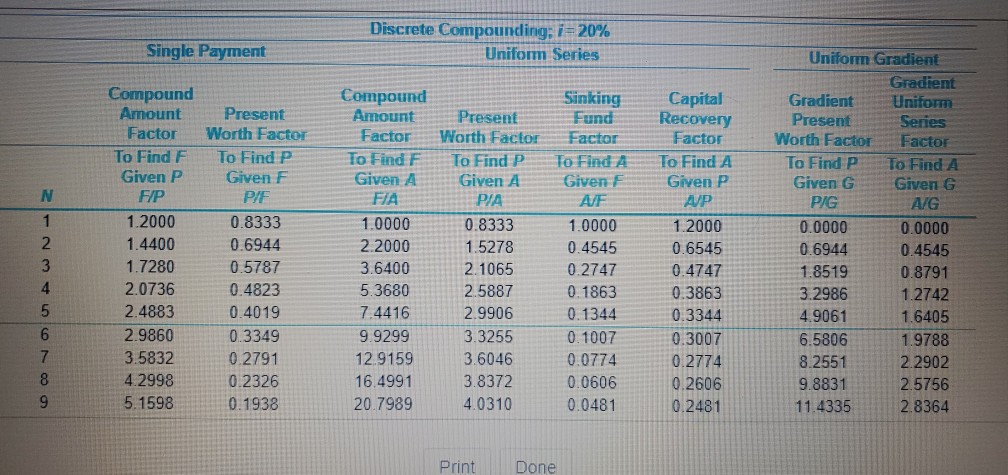

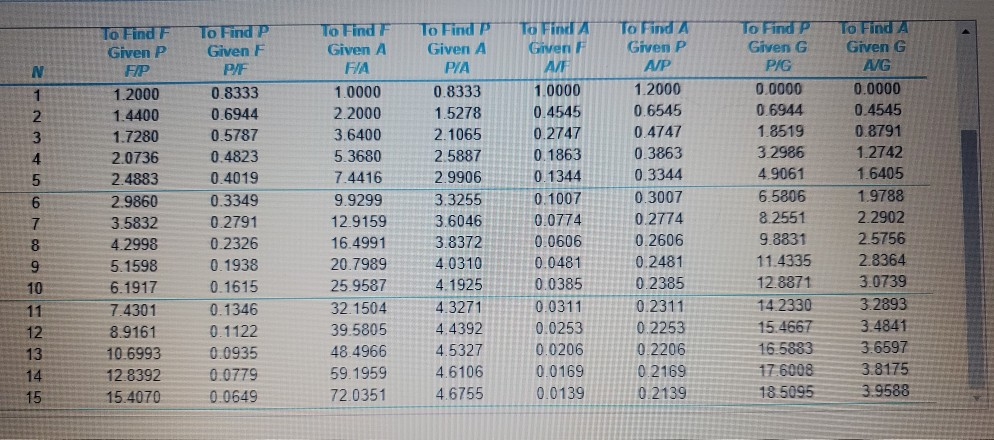

An existing robot is used in a commercial material laboratory to handle ceramic samples in the high-temperature environment that is part of several test procedures. Due to changing customer needs, the robot will not meet future service requirements unless it is upgraded at a cost of $2,500. Because of this situation, a new advanced technology robot has been selected for potential replacement of the existing robot. The accompanying estimates have been developed from information provided by some current users of the new robot and data obtained from the manufacturer. The firm's before-tax MARR is 20% per year Based on this information, should the existing robot be replaced? Assume that a robot will be needed for an indefinite period. EL Click the icon to view the data for the Defender and the Challenger Click the icon to view the interest and annuity table for discrete compounding when i = 9% per year. Click the icon to view the interest and annuity table for discrete compounding when MARR = 20% per year. The AW value for Defender is $(Round to the nearest dollar) The AW value for Challenger is $(Round to the nearest dollar) The defender should be retained replaced Current MV Upgrade cost (year 0) Annual expenses Useful life (years) MV at end of useful life Defender $38,200 $2.500 $1,400 in year one, and increasing at the rate of 9% per year thereafter 5 $1,200 Challenger $49.000 S5.400 $900 in year one and increasing by $100 per year thereafter 9 $6.800 Purchase price Installation cost Annual expenses Useful life (years) MV at end of useful life 1 Discrete Compounding: 9% Single Payment Uniform Series Compound Compound Capital Amount Present Amount Present Sinking Fund Recovery Factor Worth Factor Factor Worth Factor Factor Factor To Find E To Find P To Find, F To find P To Find A To Find A Given P Given Givein A Given A Given F Given P FA 1.0900 1.0900 1.0000 0.9174 1.0000 1.0900 1.1881 0.8417 2.0900 1.7591 0.4785 0.5685 1.2950 0.7722 3.2781 2 5313 0.3051 0.3951 1.4116 0.7084 4.5731 3.2397 0.2187 0.3087 1.5386 0.6499 5.9847 3.8897 0.1671 0.2571 1.6771 0.5963 7 5233 4.4859 01329 0 2229 1 8280 0.5470 9.2004 5.0330 0.1087 1.9926 0.5019 11.0285 5.5348 0.0907 2. 1719 0 4604 13.0210 5.9952 0 0768 2.3674 0.4224 15.1929 6 4177 0.0658 0 1558 2 3 4 5 6 7 9 To Find F Given P To Find A Given P N 2 3 4 5 6 7 8 9 10 1.0900 1.1881 12950 1.4116 1.5386 1.6771 1.8280 1.9926 2.1719 2.3674 2.5804 2.8127 3.0658 3.3417 3.6425 To Find P Given F PE 1.0900 0.8417 0.7722 0.7084 0.6499 0.5963 0.5470 0.5019 0.4604 0.4224 0.3875 0.3555 0.3262 0.2992 0.2745 To Find Given A FIA 1.0000 2.0900 3.2781 4.5731 5.9847 7.5233 9.2004 11.0285 13.0210 15.1929 17.5603 20.1407 22.9534 26.0192 29.3609 To Find P Given A PYA 0.9174 1.7591 2.5313 3.2397 3.8897 4.4859 5.0330 5.5348 5.9952 6.4177 6.8052 7 1607 7.4869 7 7862 8.0607 To Find A Given F A/F 1.0000 0.4785 0.3051 0.2187 0.1671 0.1329 0.1087 0.0907 0.0768 0.0658 0.0569 0.0497 0.0436 0.0384 0.0341 1.0900 0.5685 0.3951 0.3087 0.2571 0.2229 0.1987 0.1807 0. 1668 0.1558 12 13 14 15 0.1336 0 1284 0 1241 Discrete Compounding: i=20% Uniform Series Single Payment Sinking Fund Factor To Find A Given Capital Recovery Factor To Find A Given P N AF AP 1 Compound Amount Factor To Find F Given P F/P 1.2000 1.4400 1.7280 2.0736 2.4883 2.9860 3.5832 4.2998 5.1598 2 3 4 5 Present Worth Factor To Find P Given F P/E 0.8333 0.6944 0.5787 0.4823 0.4019 0.3349 0.2791 0.2326 0.1938 Compound Amount Factor To Find F Given A FIA 1.0000 2.2000 3.6400 5.3680 7.4416 9.9299 12.9159 16.4991 20.7989 Present Worth Factor To Find P Given A PA 0.8333 1.5278 2.1065 2.5887 2.9906 3.3255 3.6046 3.8372 4.0310 1.0000 0.4545 0.2747 0.1863 0.1344 0.1007 0.0774 0.0606 0.0481 Uniform Gradient Gradient Gradient Uniform Present Series Worth Factor Factor To Find P To Find A Given G Given G P/G A/G 0.0000 0.0000 0.6944 0.4545 1.8519 0.8791 3.2986 1.2742 4.9061 1.6405 6.5806 1.9788 8.2551 2.2902 9.8831 2.5756 11.4335 2.8364 1.2000 0.6545 0.4747 0.3863 0.3344 0.3007 0.2774 0.2606 0.2481 6 7 8 9 Print Done To Find A Given G A/G To Find P Given A P/A 0.8333 1.5278 2.1065 2.5887 2.9906 3.3255 N 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 To Find F Given P F/P 1.2000 1.4400 1.7280 2.0736 2.4883 2.9860 3.5832 4.2998 5.1598 6.1917 7.4301 8.9161 10.6993 12.8392 15.4070 To Find P Given F P/F 0.8333 0.6944 0.5787 0.4823 0.4019 0.3349 0.2791 0.2326 0.1938 0.1615 0.1346 0.1122 0.0935 0.0779 0.0649 To Find Given A F/A 1.0000 2.2000 3.6400 5.3680 74416 9.9299 12.9159 16.4991 20.7989 25.9587 32.1504 39.5805 48.4966 59.1959 72.0351 To Find A Given F A/F 1.0000 0.4545 0.2747 0.1863 0.1344 0.1007 0.0774 0.0606 0.0481 0.0385 0.0311 0.0253 0.0206 0.0169 0.0139 To Find A Given P AIP 1.2000 0.6545 0.4747 0.3863 0.3344 0.3007 0.2774 0.2606 0.2481 0.2385 0.2311 0.2253 0.2206 0.2169 0.2139 To Find P Given G P/G 0.0000 0.6944 1.8519 32986 4.9061 6.5806 8.2551 9.8831 11.4335 12.8871 14.2330 15.4667 16.5883 17.6008 18.5095 3.6046 3.8372 4.0310 4.1925 4.3271 4.4392 4.5327 4.6106 4.6755 0.0000 0.4545 0.8791 1.2742 1.6405 1.9788 2.2902 2.5756 2.8364 3.0739 3.2893 3.4841 3.6597 3.8175 3.9588

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started