An explanation of what the return on assets and the return on equity reveal about the investment performance of Tuhoe in 2018.

Must be explained in 250-300 words!

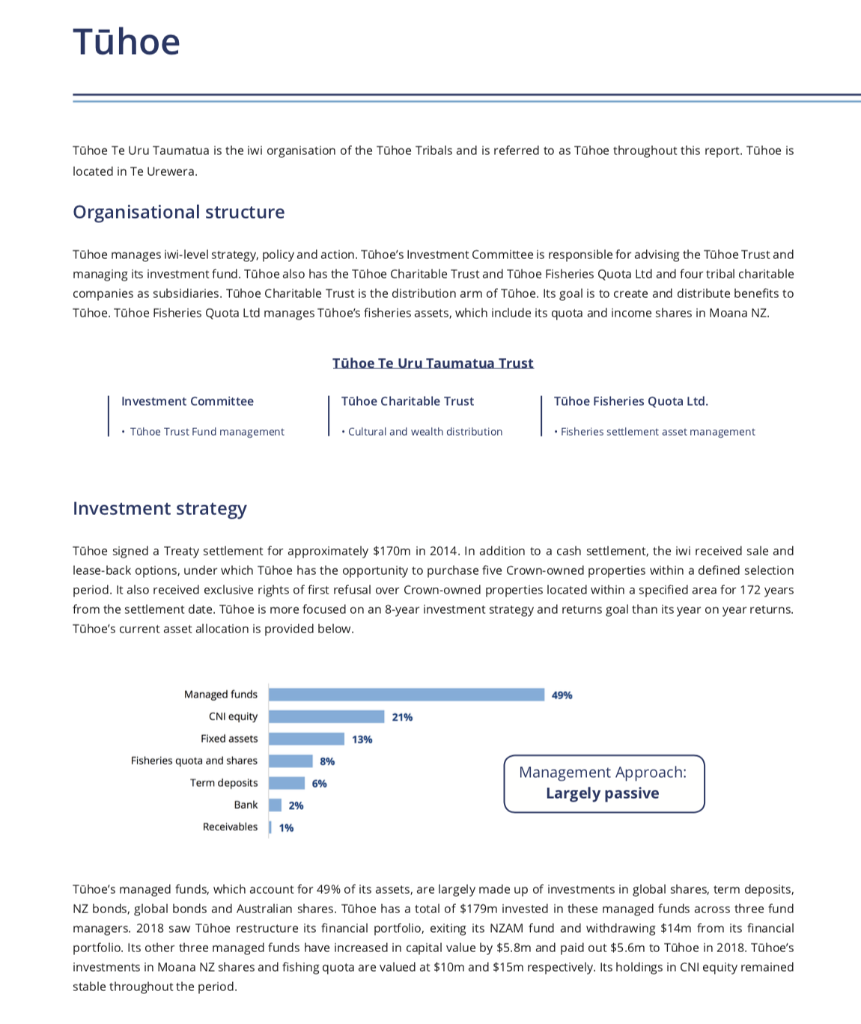

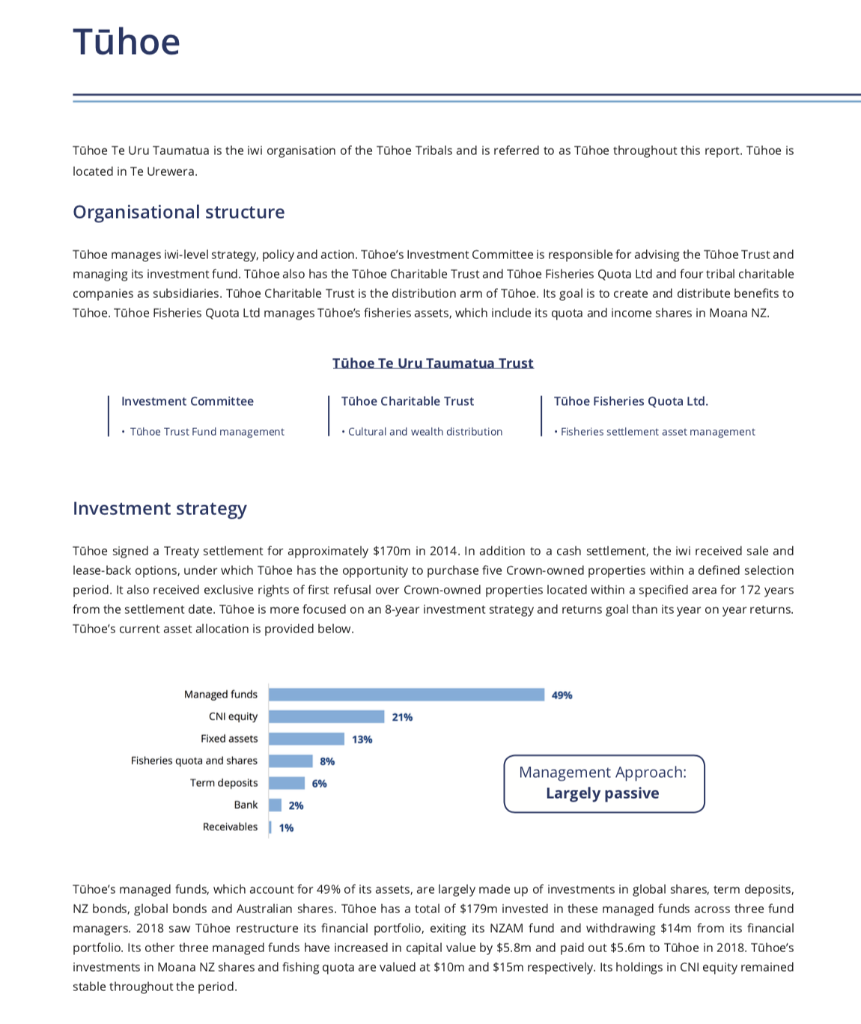

Thoe Thoe Te Uru Taumatua is the iwi organisation of the Thoe Tribals and is referred to as Thoe throughout this report. Thoe is located in Te Urewera. Organisational structure Thoe manages iwi-level strategy, policy and action. Thoe's Investment Committee is responsible for advising the Tahoe Trust and managing its investment fund. Tahoe also has the Tahoe Charitable Trust and Thoe Fisheries Quota Ltd and four tribal charitable companies as subsidiaries. Thoe Charitable Trust is the distribution arm of Thoe. Its goal is to create and distribute benefits to Thoe. Tahoe Fisheries Quota Ltd manages Thoe's fisheries assets, which include its quota and income shares in Moana NZ. Thoe Te Uru Taumatua Trust Investment Committee Thoe Charitable Trust Tahoe Fisheries Quota Ltd. Tahoe Trust Fund management Cultural and wealth distribution Fisheries settlement asset management Investment strategy Tahoe signed a Treaty settlement for approximately $170m in 2014. In addition to a cash settlement, the iwi received sale and lease-back options, under which Thoe has the opportunity to purchase five Crown-owned properties within a defined selection period. It also received exclusive rights of first refusal over Crown-owned properties located within a specified area for 172 years from the settlement date. Thoe is more focused on an 8-year investment strategy and returns goal than its year on year returns. Tahoe's current asset allocation is provided below. Managed funds 49% CNI equity 21% Fixed assets 13% Fisheries quota and shares 8% 6% Term deposits Bank Management Approach: Largely passive 2% Receivables 1% Thoe's managed funds, which account for 49% of its assets, are largely made up of investments in global shares, term deposits, NZ bonds, global bonds and Australian shares. Tahoe has a total of $179m invested in these managed funds across three fund managers. 2018 saw Thoe restructure its financial portfolio, exiting its NZAM fund and withdrawing $14m from its financial portfolio. Its other three managed funds have increased in capital value by $5.8m and paid out $5.6m to Thoe in 2018. Tahoe's investments in Moana NZ shares and fishing quota are valued at $10m and $15m respectively. Its holdings in CNI equity remained stable throughout the period. Thoe Capital structure Thoe is entirely financed by equity capital and has no debt on its books. Asset base Sm 400 Investment performance 300 Asset base and net worth 200 2013 2014 2017 2018 2015 2016 Assets Net worth As at 30 June 2018, Tahoe's assets and net worth were valued at $365m and $360m respectively. Thoe's financial portfolio provides asset growth as well as cash dividends. The main gains this year came on these managed portfolios. Work-in progress at the new "central hub Te Tii in Ruathuna is one of Thoe's current key projects, with a payment of $11m on its construction. Net assets per member grew to $9,588. Return on assets 9% Return on assets 6% 54 4% Tahoe's ROA increased steadily from 2013 to 2016, but declined to 6% in 2017 and 4% in 2018. The low 2018 ROA can be attributed to weaker returns from the CNI iwi collective, which returned $6m in 2018, down from $9m in 2017 and $17m in 2016, (years in which there were large gains with the increase in the price of carbon). Revaluations of Tahoe's financial portfolio contributed $5.6m in income in 2018, alongside $5.8m in unrealised gains from increases in the value of those portfolios. 2013 2014 2015 2016 2017 2018 Return on equity Return on equity 8% 7 6 5 5 46 Thoe's RoE has been similar to its RoA due to the absence of term debt in its capital structure. Like RoA, the decline in RoE in 2018 to 4% can be largely attributed to weaker CNI returns. RoE over the past six year has averaged 6% p.a. Tahoe has made distributions to its iwi beneficiaries over the past years largely for Marae funding purposes. Otherwise, profits are retained and reinvested in financial assets, new investment and building projects like Te Til and Te Wharehou o Waikaremoana, with the latter opening last year. 2013 2014 2015 2016 2017 2018 Net asset value 2014 2015 2016 2017 2018 Net assets per member ($) 7,117 8,258 8,923 9,319 9,588