Answered step by step

Verified Expert Solution

Question

1 Approved Answer

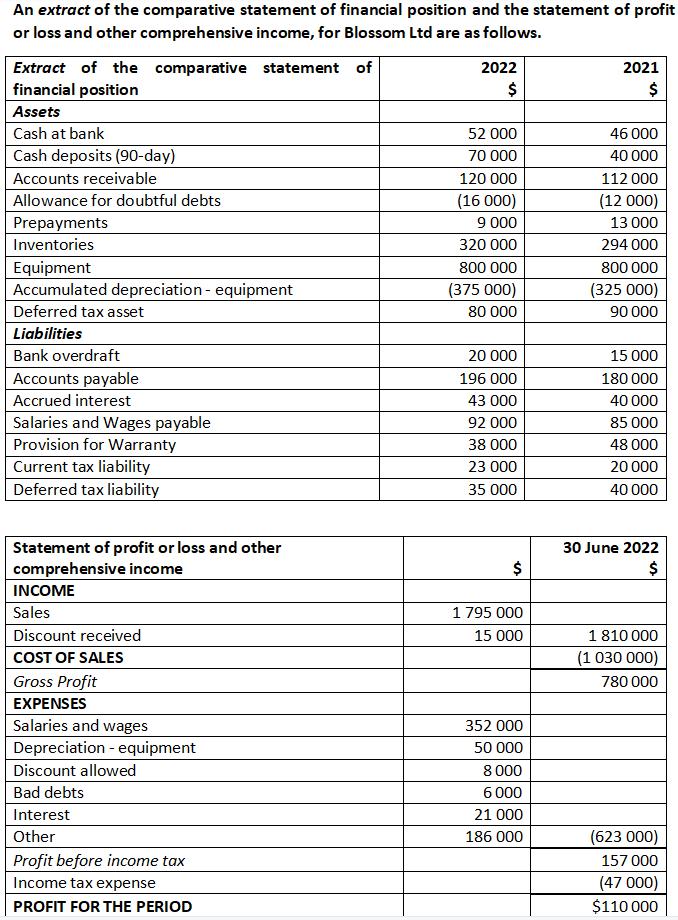

An extract of the comparative statement of financial position and the statement of profit or loss and other comprehensive income, for Blossom Ltd are

An extract of the comparative statement of financial position and the statement of profit or loss and other comprehensive income, for Blossom Ltd are as follows. statement of Extract of the comparative financial position Assets Cash at bank Cash deposits (90-day) Accounts receivable Allowance for doubtful debts Prepayments Inventories Equipment Accumulated depreciation - equipment Deferred tax asset Liabilities Bank overdraft Accounts payable Accrued interest Salaries and Wages payable Provision for Warranty Current tax liability Deferred tax liability Statement of profit or loss and other comprehensive income INCOME Sales Discount received COST OF SALES Gross Profit EXPENSES Salaries and wages Depreciation equipment Discount allowed Bad debts Interest Other Profit before income tax Income tax expense PROFIT FOR THE PERIOD 2022 $ 52 000 70 000 120 000 (16 000) 9 000 320 000 800 000 (375 000) 80 000 20 000 196 000 43 000 92 000 38 000 23 000 35 000 $ 1 795 000 15 000 352 000 50 000 8 000 6 000 21 000 186 000 2021 $ 46 000 40 000 112 000 (12 000) 13 000 294 000 800 000 (325 000) 90 000 15 000 180 000 40 000 85 000 48 000 20 000 40 000 30 June 2022 $ 1 810 000 (1 030 000) 780 000 (623 000) 157 000 (47 000) $110 000

Step by Step Solution

★★★★★

3.37 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started