Answered step by step

Verified Expert Solution

Question

1 Approved Answer

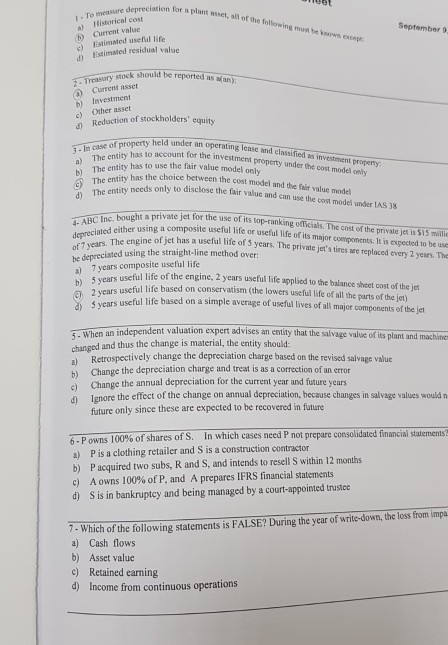

an fotr a plant nsset, all ot the following mut be known excep . To measure depreciation a a) Historical c b) Current value c)

an fotr a plant nsset, all ot the following mut be known excep . To measure depreciation a a) Historical c b) Current value c) Estimated useful life d) Estimated residual value September 9, ctock should be reported as wan) a Curret asset b) Investment c) Other asset d) Reduction of stockholders' 3- In case of property a) The entity erty held under an operating lease and classified ns investment propert has to account for the investment property under the cost model only ntity has to use the fair value model only under )The e as the choice between the cost model and the fair value model needs only to disclose the fair valuc and can use the cost model under IAS 38 d) ta private jet for the use of its top-ranking officials. The cost of the private jet is $15 millic te useful life or useful life of its major components. It is expected to be use Inc. The either using a composite usefuling depreciale rhe engine of jet has a usefiul life of 5 years. The private jet's tires are replaced every 2 years. The of 7 years. The engine of jet has a useful life of s he depreciated using the straight-line method over a) 7 years composite useful life b) 5 years ) 2 years useful life of the engine, 2 years useful life applied to the balance sheet cost of the jer useful life based on conservatism (the lowers useful life of all the parts of the jet) suseful life based on a simple average of useful lives of all major components of the jet 5 years dent valuation expert advises an entity that the salvage value of its plant and machines hen an independent ex changed and thus the change is material, the entity should al Retrospectively change the depreciation charge based on the revised salvage valuc b) Change the depreciation charge and treat is as a correction of an errar cl Change the annual depreciation for the current year and future years d Ignore the effect of the change on annual depreciation, becouse changes in salvage values would n future only since these are expected to be recovered in future 6-P owns 100% of shares of s. In which cases need P not prepare consolidated financial statements a) P is a clothing retailer and S is a construction contractor b) P acquired two subs, R and S, and intends to resell S within 12 months c) A owns 100% of P, and A prepares IFRS financial statements d) S is in bankruptcy and being managed by a court-appointed trustce 7- Which of the following statements is FALSE? During the year of write-down, the loss from impa a) Cash flows b) Asset value c) Retained earning d) Income from continuous operations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started