Answered step by step

Verified Expert Solution

Question

1 Approved Answer

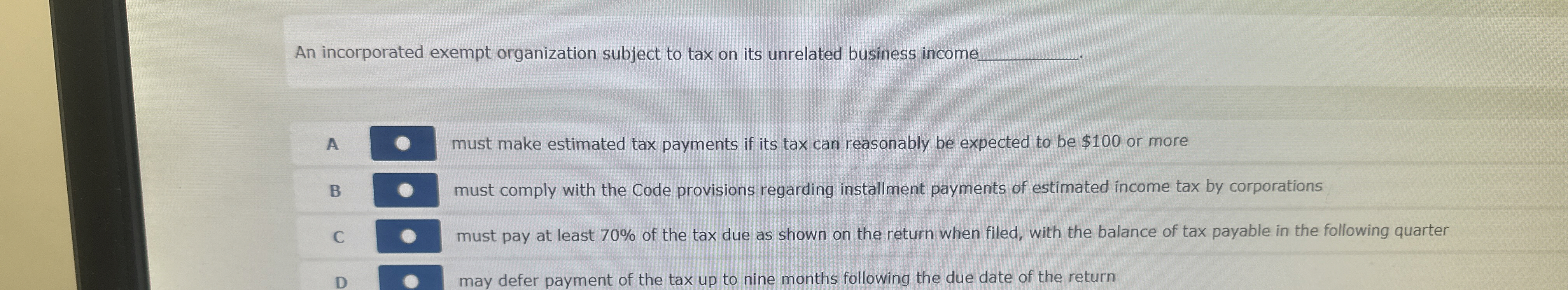

An incorporated exempt organization subject to tax on its unrelated business income . q , must make estimated tax payments if its tax can reasonably

An incorporated exempt organization subject to tax on its unrelated business income must make estimated tax payments if its tax can reasonably be expected to be $ or moreB must comply with the Code provisions regarding installment payments of estimated income tax by corporations

C must pay at least of the tax due as shown on the return when filed, with the balance of tax payable in the following quarter

D

may defer payment of the tax up to nine months following the due date of the return

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started