Answered step by step

Verified Expert Solution

Question

1 Approved Answer

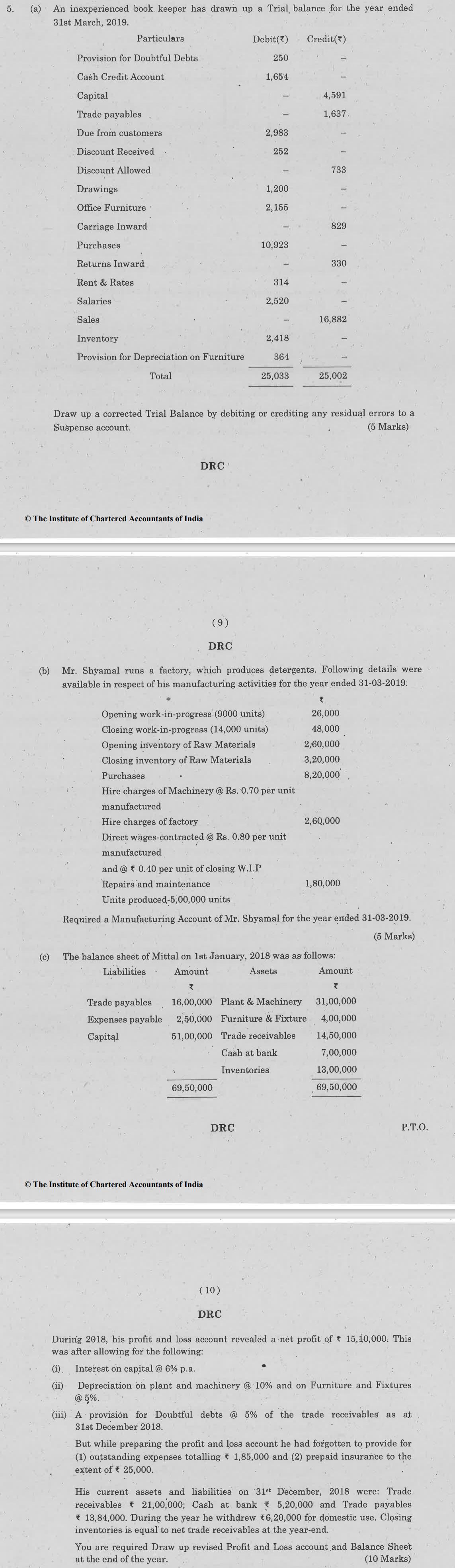

An inexperienced book keeper has drawn up a Trial balance for the year ended 31st March, 2019. Provision for Doubtful Debts Cash Credit Account

An inexperienced book keeper has drawn up a Trial balance for the year ended 31st March, 2019. Provision for Doubtful Debts Cash Credit Account Capital Trade payables Due from customers Discount Received Discount Allowed Drawings Office Furniture Carriage Inward Purchases Returns Inward Rent & Rates Salaries Particulars Sales Inventory Provision for Depreciation on Furniture Total DRC The Institute of Chartered Accountants of India (9) DRC Trade payables Expenses payable Capital Debit(*) 250 1,654 69,50,000 The Institute of Chartered Accountants of India 2,983 Opening work-in-progress (9000 units) Closing work-in-progress (14,000 units) Opening inventory of Raw Materials Closing inventory of Raw Materials Purchases DRC 252 1,200 2,155 (10) 10,923 Hire charges of Machinery @ Rs. 0.70 per unit manufactured Hire charges of factory Direct wages-contracted @ Rs. 0.80 per unit DRC 314 2,520 Draw up a corrected Trial Balance by debiting or crediting any residual errors to a Suspense account. (5 Marks) 2,418 364 25,033 Credit(*) (b) Mr. Shyamal runs a factory, which produces detergents. Following details were available in respect of his manufacturing activities for the year ended 31-03-2019. 4,591 1,637. 733 829 330 16,882 manufactured and @ 0.40 per unit of closing W.I.P Repairs and maintenance Units produced-5,00,000 units Required a Manufacturing Account of Mr. Shyamal for the year ended 31-03-2019. (5 Marks) 25,002 (c) The balance sheet of Mittal on 1st January, 2018 was as follows: Liabilities Amount Assets 16,00,000 Plant & Machinery 31,00,000 2,50,000 Furniture & Fixture 4,00,000 51,00,000 Trade receivables 14,50,000 Cash at bank 7,00,000 Inventories 13,00,000 69,50,000 26,000 48,000 2,60,000 3,20,000 8,20,000 2,60,000 1,80,000 Amount P.T.O. During 2018, his profit and loss account revealed a net profit of 15,10,000. This was after allowing for the following: (i) Interest on capital @ 6% p.a. (ii) Depreciation on plant and machinery @ 10% and on Furniture and Fixtures @ 5%. (iii) A provision for Doubtful debts @ 5% of the trade receivables as at 31st December 2018. But while preparing the profit and loss account he had forgotten to provide for (1) outstanding expenses totalling 1,85,000 and (2) prepaid insurance to the extent of 25,000. His current assets and liabilities on 31st December, 2018 were: Trade receivables 21,00,000; Cash at bank 5,20,000 and Trade payables 13,84,000. During the year he withdrew 6,20,000 for domestic use. Closing inventories is equal to net trade receivables at the year-end. You are required Draw up revised Profit and Loss account and Balance Sheet at the end of the year. (10 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started