Answered step by step

Verified Expert Solution

Question

1 Approved Answer

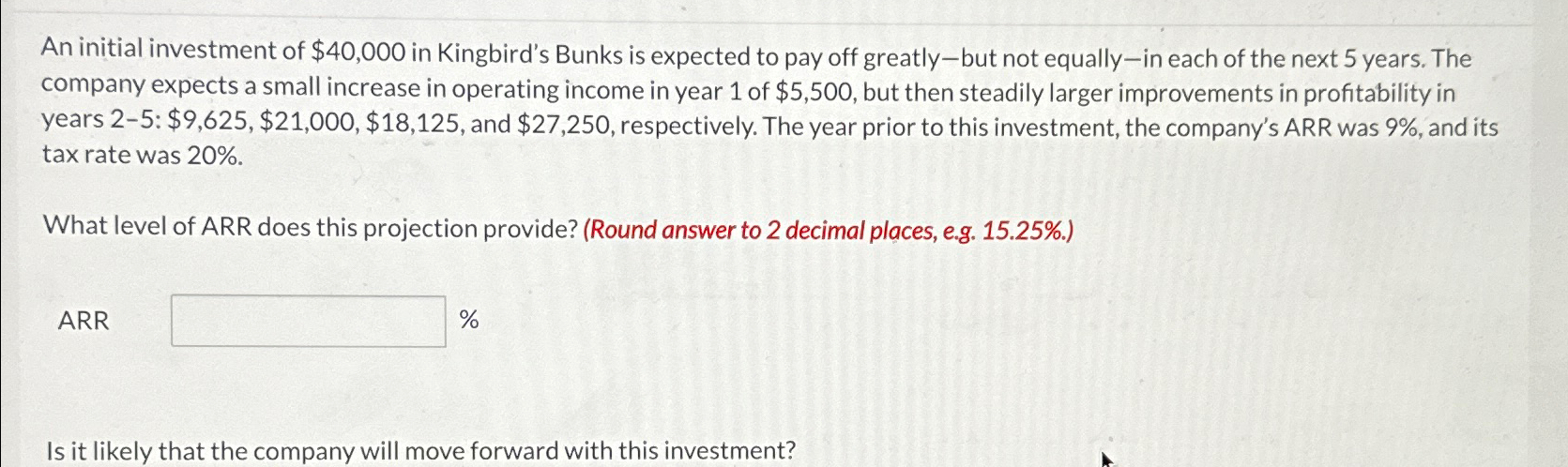

An initial investment of $ 4 0 , 0 0 0 in Kingbird's Bunks is expected to pay off greatly - but not equally -

An initial investment of $ in Kingbird's Bunks is expected to pay off greatlybut not equallyin each of the next years. The company expects a small increase in operating income in year of $ but then steadily larger improvements in profitability in years : $$$ and $ respectively. The year prior to this investment, the company's ARR was and its tax rate was

What level of ARR does this projection provide? Round answer to decimal places, eg

ARR

Is it likely that the company will move forward with this investment?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started