Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An insurance company has liabilities consisting of eleven annual payments of 1 million, with the first payment due to be made in 10 years'

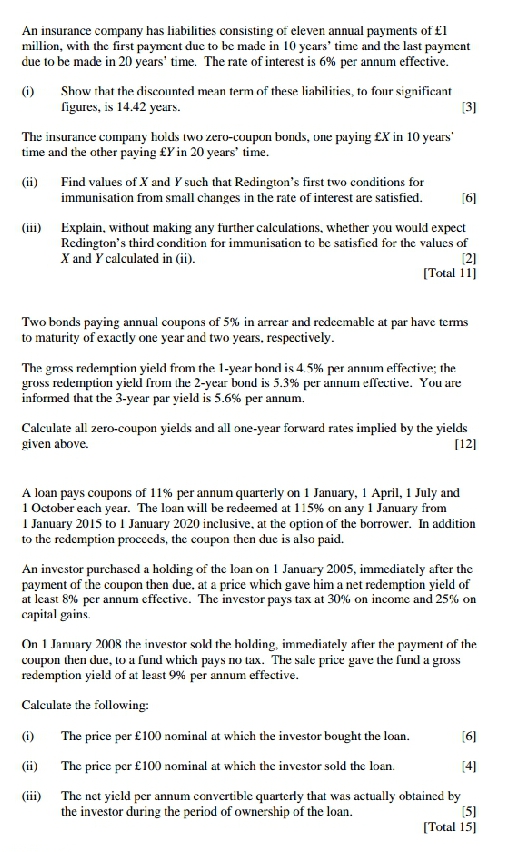

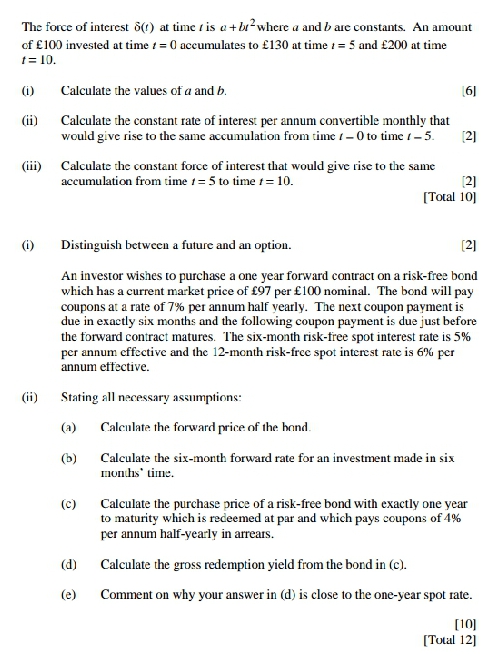

An insurance company has liabilities consisting of eleven annual payments of 1 million, with the first payment due to be made in 10 years' time and the last payment due to be made in 20 years' time. The rate of interest is 6% per annum effective. (i) Show that the discounted mean term of these liabilities, to four significant figures, is 14.42 years. [3] The insurance company holds two zero-coupon bonds, one paying X in 10 years' time and the other paying Y in 20 years' time. (ii) Find values of X and Y such that Redington's first two conditions for immunisation from small changes in the rate of interest are satisfied. [6] (iii) Explain, without making any further calculations, whether you would expect Redington's third condition for immunisation to be satisfied for the values of X and Y calculated in (ii). [2] [Total 11] Two bonds paying annual coupons of 5% in arrear and redeemable at par have terms to maturity of exactly one year and two years, respectively. The gross redemption yield from the 1-year bond is 4.5% per annum effective; the gross redemption yield from the 2-year bond is 5.3% per annum effective. You are informed that the 3-year par yield is 5.6% per annum. Calculate all zero-coupon yields and all one-year forward rates implied by the yields given above. [12] A loan pays coupons of 11% per annum quarterly on 1 January, 1 April, 1 July and 1 October each year. The loan will be redeemed at 115% on any 1 January from 1 January 2015 to 1 January 2020 inclusive, at the option of the borrower. In addition to the redemption proceeds, the coupon then due is also paid. An investor purchased a holding of the loan on 1 January 2005, immediately after the payment of the coupon then due, at a price which gave him a net redemption yield of at least 8% per annum effective. The investor pays tax at 30% on income and 25% on capital gains. On 1 January 2008 the investor sold the holding, immediately after the payment of the coupon then due, to a fund which pays no tax. The sale price gave the fund a gross redemption yield of at least 9% per annum effective. Calculate the following: (i) The price per 100 nominal at which the investor bought the loan. [6] (ii) The price per 100 nominal at which the investor sold the loan. [4] (iii) The net yield per annum convertible quarterly that was actually obtained by the investor during the period of ownership of the loan. [5] [Total 15] The force of interest (1) at time is a+b where a and b are constants. An amount of 100 invested at time = 0 accumulates to 130 at time = 5 and 200 at time t=10. (i) Calculate the values of a and b. (ii) [6] Calculate the constant rate of interest per annum convertible monthly that would give rise to the same accumulation from time 1-0 to time 1-5. (iii) Calculate the constant force of interest that would give rise to the same accumulation from time 15 to time = 10. [2] [2] [Total 10] (i) Distinguish between a future and an option. [2] An investor wishes to purchase a one year forward contract on a risk-free bond which has a current market price of 97 per 100 nominal. The bond will pay coupons at a rate of 7% per annum half yearly. The next coupon payment is due in exactly six months and the following coupon payment is due just before the forward contract matures. The six-month risk-free spot interest rate is 5% per annum effective and the 12-month risk-free spot interest rate is 6% per annum effective. Stating all necessary assumptions: (ii) (a) Calculate the forward price of the bond. (b) Calculate the six-month forward rate for an investment made in six months' time. (c) Calculate the purchase price of a risk-free bond with exactly one year to maturity which is redeemed at par and which pays coupons of 4% per annum half-yearly in arrears. (d) Calculate the gross redemption yield from the bond in (c). (e) Comment on why your answer in (d) is close to the one-year spot rate. [10] [Total 12]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

i To calculate the values of a and b Given Amount invested at time 0 100 Accumulates to 130 at time 15 Accumulates to 200 at time 10 We can use the formula for compound interest to solve for a and b A...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6641e0db93b81_987783.pdf

180 KBs PDF File

6641e0db93b81_987783.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started