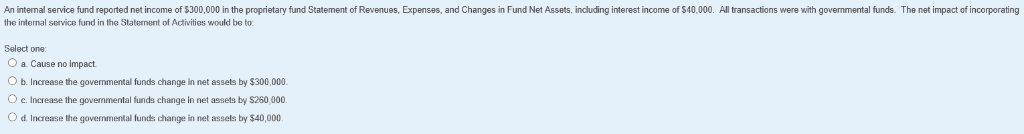

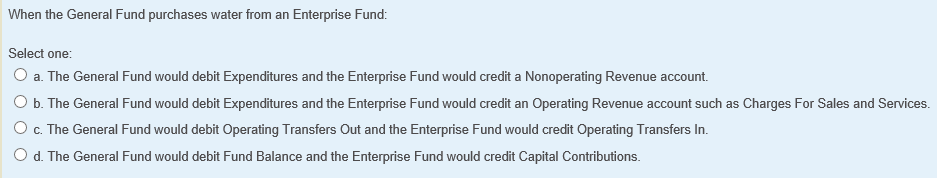

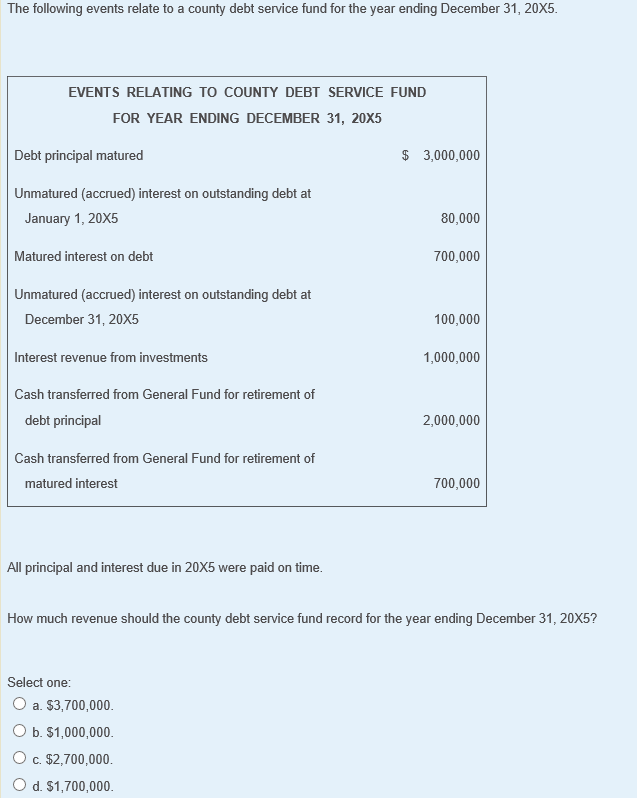

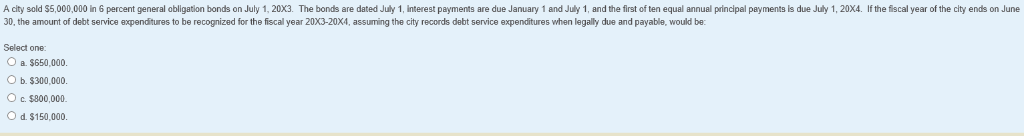

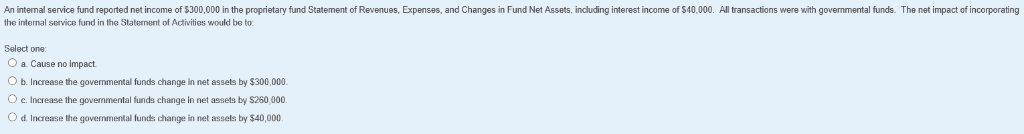

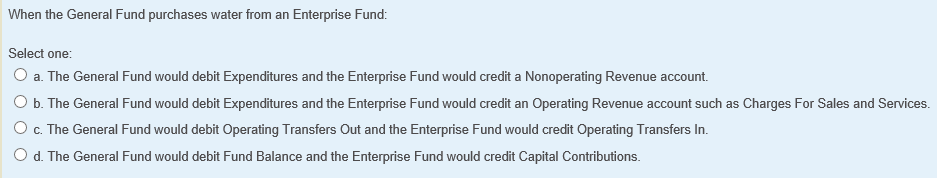

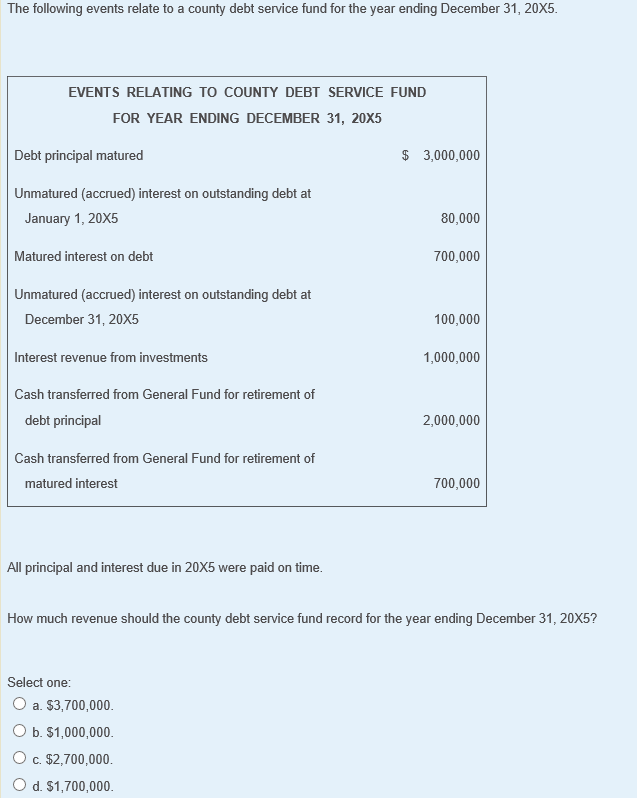

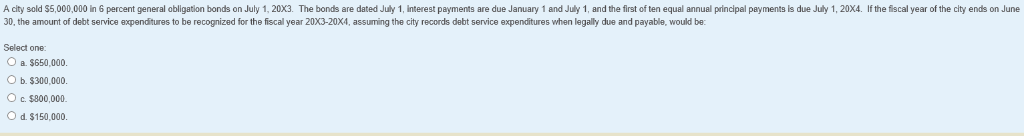

An internal service fund reported net income of $300,000 in the proprietary fund Statement of Revenues, Expenses, and Changes in Fund Net Assets, including interest income of $40,000. All transactions were with governmental funds. The net impact of incorporating the internal service fund in the Statement of Activities would be to Select one O a. Cause no impact O b. Increase the govenmental funds change in net assets by $300,000 O c. Increase the govemmental funds change in net assets by $260,000. O d Increase the govenmental funds change in net assels by $40,000 When the General Fund purchases water from an Enterprise Fund: Select one: O a. The General Fund would debit Expenditures and the Enterprise Fund would credit a Nonoperating Revenue account O b. The General Fund would debit Expenditures and the Enterprise Fund would credit an Operating Revenue account such as Charges For Sales and Services. O c. The General Fund would debit Operating Transfers Out and the Enterprise Fund would credit Operating Transfers In. O d. The General Fund would debit Fund Balance and the Enterprise Fund would credit Capital Contributions. The following events relate to a county debt service fund for the year ending December 31, 20X5 EVENTS RELATING TO COUNTY DEBT SERVICE FUND FOR YEAR ENDING DECEMBER 31, 20X5 Debt principal matured $ 3,000,000 Unmatured (accrued) interest on outstanding debt at January 1, 20X5 80,000 Matured interest on debt 700,000 Unmatured (accrued) interest on outstanding debt at December 31, 20X5 100,000 Interest revenue from investments 1,000,000 Cash transferred from General Fund for retirement of debt principal 2,000,000 Cash transferred from General Fund for retirement of matured interest 700,000 All principal and interest due in 20X5 were paid on time How much revenue should the county debt service fund record for the year ending December 31, 20X5? Select one: a. $3,700,000 O b. $1,000,000 C. $2,700,000 O d. $1,700,000 A city sold $5,000,000 in 6 percent general obligation bonds on July 1, 20X3. The bonds are dated July 1, Interest payments are due January 1 and July 1, and the first of ten equal annual principal payments is due July 1, 20X4. If the fiscal year of the city ends on June 30, the amount of debt service expenditures to be recognized for the fiscall year 20X3-20x4, assuming the city records debt service expenditures when legally due and payable, would be: Select one: a. $650,000. O b.$300,000 O c. $800,000 O d.$150,000 An internal service fund reported net income of $300,000 in the proprietary fund Statement of Revenues, Expenses, and Changes in Fund Net Assets, including interest income of $40,000. All transactions were with governmental funds. The net impact of incorporating the internal service fund in the Statement of Activities would be to Select one O a. Cause no impact O b. Increase the govenmental funds change in net assets by $300,000 O c. Increase the govemmental funds change in net assets by $260,000. O d Increase the govenmental funds change in net assels by $40,000 When the General Fund purchases water from an Enterprise Fund: Select one: O a. The General Fund would debit Expenditures and the Enterprise Fund would credit a Nonoperating Revenue account O b. The General Fund would debit Expenditures and the Enterprise Fund would credit an Operating Revenue account such as Charges For Sales and Services. O c. The General Fund would debit Operating Transfers Out and the Enterprise Fund would credit Operating Transfers In. O d. The General Fund would debit Fund Balance and the Enterprise Fund would credit Capital Contributions. The following events relate to a county debt service fund for the year ending December 31, 20X5 EVENTS RELATING TO COUNTY DEBT SERVICE FUND FOR YEAR ENDING DECEMBER 31, 20X5 Debt principal matured $ 3,000,000 Unmatured (accrued) interest on outstanding debt at January 1, 20X5 80,000 Matured interest on debt 700,000 Unmatured (accrued) interest on outstanding debt at December 31, 20X5 100,000 Interest revenue from investments 1,000,000 Cash transferred from General Fund for retirement of debt principal 2,000,000 Cash transferred from General Fund for retirement of matured interest 700,000 All principal and interest due in 20X5 were paid on time How much revenue should the county debt service fund record for the year ending December 31, 20X5? Select one: a. $3,700,000 O b. $1,000,000 C. $2,700,000 O d. $1,700,000 A city sold $5,000,000 in 6 percent general obligation bonds on July 1, 20X3. The bonds are dated July 1, Interest payments are due January 1 and July 1, and the first of ten equal annual principal payments is due July 1, 20X4. If the fiscal year of the city ends on June 30, the amount of debt service expenditures to be recognized for the fiscall year 20X3-20x4, assuming the city records debt service expenditures when legally due and payable, would be: Select one: a. $650,000. O b.$300,000 O c. $800,000 O d.$150,000